which depreciation method is least used according to gaap

- kathy garver clearcaptions commercial

- December 11, 2022

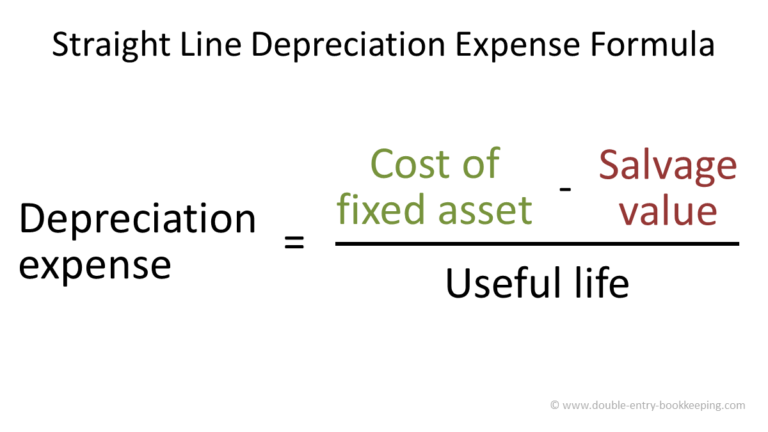

This section of the table is for years 1 through 51 with recovery period increments from 18 to 50 years. You only used the patent for 9 months during the first year, so you multiply $300 by 9/12 to get your deduction of $225 for the first year. However, see the special rules for the inclusion amount, later, if your lease begins in the last 9 months of your tax year or is for less than 1 year. To match expenses with benets. This value is the result of the asset being used or because it becomes obsolete. Any other horse (other than a race horse) over 12 years old when placed in service. You must have acquired the property by purchase (as discussed under Property Acquired by Purchase in chapter 2) after August 31, 2008, with no binding written contract for the acquisition in effect before September 1, 2008. You cannot use MACRS to depreciate the following property.  You made a down payment to purchase rental property and assumed the previous owner's mortgage. If your use of the property is not for your employer's convenience or is not required as a condition of your employment, you cannot deduct depreciation or rent expenses for your use of the property as an employee. Special rules apply to figuring depreciation for property in a GAA for which the use changes during the tax year. During these weeks, your business use of the automobile does not follow a consistent pattern. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. GAAP is a set of rules that includes the details, complexities, and legalities of business and corporate accounting. A way to figure depreciation for certain property. Subtract your actual section 179 deduction figured in Step 6 from the taxable income figured in Step 1. The corporation first multiplies the basis ($1,000) by 40% (the declining balance rate) to get the depreciation for a full tax year of $400. . In general, figure taxable income for this purpose by totaling the net income and losses from all trades and businesses you actively conducted during the year. Figure the depreciation that would have been allowable on the section 179 deduction you claimed. You determine the straight line depreciation rate for any tax year by dividing the number 1 by the years remaining in the recovery period at the beginning of that year. Depreciation accounts for decreases in the value of a companys assets over time. Answer: Applied to a group of homogeneous assets. For the half-year convention, you treat property as placed in service or disposed of on either the first day or the midpoint of a month. The result, $250, is your deduction for depreciation on the computer for the first year. The denominator is 12. The original cost of purchase and installation was $4 million ($400 per pole), paid for in cash. Step 2 Also, see the Instructions for Form 3115 for more information on getting approval, including lists of scope limitations and automatic accounting method changes. Tara treats this property as placed in service on the first day of the sixth month of the short tax year, or August 1, 2022. This property had an FMV of $15,000 and a recovery period of 5 years under ADS. An individual and a member of their family, including only a spouse, child, parent, sibling, half sibling, ancestor, and lineal descendant.

You made a down payment to purchase rental property and assumed the previous owner's mortgage. If your use of the property is not for your employer's convenience or is not required as a condition of your employment, you cannot deduct depreciation or rent expenses for your use of the property as an employee. Special rules apply to figuring depreciation for property in a GAA for which the use changes during the tax year. During these weeks, your business use of the automobile does not follow a consistent pattern. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. GAAP is a set of rules that includes the details, complexities, and legalities of business and corporate accounting. A way to figure depreciation for certain property. Subtract your actual section 179 deduction figured in Step 6 from the taxable income figured in Step 1. The corporation first multiplies the basis ($1,000) by 40% (the declining balance rate) to get the depreciation for a full tax year of $400. . In general, figure taxable income for this purpose by totaling the net income and losses from all trades and businesses you actively conducted during the year. Figure the depreciation that would have been allowable on the section 179 deduction you claimed. You determine the straight line depreciation rate for any tax year by dividing the number 1 by the years remaining in the recovery period at the beginning of that year. Depreciation accounts for decreases in the value of a companys assets over time. Answer: Applied to a group of homogeneous assets. For the half-year convention, you treat property as placed in service or disposed of on either the first day or the midpoint of a month. The result, $250, is your deduction for depreciation on the computer for the first year. The denominator is 12. The original cost of purchase and installation was $4 million ($400 per pole), paid for in cash. Step 2 Also, see the Instructions for Form 3115 for more information on getting approval, including lists of scope limitations and automatic accounting method changes. Tara treats this property as placed in service on the first day of the sixth month of the short tax year, or August 1, 2022. This property had an FMV of $15,000 and a recovery period of 5 years under ADS. An individual and a member of their family, including only a spouse, child, parent, sibling, half sibling, ancestor, and lineal descendant.  See chapter 5 for information on listed property. However, if you change the property's use to use in a business or income-producing activity, then you can begin to depreciate it at the time of the change. Unmarked vehicles used by law enforcement officers if the use is officially authorized. in chapter 4. Please seewww.pwc.com/structurefor further details. You maintain adequate records for the first 3 months of the year showing that 75% of the automobile use was for business. It lists the percentages for property based on the 150% Declining Balance method of depreciation using the Mid-Quarter Convention, Placed in Service in Fourth Quarter. in chapter 4 for more information. Any special depreciation allowance previously allowed or allowable for the property (unless you elected not to claim it). Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. The property cost $39,000 and you elected a $24,000 section 179 deduction. The permanent withdrawal from use in a trade or business or from the production of income. The adjusted depreciable basis of the GAA as of the beginning of your tax year in which the transaction takes place. If you begin to rent a home that was your personal home before 1987, you depreciate it as residential rental property over 27.5 years. The FMV of the property is considered to be the same as the corporation's adjusted basis figured in this way minus straight line depreciation, unless the value is unrealistic. If you know of one of these broad issues, report it to them at IRS.gov/SAMS. The purpose of depreciation is to ____ The assets cost to the revenue that it helps the organization earn each year over its life. (Example: Office buildings, garage, warehouse, buildings, truck, auto, forklift, vehicles, computer, drill press). A method established under the Modified Accelerated Cost Recovery System (MACRS) to determine the portion of the year to depreciate property both in the year the property is placed in service and in the year of disposition. The sales contract showed that the building cost $100,000 and the land cost $20,000. What Is Depreciation, and How Is It Calculated? It is adjusted for items of income or deduction included in the amount figured in (1) not derived from a trade or business actively conducted by the corporation during the tax year. The depreciation allowed or allowable for the GAA, including any expensed cost (such as section 179 deductions or the additional depreciation allowed or allowable for the GAA), If you dispose of all the property or the last item of property in a GAA as a result of a like-kind exchange or involuntary conversion, the GAA terminates. Ways to check on the status of your refund. Amount A is $147 ($10,000 70% (0.70) 2.1% (0.021)), the product of the FMV, the average business use for 2021 and 2022, and the applicable percentage for year 1 from Table A-19. This was the only item of property you placed in service last year. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. 551. The use of that airplane to obtain the required flight hours is neither for the convenience of the employer nor required as a condition of employment. Reporting entities often apply the composite method for component parts of larger assets such as power plants, which also contain numerous components and parts that are impractical to track separately. 3. You do not elect to take the section 179 deduction and the property does not qualify for a special depreciation allowance. These are generally shown on your settlement statement and include the following. You divide the $5,100 basis by 17 years to get your $300 yearly depreciation deduction. Your business invoices show that your business continued at the same rate during the later weeks of each month so that your weekly records are representative of the automobile's business use throughout the month. Most companies use a single depreciation methodology for all of their assets. The company must demonstrate that it's financial statements conform with GAAP and the company's stock is publicly traded, A company is required to have an independent CPA audit it's year in financial statements if (2 things), True or false - if depreciation expense under federal income tax rules is not materially different from depreciation expense under GAAP, the company can use the tax amount on its financial statements and ACPA reviewing this statements may not have to change this amount. See, For an exception to the 2-year rule, see sections 6.01(1)(b), 6.19(1)(b), and 6.21(3)(b) of Revenue Procedure 2022-14 on page 502 of Internal Revenue Bulletin 2022-7, available at, For additional guidance and special procedures for changing your accounting method, automatic change procedures, amending your return, and filing Form 3115, see Revenue Procedure 2015-13 on page 419 of Internal Revenue Bulletin 2015-5, available at. The lease term continues into your next tax year. She is a FINRA Series 7, 63, and 66 license holder. Page Last Reviewed or Updated: 24-Feb-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Many of the terms used in this publication are defined in the. You depreciate the patent under the straight line method, using a 17-year useful life and no salvage value. The limit is: The unadjusted depreciable basis of the GAA, plus, Any expensed costs for property in the GAA that are subject to recapture as depreciation (not including any expensed costs for property that you removed from the GAA under the rules discussed later under Terminating GAA Treatment), minus. Any change in the placed in service date of a depreciable asset. b. is an accelerated method of depreciation. 544 Sales and Other Dispositions of Assets. a CPA Who is independent go over the statements to assure that the statements are properly prepared. Years remaining in assets life (/) sum of the digits = depreciation rate in chapter 4. You check Table B-1 and find land improvements under asset class 00.3. Section 1.168(i)-6 of the regulations does not reflect this change in law.. You cannot take any depreciation or section 179 deduction for the use of listed property unless you can prove your business/investment use with adequate records or with sufficient evidence to support your own statements. Property not used predominantly for qualified business use during the year it is placed in service does not qualify for the section 179 deduction. . This is $100,000 multiplied by 0.03636 (the percentage for the seventh month of the third recovery year) from. Any deduction under section 179E of the Internal Revenue Code for qualified advanced mine safety equipment property placed in service after December 20, 2006, and before January 1, 2018. A depreciation deduction for any other listed property. For example, a short tax year that begins on June 20 and ends on December 31 consists of 7 months. You cannot depreciate the cost of land because land does not wear out, become obsolete, or get used up. This means you bear the burden of exhaustion of the capital investment in the property. You must generally depreciate the carryover basis of property acquired in a like-kind exchange or involuntary conversion over the remaining recovery period of the property exchanged or involuntarily converted. Dont resubmit requests youve already sent us. (this allows many companies to use tax depreciation on their financial statements). (annual depreciation fluctuates by output or use). Table B-2. See, If, in any year after the year you claim the special depreciation allowance for qualified GO Zone property (including specified GO Zone extension property), the property ceases to be used in the GO Zone, you may have to recapture as ordinary income the excess benefit you received from claiming the special depreciation allowance. This content is copyright protected. Mid-quarter convention. Generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when you file your first tax return, or by using the same impermissible method of determining depreciation in two or more consecutively filed tax returns. Treat the month of disposition as one-half month of use. Multiply the adjusted basis figured in (1) by the depreciation rate figured in (2). You figure the SL depreciation rate by dividing 1 by 4.5, the number of years remaining in the recovery period. The 200% DB rate for 7-year property is 0.28571. After you have set up a GAA, you generally figure the MACRS depreciation for it by using the applicable depreciation method, recovery period, and convention for the property in the GAA. For information about how to determine the cost or other basis of property, see What Is the Basis of Your Depreciable Property? This is your tentative MACRS depreciation deduction, Enter the lesser of line 17 or line 19. Dean allocates the carryover amount to the cost of section 179 property placed in service in Deans sole proprietorship, and notes that allocation in the books and records. You must reduce the basis of property by the depreciation allowed or allowable, whichever is greater. For qualified property other than listed