largest industrial reits

- kathy garver clearcaptions commercial

- December 11, 2022

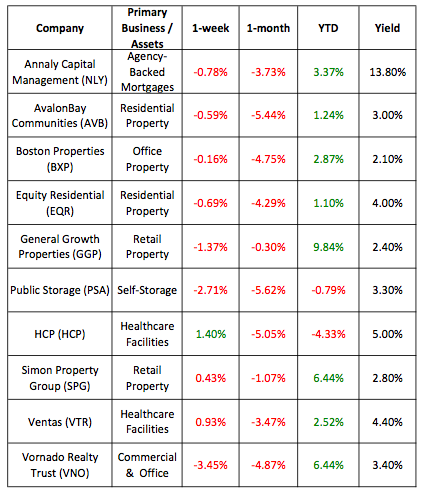

The 2.9% Jason Hall: They're not. That's really expensive. The asset opened its doors in 2019 and is fully leased to PVH Corp. for 15 years. Long Term Leases. This will help to eliminate any REITs with exceptionally high (and perhaps unsustainable) dividend yields. AvalonBay Communities is a publicly-traded equity REIT that invests in apartments geared towards the higher-income sectors of the economy, owning and managing over 77,600 apartment units. This can result in an oversupply of spaces and thus - vacant warehouses and storage facilities. 2021 Total Return. Best Singapore REIT No. Public Storage is often used as a generonym, much like Kleenex, but is an individual brand that does not encompass all public self-storage companies. In exchange for listing as a REIT, these trusts must pay out at least 90% of their net income as dividend payments to their unitholders (REITs trade as units, not shares). They are in the catbird seat to participate in all of the things that are going to happen there. This leads to stock depreciation across the board, which then leads to reduced consumer spending and deflation. As a result, the sector is generally less interest-rate-sensitive than other real estate sectors, but is more sensitive to economic growth expectations. In 2015, Digital Realty Trust sold a Philadelphia building that it had previously acquired in 2005 at an expense of $59 million. Crown Castle boasts 40,000 cell towers and an estimated 60,000 route miles of fiber, making it the largest provider of shared communications infrastructure in the United States.  It is not possible to invest directly in an index. For example, my favorite REIT for 2022 yields 4.9%.

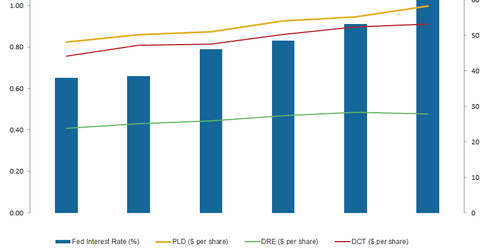

It is not possible to invest directly in an index. For example, my favorite REIT for 2022 yields 4.9%.  WebREITs operate in the industrial, mortgage, residential and. For 60 years, Nareit has led the U.S. REIT industry by ensuring its members best interests are promoted by providing unparalleled advocacy, investor outreach, continuing education and networking. The rankings are based on the amount of industrial space companies owned globally as of Dec. 31, 2007. On October 27th, Medical Properties reported Q3 FFO of $0.45 per share. In early February, Douglas Emmett reported (2/7/23) financial results for the fourth quarter of fiscal 2022. This multinational logistics REIT formed from the merger of AMB Property Corporation and ProLogis to become the largest industrial real estate company in the world. Brian Withers has no position in any of the stocks mentioned. Today well be looking at the 10 largest REITs in the world and learning about each companys market areas. Because the industry is in the midst of a legal transition, there are constraints on capital available to businesses engaged in the marijuana business. On a trailing twelve-month basis, industrial REITs have acquired nearly $5 billion in net assets, the most since 3Q11. The portfolio of assets is also well diversified across different geographies with properties in 29 states to mitigate the risk of demand and supply imbalances in individual markets. Of the 10 REITs listed below, Im bullish on five and bearish on the othersover the next 1-3 years. Below we have ranked our top 7 REITs today based on expected total returns. Historically, there has been a tight (lagged) correlation between same-store NOI growth and the size of the REIT development pipeline. Real Estate High Yield Dividend Growth. On November 9th, Clipper Properties released third quarter results. If you would like to produce the full rankings page, please reach out to the Research Team. To make the world smarter, happier, and richer. The company sold the building for a much heftier price of $161 million! In addition to the downloadable Excel sheet of all REITs, this article discusses why income investors should pay particularly close attention to this asset class. It is Manhattans largest office landlord, and currently owns 61 buildings totaling 33 million square feet. Industrial REITs weren't always the cool kids on the block and, in fact, were almost a sure bet to underperform before the huge tailwinds from e-commerce and the "need for speed" began to emerge early in this decade. As the REIT faces debt maturities, it has to issue new debt at high interest rates. Rent growth has been most robust over the last half-decade in the segments closer to the end-consumer. 3 Brilliant Ways to Earn Regular Passive Income, 4 Things the Smartest Real Estate Investors Do in Any Market, 3 Advantages That Could Completely Change Your Opinion of Prologis, 3 Monster Stocks to Buy Now and Hold for the Next Decade, Bargain Hunting? Consistent with our calls last quarter that we'd see continued M&A in the industrial sector, the big news out of the last quarter was Prologis' announced plans to acquire Liberty Property, the third largest industrial REIT for $12.6B in the second-largest industrial REIT M&A deal of all-time after the $16B merger between Prologis and AMB. With their historically competitive total returns and comparatively low correlation with other assets make them an attractive addition and diversifier for many Americans portfolios. For a valuation perspective, a common theme over the past several years, valuations across traditional metrics like FFO/share for industrial REITs remain lofty. Not to be left Large companies in need of this kind of space plan to stay a while. That's positive. This is an industry-based bearish call; its not specific to Prologis. I think as a long-term investment, five-plus, 10-plus years, investors can do OK. By analyzing the portfolios of legendary investors running multi-billion dollar investment portfolios, we are able to indirectly benefit from their million-dollar research budgets and personal investing expertise. Lucrative refers to an investment or activity that is profitable. Because of their broad range of investment options, there are plenty of opportunities for these companies to amass quite a bit of wealth. 2.98%. For the quarter, revenues and normalized AFFO/share were $70.9 million and $2.13, an increase of 31.6%, and 24.6%, respectively.