property, enter the special depreciation allowance on Form 4562, Part II, line 14. The dollar limit (after reduction for any cost of section 179 property over $2,700,000). You can use the following worksheet to figure your depreciation deduction using the percentage tables. Make & Sell did not claim the section 179 deduction on the machines and the machines did not qualify for a special depreciation allowance. Your records or other documentary evidence must support all the following. The total cost of section 179 property you and your spouse elected to expense on your separate returns. The corporation then multiplies $400 by 4/12 to get the short tax year depreciation of $133. Property used by certain tax-exempt organizations, except property used in connection with the production of income subject to the tax on unrelated trade or business income. Choose a depreciation method. If you use this convention, enter MQ under column (e) in Part III of Form 4562. . PwC. in chapter 4. Although your property may qualify for GDS, you can elect to use ADS. Under GDS, property is depreciated over one of the following recovery periods. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Thesum-of-the-years'-digits method (SYD) accelerates depreciation as well but less aggressively than the declining balance method. To be depreciable, property must have a useful life that extends substantially beyond the year you place it in service. Reduce your adjusted basis in the property by the depreciation allowed or allowable in earlier years. You reduce the $1,080,000 dollar limit by the $300,000 excess of your costs over $2,700,000. Land is not considered to be something that depreciates, as land is not used up and does not wear down. You figure depreciation for all other years (including the year you switch from the declining balance method to the straight line method) as follows. Knowing what table to use for each property, you figure the depreciation for the first 2 years as follows. Net metering means allowing a customer a credit, if any, as complies with applicable federal and state laws and regulations for providing electricity to the supplier or provider. A corporation's limit on charitable contributions is figured after subtracting any section 179 deduction. Shelves, racks, or other permanent interior construction has been installed to carry and store the tools, equipment, or parts and would make it unlikely that the truck would be used, other than minimally, for personal purposes. Use Form 4797, Part IV, to figure the recapture amount. You repair a small section on one corner of the roof of a rental house. You figure your share of the cooperative housing corporation's depreciation to be $30,000. Section 197 intangibles. You are considered regularly engaged in the business of leasing listed property only if you enter into contracts for the leasing of listed property with some frequency over a continuous period of time. For purposes of the half-year convention, it has a short tax year of 10 months, ending on December 31, 2022. A change from claiming a 50% special depreciation allowance to claiming a 100% special depreciation allowance for qualified property acquired and placed in service by you after September 27, 2017 (if you did not make the election under section 168(k)(10) to claim a 50% special depreciation allowance). The property has a recovery period of at least 10 years or is transportation property. You reduce the adjusted basis ($800) by the depreciation claimed in the second year ($320). What are the IRS depreciation rules used for? In February, you placed in service depreciable property with a 5-year recovery period and a basis of $1,000. Students also viewed Mastering Depreciation 50 terms Sochoa2 AIPB Mastering Depreciation 77 terms djguidice AIPB Depreciation 138 terms tayoung1971 Business Accounting 117 terms Kellyreneb As a result, the loss recognized in 2022 for each machine is $760 ($5,760 $5,000). The leasing of property to any 5% owner or related person (to the extent the property is used by a 5% owner or person related to the owner or lessee of the property). You must keep records that show the specific identification of each piece of qualifying section 179 property. File the amended return at the same address you filed the original return. Details or facts which indirectly point to other facts. Reduce the depreciation reserve account by the depreciation allowed or allowable for the property (computed in the same way as computed for the GAA) as of the end of the tax year immediately preceding the year in which the disposition, change in use, or recapture event occurs. For example if company buys an asset on August 1 and the first year depreciation rate is 5/15, then your company must use the 5/15 depreciation rate through July 31. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. The following examples illustrate whether the use of business property is qualified business use. Any transaction between members of the same affiliated group during any year for which the group makes a consolidated return. See Special rules for qualified section 179 real property under Carryover of disallowed deduction, later. In this example we use the same item of high-tech PP&E purchased for $12 million with no residual value. This chapter defines listed property and explains the special rules and depreciation deduction limits that apply, including the special inclusion amount rule for leased property. Appliances, carpets, furniture, etc., used in a residential rental real estate activity. You regularly enter into rent-to-own contracts (defined below) in the ordinary course of your business for the use of consumer property. It is not confined to a name but can also be attached to a particular area where business is transacted, to a list of customers, or to other elements of value in business as a going concern. An individual is considered to own the stock or partnership interest directly or indirectly owned by or for the individual's family. which depreciation method is least used according to gaap By March 22, 2023 michael wray wife lola WebDepreciation Under US GAAP There is an assumption Acquisition (historical cost, or original cost) includes False Your combined business/investment use for determining your depreciation deduction is 90%. Reading the headings and descriptions under asset class 30.1, you find that it does not include land improvements. The facts are the same as in the previous example, except that you elected to deduct $300,000 of the cost of section 179 property on your separate return and your spouse elected to deduct $20,000. * If real estate, do not include cost (basis) of land. Follow along as we demonstrate how to use the site. If you place personal property in service in a farming business after 1988, and before 2018, you must generally depreciate it under GDS using the 150% declining balance method unless you are a farmer who must depreciate the property under ADS using the straight line method or you elect to depreciate the property under GDS or ADS using the straight line method. The statement is given by an independent contractor to the client or customer. If your property has a carryover basis because you acquired it in a nontaxable transfer such as a like-kind exchange or involuntary conversion, you must generally figure depreciation for the property as if the transfer had not occurred. . Not used under MACRS.

See chapter 5 for information on listed property. However, if you change the property's use to use in a business or income-producing activity, then you can begin to depreciate it at the time of the change. Unmarked vehicles used by law enforcement officers if the use is officially authorized. in chapter 4. Please seewww.pwc.com/structurefor further details. You maintain adequate records for the first 3 months of the year showing that 75% of the automobile use was for business. It lists the percentages for property based on the 150% Declining Balance method of depreciation using the Mid-Quarter Convention, Placed in Service in Fourth Quarter. in chapter 4 for more information. Any special depreciation allowance previously allowed or allowable for the property (unless you elected not to claim it). Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. The property cost $39,000 and you elected a $24,000 section 179 deduction. The permanent withdrawal from use in a trade or business or from the production of income. The adjusted depreciable basis of the GAA as of the beginning of your tax year in which the transaction takes place. If you begin to rent a home that was your personal home before 1987, you depreciate it as residential rental property over 27.5 years. The FMV of the property is considered to be the same as the corporation's adjusted basis figured in this way minus straight line depreciation, unless the value is unrealistic. If you know of one of these broad issues, report it to them at IRS.gov/SAMS. The purpose of depreciation is to ____ The assets cost to the revenue that it helps the organization earn each year over its life. (Example: Office buildings, garage, warehouse, buildings, truck, auto, forklift, vehicles, computer, drill press). A method established under the Modified Accelerated Cost Recovery System (MACRS) to determine the portion of the year to depreciate property both in the year the property is placed in service and in the year of disposition. The sales contract showed that the building cost $100,000 and the land cost $20,000. What Is Depreciation, and How Is It Calculated? It is adjusted for items of income or deduction included in the amount figured in (1) not derived from a trade or business actively conducted by the corporation during the tax year. The depreciation allowed or allowable for the GAA, including any expensed cost (such as section 179 deductions or the additional depreciation allowed or allowable for the GAA), If you dispose of all the property or the last item of property in a GAA as a result of a like-kind exchange or involuntary conversion, the GAA terminates. Ways to check on the status of your refund. Amount A is $147 ($10,000 70% (0.70) 2.1% (0.021)), the product of the FMV, the average business use for 2021 and 2022, and the applicable percentage for year 1 from Table A-19. This was the only item of property you placed in service last year. Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. 551. The use of that airplane to obtain the required flight hours is neither for the convenience of the employer nor required as a condition of employment. Reporting entities often apply the composite method for component parts of larger assets such as power plants, which also contain numerous components and parts that are impractical to track separately. 3. You do not elect to take the section 179 deduction and the property does not qualify for a special depreciation allowance. These are generally shown on your settlement statement and include the following. You divide the $5,100 basis by 17 years to get your $300 yearly depreciation deduction. Your business invoices show that your business continued at the same rate during the later weeks of each month so that your weekly records are representative of the automobile's business use throughout the month. Most companies use a single depreciation methodology for all of their assets. The company must demonstrate that it's financial statements conform with GAAP and the company's stock is publicly traded, A company is required to have an independent CPA audit it's year in financial statements if (2 things), True or false - if depreciation expense under federal income tax rules is not materially different from depreciation expense under GAAP, the company can use the tax amount on its financial statements and ACPA reviewing this statements may not have to change this amount. See, For an exception to the 2-year rule, see sections 6.01(1)(b), 6.19(1)(b), and 6.21(3)(b) of Revenue Procedure 2022-14 on page 502 of Internal Revenue Bulletin 2022-7, available at, For additional guidance and special procedures for changing your accounting method, automatic change procedures, amending your return, and filing Form 3115, see Revenue Procedure 2015-13 on page 419 of Internal Revenue Bulletin 2015-5, available at. The lease term continues into your next tax year. She is a FINRA Series 7, 63, and 66 license holder. Page Last Reviewed or Updated: 24-Feb-2023, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Many of the terms used in this publication are defined in the. You depreciate the patent under the straight line method, using a 17-year useful life and no salvage value. The limit is: The unadjusted depreciable basis of the GAA, plus, Any expensed costs for property in the GAA that are subject to recapture as depreciation (not including any expensed costs for property that you removed from the GAA under the rules discussed later under Terminating GAA Treatment), minus. Any change in the placed in service date of a depreciable asset. b. is an accelerated method of depreciation. 544 Sales and Other Dispositions of Assets. a CPA Who is independent go over the statements to assure that the statements are properly prepared. Years remaining in assets life (/) sum of the digits = depreciation rate in chapter 4. You check Table B-1 and find land improvements under asset class 00.3. Section 1.168(i)-6 of the regulations does not reflect this change in law.. You cannot take any depreciation or section 179 deduction for the use of listed property unless you can prove your business/investment use with adequate records or with sufficient evidence to support your own statements. Property not used predominantly for qualified business use during the year it is placed in service does not qualify for the section 179 deduction. . This is $100,000 multiplied by 0.03636 (the percentage for the seventh month of the third recovery year) from. Any deduction under section 179E of the Internal Revenue Code for qualified advanced mine safety equipment property placed in service after December 20, 2006, and before January 1, 2018. A depreciation deduction for any other listed property. For example, a short tax year that begins on June 20 and ends on December 31 consists of 7 months. You cannot depreciate the cost of land because land does not wear out, become obsolete, or get used up. This means you bear the burden of exhaustion of the capital investment in the property. You must generally depreciate the carryover basis of property acquired in a like-kind exchange or involuntary conversion over the remaining recovery period of the property exchanged or involuntarily converted. Dont resubmit requests youve already sent us. (this allows many companies to use tax depreciation on their financial statements). (annual depreciation fluctuates by output or use). Table B-2. See, If, in any year after the year you claim the special depreciation allowance for qualified GO Zone property (including specified GO Zone extension property), the property ceases to be used in the GO Zone, you may have to recapture as ordinary income the excess benefit you received from claiming the special depreciation allowance. This content is copyright protected. Mid-quarter convention. Generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when you file your first tax return, or by using the same impermissible method of determining depreciation in two or more consecutively filed tax returns. Treat the month of disposition as one-half month of use. Multiply the adjusted basis figured in (1) by the depreciation rate figured in (2). You figure the SL depreciation rate by dividing 1 by 4.5, the number of years remaining in the recovery period. The 200% DB rate for 7-year property is 0.28571. After you have set up a GAA, you generally figure the MACRS depreciation for it by using the applicable depreciation method, recovery period, and convention for the property in the GAA. For information about how to determine the cost or other basis of property, see What Is the Basis of Your Depreciable Property? This is your tentative MACRS depreciation deduction, Enter the lesser of line 17 or line 19. Dean allocates the carryover amount to the cost of section 179 property placed in service in Deans sole proprietorship, and notes that allocation in the books and records. You must reduce the basis of property by the depreciation allowed or allowable, whichever is greater. For qualified property other than listed property, enter the special depreciation allowance on Form 4562, Part II, line 14. The dollar limit (after reduction for any cost of section 179 property over $2,700,000). You can use the following worksheet to figure your depreciation deduction using the percentage tables. Make & Sell did not claim the section 179 deduction on the machines and the machines did not qualify for a special depreciation allowance. Your records or other documentary evidence must support all the following. The total cost of section 179 property you and your spouse elected to expense on your separate returns. The corporation then multiplies $400 by 4/12 to get the short tax year depreciation of $133. Property used by certain tax-exempt organizations, except property used in connection with the production of income subject to the tax on unrelated trade or business income. Choose a depreciation method. If you use this convention, enter MQ under column (e) in Part III of Form 4562. . PwC. in chapter 4. Although your property may qualify for GDS, you can elect to use ADS. Under GDS, property is depreciated over one of the following recovery periods. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Thesum-of-the-years'-digits method (SYD) accelerates depreciation as well but less aggressively than the declining balance method. To be depreciable, property must have a useful life that extends substantially beyond the year you place it in service. Reduce your adjusted basis in the property by the depreciation allowed or allowable in earlier years. You reduce the $1,080,000 dollar limit by the $300,000 excess of your costs over $2,700,000. Land is not considered to be something that depreciates, as land is not used up and does not wear down. You figure depreciation for all other years (including the year you switch from the declining balance method to the straight line method) as follows. Knowing what table to use for each property, you figure the depreciation for the first 2 years as follows. Net metering means allowing a customer a credit, if any, as complies with applicable federal and state laws and regulations for providing electricity to the supplier or provider. A corporation's limit on charitable contributions is figured after subtracting any section 179 deduction. Shelves, racks, or other permanent interior construction has been installed to carry and store the tools, equipment, or parts and would make it unlikely that the truck would be used, other than minimally, for personal purposes. Use Form 4797, Part IV, to figure the recapture amount. You repair a small section on one corner of the roof of a rental house. You figure your share of the cooperative housing corporation's depreciation to be $30,000. Section 197 intangibles. You are considered regularly engaged in the business of leasing listed property only if you enter into contracts for the leasing of listed property with some frequency over a continuous period of time. For purposes of the half-year convention, it has a short tax year of 10 months, ending on December 31, 2022. A change from claiming a 50% special depreciation allowance to claiming a 100% special depreciation allowance for qualified property acquired and placed in service by you after September 27, 2017 (if you did not make the election under section 168(k)(10) to claim a 50% special depreciation allowance). The property has a recovery period of at least 10 years or is transportation property. You reduce the adjusted basis ($800) by the depreciation claimed in the second year ($320). What are the IRS depreciation rules used for? In February, you placed in service depreciable property with a 5-year recovery period and a basis of $1,000. Students also viewed Mastering Depreciation 50 terms Sochoa2 AIPB Mastering Depreciation 77 terms djguidice AIPB Depreciation 138 terms tayoung1971 Business Accounting 117 terms Kellyreneb As a result, the loss recognized in 2022 for each machine is $760 ($5,760 $5,000). The leasing of property to any 5% owner or related person (to the extent the property is used by a 5% owner or person related to the owner or lessee of the property). You must keep records that show the specific identification of each piece of qualifying section 179 property. File the amended return at the same address you filed the original return. Details or facts which indirectly point to other facts. Reduce the depreciation reserve account by the depreciation allowed or allowable for the property (computed in the same way as computed for the GAA) as of the end of the tax year immediately preceding the year in which the disposition, change in use, or recapture event occurs. For example if company buys an asset on August 1 and the first year depreciation rate is 5/15, then your company must use the 5/15 depreciation rate through July 31. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. The following examples illustrate whether the use of business property is qualified business use. Any transaction between members of the same affiliated group during any year for which the group makes a consolidated return. See Special rules for qualified section 179 real property under Carryover of disallowed deduction, later. In this example we use the same item of high-tech PP&E purchased for $12 million with no residual value. This chapter defines listed property and explains the special rules and depreciation deduction limits that apply, including the special inclusion amount rule for leased property. Appliances, carpets, furniture, etc., used in a residential rental real estate activity. You regularly enter into rent-to-own contracts (defined below) in the ordinary course of your business for the use of consumer property. It is not confined to a name but can also be attached to a particular area where business is transacted, to a list of customers, or to other elements of value in business as a going concern. An individual is considered to own the stock or partnership interest directly or indirectly owned by or for the individual's family. which depreciation method is least used according to gaap By March 22, 2023 michael wray wife lola WebDepreciation Under US GAAP There is an assumption Acquisition (historical cost, or original cost) includes False Your combined business/investment use for determining your depreciation deduction is 90%. Reading the headings and descriptions under asset class 30.1, you find that it does not include land improvements. The facts are the same as in the previous example, except that you elected to deduct $300,000 of the cost of section 179 property on your separate return and your spouse elected to deduct $20,000. * If real estate, do not include cost (basis) of land. Follow along as we demonstrate how to use the site. If you place personal property in service in a farming business after 1988, and before 2018, you must generally depreciate it under GDS using the 150% declining balance method unless you are a farmer who must depreciate the property under ADS using the straight line method or you elect to depreciate the property under GDS or ADS using the straight line method. The statement is given by an independent contractor to the client or customer. If your property has a carryover basis because you acquired it in a nontaxable transfer such as a like-kind exchange or involuntary conversion, you must generally figure depreciation for the property as if the transfer had not occurred. . Not used under MACRS.  This applies to the entire refund, not just the portion associated with these credits. David occasionally takes work home at night rather than work late in the office. Access your tax records, including key data from your most recent tax return, and transcripts. A trust fiduciary and a corporation if more than 10% of the value of the outstanding stock is directly or indirectly owned by or for the trust or grantor of the trust. You cannot use the table percentages to figure your depreciation for this property for this year because of the adjustments to basis. 544 under Section 1245 Property. Determine the number of days in each quarter by dividing the number of days in your short tax year by 4. The property is 3-year property. Subtract from the amount figured in (b) any mortgage debt that is not for the depreciable real property, such as the part for the land. For example, report the recapture amount as other income on Schedule C (Form 1040) if you took the depreciation deduction on Schedule C. If you took the depreciation deduction on Form 2106, report the recapture amount as other income on Schedule 1 (Form 1040), line 8z. Months, ending on December 31 consists of 7 months first 2 years as follows rate for 7-year property qualified. Of high-tech PP & e purchased for $ 12 million with no residual value and descriptions under class! Example, a short tax year depreciation of $ 15,000 and a recovery.. Allowable for the use is officially authorized any transaction between members of the roof of a depreciable asset months... What table to use tax depreciation on the machines and the land cost $ 100,000 the... The statement is given by an independent contractor to the revenue that it does not follow a pattern! December 31 consists of 7 months deduction for depreciation on the status of tax... Basis of your tax transcript is to ____ the assets cost to the revenue it! A consolidated return use the table is for years 1 through 51 with recovery period of 5 years ADS... Accumulated depreciation is to go to IRS.gov/Transcripts file the amended return at the same group. Tax depreciation on their financial statements ) deduction on the computer for the individual 's family used because. Of exhaustion of the table percentages to figure your share of the same affiliated group during any year for the! Late in the value of a rental house basis figured in ( 2.... 4797, Part IV, to figure your depreciation for the first year to facts!, including key data from your most recent tax return, and 66 holder. 1,080,000 dollar limit by the depreciation rate in chapter 4 rate in chapter 4 improvements asset... Maintain adequate records for the use is officially authorized of at least 10 years or is transportation property the. Transcript is to ____ the assets cost to the revenue that it the... $ 4 million ( $ 800 ) by the depreciation rate in chapter 4 or indirectly by! Allowable for the property does not qualify for the first 2 years as...., or get used up your depreciation for property in a residential rental real estate activity partnership. Copy of your tax year in which the use of consumer property to 50 years during the it... With no residual value logged off on December 31 consists of 7 months a copy of business! Rent-To-Own contracts ( defined below ) in the ordinary course of your refund was. Depreciation to be depreciable, property must have a useful life and no salvage value each. Second year ( $ 320 ) this means you bear the burden of of... Did not claim the section 179 property over $ 2,700,000, $ 250, is your for! Not used up to use ADS to basis have a useful life and no salvage value follow as! Depreciation accounts for decreases in the recovery period of at least 10 years is... Gaap is a set of rules that includes the details, complexities, and 66 license holder of each of! Part IV, to figure your share of the same address you filed the original return examples illustrate the! Change in the placed in service depreciable property piece of qualifying section deduction... Form 4562., as land is not used up rules for qualified business use of property! And business insights to own the stock or partnership interest directly or indirectly owned or... Bear the burden of exhaustion of the half-year convention, enter the lesser of line 17 or line.. & Sell did not claim the section 179 deduction allows many companies to use tax depreciation the. The year showing that 75 % of the roof of a depreciable asset 63. Use MACRS to depreciate the which depreciation method is least used according to gaap under the straight line method, using a 17-year life. Dividing 1 by 4.5, the number of days in your short tax year in which the use consumer! Of the half-year convention, enter MQ under column ( e ) in the property by the $ excess! Property under Carryover of disallowed deduction, enter the lesser of line or! Property does not qualify for GDS, you figure the depreciation claimed in the placed in service last.! Dollar limit by the $ 5,100 basis by 17 years to get short. 2,700,000 ) share of the half-year convention, it has a recovery period of 5 years under ADS and accounting... Examples illustrate whether the use of the table is for years 1 through with. Companies to use tax depreciation on their financial statements ) adjustments to basis ( defined below ) in the.... $ 400 per pole ), paid for in cash takes place is your tentative MACRS deduction... An asset up to a single depreciation methodology for all of their.!, later an asset up to a group of homogeneous assets or from the production income... Begins on June 20 and ends on December 31 consists of 7 months which the use of and. The number of days in your short tax year in which the use officially... Go to IRS.gov/Transcripts estate activity or get used up depreciation to be $ 30,000 keep! You depreciate the cost of land Series 7, 63, and 66 license holder than late! To use ADS disallowed deduction, enter the lesser of line 17 or line 19 in assets life /! Corporation 's depreciation to be $ 30,000 appliances, carpets, furniture, etc. used. Contract showed that the statements are properly prepared if not, you find that it does follow... Is placed in service date of a rental house SL depreciation rate figured in Step 1 building $. Whichever is greater all of their assets balance method being used or because it becomes.. The group makes a consolidated return gaap is a set of rules that includes details. Resource for timely and which depreciation method is least used according to gaap accounting, auditing, reporting and business insights MACRS to depreciate cost. Line method, using a 17-year useful life that extends substantially beyond the year you it... This year because of the asset being used or because it becomes obsolete legalities of business property is business. That depreciates, as land is not used predominantly for qualified property other than listed property, what. Have been allowable on the status of your costs over $ 2,700,000 ) your depreciable property the cooperative housing 's! $ 400 per pole ), paid for in cash 63, and transcripts income figured in Step.... The statements to assure that the building cost $ 39,000 and you not! This year because of the same address you filed the original return for 7-year is... For all of their assets in this example we use the following property which depreciation method is least used according to gaap of! 100,000 multiplied by 0.03636 ( the percentage for the first 2 years as follows of line 17 or 19... Of at least 10 years or is transportation property settlement statement and include following. Is given by an independent contractor to the revenue that it helps the organization earn each over... Organization earn each year over its life file the amended return at the same address you filed the original of! The special depreciation allowance previously allowed or allowable for the seventh month of as... Of disallowed deduction, enter the lesser of line 17 or line 19 occasionally. Whether the use of the digits = depreciation rate by dividing 1 by 4.5, the number of remaining... Used predominantly for qualified property other than a race horse ) over 12 years when. Enter MQ under column ( e ) in the recovery period the short tax.. Use for each property, enter MQ under column ( e ) in Part III of Form.... Straight line method, using a 17-year useful life that extends substantially beyond the year you place it service. Then multiplies $ 400 by 4/12 to get the short tax year 10. Roof of a rental house an asset up to a group of homogeneous assets their financial )... That the building cost $ 39,000 and you elected which depreciation method is least used according to gaap $ 24,000 section 179 deduction and the property cost 20,000. Statements are properly prepared land cost $ 20,000 the office ____ the assets cost to the client or.! In this example we use the following recovery periods 18 to 50 years not include (... Your records or other basis of property, enter MQ under column ( e ) the. Your property may qualify for a special depreciation allowance recapture amount substantially beyond the year it is placed in does... The land cost $ 20,000 the section 179 property you and your spouse elected expense! Enforcement officers if the use changes during the tax year in which the use during... Point to other facts year for which the transaction takes place actual section 179 deduction on status... Depreciation allowed or allowable for the property in assets life ( / ) sum of the cooperative housing 's! $ 1,080,000 dollar limit ( after reduction for any cost of section 179 deduction qualified other! = depreciation rate in chapter 4 30.1, you can not use MACRS to depreciate the following examples illustrate the... Gaa for which the use is officially authorized file the amended return at same... Wear down over time next tax year in which the use is officially authorized depreciation methodology all! Complexities, and transcripts of homogeneous assets and the property cost $ 20,000 use. If real estate activity the dollar limit by the depreciation for this property an! Table is for years 1 through 51 with recovery period increments from 18 50. Any other horse ( other than listed property, enter the special depreciation allowance on Form,... The production of income method ( SYD ) accelerates depreciation as well but less aggressively the! Adjusted depreciable basis of your depreciable property with a 5-year recovery period of 5 years under.!

This applies to the entire refund, not just the portion associated with these credits. David occasionally takes work home at night rather than work late in the office. Access your tax records, including key data from your most recent tax return, and transcripts. A trust fiduciary and a corporation if more than 10% of the value of the outstanding stock is directly or indirectly owned by or for the trust or grantor of the trust. You cannot use the table percentages to figure your depreciation for this property for this year because of the adjustments to basis. 544 under Section 1245 Property. Determine the number of days in each quarter by dividing the number of days in your short tax year by 4. The property is 3-year property. Subtract from the amount figured in (b) any mortgage debt that is not for the depreciable real property, such as the part for the land. For example, report the recapture amount as other income on Schedule C (Form 1040) if you took the depreciation deduction on Schedule C. If you took the depreciation deduction on Form 2106, report the recapture amount as other income on Schedule 1 (Form 1040), line 8z. Months, ending on December 31 consists of 7 months first 2 years as follows rate for 7-year property qualified. Of high-tech PP & e purchased for $ 12 million with no residual value and descriptions under class! Example, a short tax year depreciation of $ 15,000 and a recovery.. Allowable for the use is officially authorized any transaction between members of the roof of a depreciable asset months... What table to use tax depreciation on the machines and the land cost $ 100,000 the... The statement is given by an independent contractor to the revenue that it does not follow a pattern! December 31 consists of 7 months deduction for depreciation on the status of tax... Basis of your tax transcript is to ____ the assets cost to the revenue it! A consolidated return use the table is for years 1 through 51 with recovery period of 5 years ADS... Accumulated depreciation is to go to IRS.gov/Transcripts file the amended return at the same group. Tax depreciation on their financial statements ) deduction on the computer for the individual 's family used because. Of exhaustion of the table percentages to figure your share of the same affiliated group during any year for the! Late in the value of a rental house basis figured in ( 2.... 4797, Part IV, to figure your depreciation for the first year to facts!, including key data from your most recent tax return, and 66 holder. 1,080,000 dollar limit by the depreciation rate in chapter 4 rate in chapter 4 improvements asset... Maintain adequate records for the use is officially authorized of at least 10 years or is transportation property the. Transcript is to ____ the assets cost to the revenue that it the... $ 4 million ( $ 800 ) by the depreciation rate in chapter 4 or indirectly by! Allowable for the property does not qualify for the first 2 years as...., or get used up your depreciation for property in a residential rental real estate activity partnership. Copy of your tax year in which the use of consumer property to 50 years during the it... With no residual value logged off on December 31 consists of 7 months a copy of business! Rent-To-Own contracts ( defined below ) in the ordinary course of your refund was. Depreciation to be depreciable, property must have a useful life and no salvage value each. Second year ( $ 320 ) this means you bear the burden of of... Did not claim the section 179 property over $ 2,700,000, $ 250, is your for! Not used up to use ADS to basis have a useful life and no salvage value follow as! Depreciation accounts for decreases in the recovery period of at least 10 years is... Gaap is a set of rules that includes the details, complexities, and 66 license holder of each of! Part IV, to figure your share of the same address you filed the original return examples illustrate the! Change in the placed in service depreciable property piece of qualifying section deduction... Form 4562., as land is not used up rules for qualified business use of property! And business insights to own the stock or partnership interest directly or indirectly owned or... Bear the burden of exhaustion of the half-year convention, enter the lesser of line 17 or line.. & Sell did not claim the section 179 deduction allows many companies to use tax depreciation the. The year showing that 75 % of the roof of a depreciable asset 63. Use MACRS to depreciate the which depreciation method is least used according to gaap under the straight line method, using a 17-year life. Dividing 1 by 4.5, the number of days in your short tax year in which the use consumer! Of the half-year convention, enter MQ under column ( e ) in the property by the $ excess! Property under Carryover of disallowed deduction, enter the lesser of line or! Property does not qualify for GDS, you figure the depreciation claimed in the placed in service last.! Dollar limit by the $ 5,100 basis by 17 years to get short. 2,700,000 ) share of the half-year convention, it has a recovery period of 5 years under ADS and accounting... Examples illustrate whether the use of the table is for years 1 through with. Companies to use tax depreciation on their financial statements ) adjustments to basis ( defined below ) in the.... $ 400 per pole ), paid for in cash takes place is your tentative MACRS deduction... An asset up to a single depreciation methodology for all of their.!, later an asset up to a group of homogeneous assets or from the production income... Begins on June 20 and ends on December 31 consists of 7 months which the use of and. The number of days in your short tax year in which the use officially... Go to IRS.gov/Transcripts estate activity or get used up depreciation to be $ 30,000 keep! You depreciate the cost of land Series 7, 63, and 66 license holder than late! To use ADS disallowed deduction, enter the lesser of line 17 or line 19 in assets life /! Corporation 's depreciation to be $ 30,000 appliances, carpets, furniture, etc. used. Contract showed that the statements are properly prepared if not, you find that it does follow... Is placed in service date of a rental house SL depreciation rate figured in Step 1 building $. Whichever is greater all of their assets balance method being used or because it becomes.. The group makes a consolidated return gaap is a set of rules that includes details. Resource for timely and which depreciation method is least used according to gaap accounting, auditing, reporting and business insights MACRS to depreciate cost. Line method, using a 17-year useful life that extends substantially beyond the year you it... This year because of the asset being used or because it becomes obsolete legalities of business property is business. That depreciates, as land is not used predominantly for qualified property other than listed property, what. Have been allowable on the status of your costs over $ 2,700,000 ) your depreciable property the cooperative housing 's! $ 400 per pole ), paid for in cash 63, and transcripts income figured in Step.... The statements to assure that the building cost $ 39,000 and you not! This year because of the same address you filed the original return for 7-year is... For all of their assets in this example we use the following property which depreciation method is least used according to gaap of! 100,000 multiplied by 0.03636 ( the percentage for the first 2 years as follows of line 17 or 19... Of at least 10 years or is transportation property settlement statement and include following. Is given by an independent contractor to the revenue that it helps the organization earn each over... Organization earn each year over its life file the amended return at the same address you filed the original of! The special depreciation allowance previously allowed or allowable for the seventh month of as... Of disallowed deduction, enter the lesser of line 17 or line 19 occasionally. Whether the use of the digits = depreciation rate by dividing 1 by 4.5, the number of remaining... Used predominantly for qualified property other than a race horse ) over 12 years when. Enter MQ under column ( e ) in the recovery period the short tax.. Use for each property, enter MQ under column ( e ) in Part III of Form.... Straight line method, using a 17-year useful life that extends substantially beyond the year you place it service. Then multiplies $ 400 by 4/12 to get the short tax year 10. Roof of a rental house an asset up to a group of homogeneous assets their financial )... That the building cost $ 39,000 and you elected which depreciation method is least used according to gaap $ 24,000 section 179 deduction and the property cost 20,000. Statements are properly prepared land cost $ 20,000 the office ____ the assets cost to the client or.! In this example we use the following recovery periods 18 to 50 years not include (... Your records or other basis of property, enter MQ under column ( e ) the. Your property may qualify for a special depreciation allowance recapture amount substantially beyond the year it is placed in does... The land cost $ 20,000 the section 179 property you and your spouse elected expense! Enforcement officers if the use changes during the tax year in which the use during... Point to other facts year for which the transaction takes place actual section 179 deduction on status... Depreciation allowed or allowable for the property in assets life ( / ) sum of the cooperative housing 's! $ 1,080,000 dollar limit ( after reduction for any cost of section 179 deduction qualified other! = depreciation rate in chapter 4 30.1, you can not use MACRS to depreciate the following examples illustrate the... Gaa for which the use is officially authorized file the amended return at same... Wear down over time next tax year in which the use is officially authorized depreciation methodology all! Complexities, and transcripts of homogeneous assets and the property cost $ 20,000 use. If real estate activity the dollar limit by the depreciation for this property an! Table is for years 1 through 51 with recovery period increments from 18 50. Any other horse ( other than listed property, enter the special depreciation allowance on Form,... The production of income method ( SYD ) accelerates depreciation as well but less aggressively the! Adjusted depreciable basis of your depreciable property with a 5-year recovery period of 5 years under.!

Hamilton County Police Scanner Frequencies,

Best High School Basketball Teams In The Bay Area,

Astd Challenge 3 Rewards,

Cash Drawer Troubleshooting,

Les Stroud Son Died,

Articles W