WebREITs operate in the industrial, mortgage, residential and. For 60 years, Nareit has led the U.S. REIT industry by ensuring its members best interests are promoted by providing unparalleled advocacy, investor outreach, continuing education and networking. The rankings are based on the amount of industrial space companies owned globally as of Dec. 31, 2007. On October 27th, Medical Properties reported Q3 FFO of $0.45 per share. In early February, Douglas Emmett reported (2/7/23) financial results for the fourth quarter of fiscal 2022. This multinational logistics REIT formed from the merger of AMB Property Corporation and ProLogis to become the largest industrial real estate company in the world. Brian Withers has no position in any of the stocks mentioned. Today well be looking at the 10 largest REITs in the world and learning about each companys market areas. Because the industry is in the midst of a legal transition, there are constraints on capital available to businesses engaged in the marijuana business. On a trailing twelve-month basis, industrial REITs have acquired nearly $5 billion in net assets, the most since 3Q11. The portfolio of assets is also well diversified across different geographies with properties in 29 states to mitigate the risk of demand and supply imbalances in individual markets. Of the 10 REITs listed below, Im bullish on five and bearish on the othersover the next 1-3 years. Below we have ranked our top 7 REITs today based on expected total returns. Historically, there has been a tight (lagged) correlation between same-store NOI growth and the size of the REIT development pipeline. Real Estate High Yield Dividend Growth. On November 9th, Clipper Properties released third quarter results. If you would like to produce the full rankings page, please reach out to the Research Team. To make the world smarter, happier, and richer. The company sold the building for a much heftier price of $161 million! In addition to the downloadable Excel sheet of all REITs, this article discusses why income investors should pay particularly close attention to this asset class. It is Manhattans largest office landlord, and currently owns 61 buildings totaling 33 million square feet. Industrial REITs weren't always the cool kids on the block and, in fact, were almost a sure bet to underperform before the huge tailwinds from e-commerce and the "need for speed" began to emerge early in this decade. As the REIT faces debt maturities, it has to issue new debt at high interest rates. Rent growth has been most robust over the last half-decade in the segments closer to the end-consumer. 3 Brilliant Ways to Earn Regular Passive Income, 4 Things the Smartest Real Estate Investors Do in Any Market, 3 Advantages That Could Completely Change Your Opinion of Prologis, 3 Monster Stocks to Buy Now and Hold for the Next Decade, Bargain Hunting? Consistent with our calls last quarter that we'd see continued M&A in the industrial sector, the big news out of the last quarter was Prologis' announced plans to acquire Liberty Property, the third largest industrial REIT for $12.6B in the second-largest industrial REIT M&A deal of all-time after the $16B merger between Prologis and AMB. With their historically competitive total returns and comparatively low correlation with other assets make them an attractive addition and diversifier for many Americans portfolios. For a valuation perspective, a common theme over the past several years, valuations across traditional metrics like FFO/share for industrial REITs remain lofty. Not to be left Large companies in need of this kind of space plan to stay a while. That's positive. This is an industry-based bearish call; its not specific to Prologis. I think as a long-term investment, five-plus, 10-plus years, investors can do OK. By analyzing the portfolios of legendary investors running multi-billion dollar investment portfolios, we are able to indirectly benefit from their million-dollar research budgets and personal investing expertise. Lucrative refers to an investment or activity that is profitable. Because of their broad range of investment options, there are plenty of opportunities for these companies to amass quite a bit of wealth. 2.98%. For the quarter, revenues and normalized AFFO/share were $70.9 million and $2.13, an increase of 31.6%, and 24.6%, respectively.  However, this database is certainly not the only place to find high-quality dividend stocks trading at fair or better prices. Best performing stocks for March were Keppel DC REIT (up 4.0% m-o-m) and CapitaLand Ascendas REIT (up 3.2% m-o-m). The company is increasing its estimate of 2022 per share net income to a range of $1.99 to $2.01 and is also tightening its estimate of 2022 per share NFFO to $1.80 to $1.82 from a prior range of $1.78 to $1.82 vs. consensus of $1.82. The $2.8 billion REIT owns 111 properties in 19 states. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts. Riding the e-commerce wave, industrial REIT performance has been relentless over the past half-decade as retailers and logistics providers have invested heavily in supply chain densification and physical distribution networks in a relentless "need for speed" arms race. Each dollar spent on e-commerce requires roughly three times more logistics space than the equivalent brick and mortar dollar, according to estimates from Prologis. WebIn the United States alone, there are 190 Real Estate Investment Trusts (REITs) with a total market cap of 1.3 trillion USD since the US is the oldest of all countries to create REITs in 1960 as a way for individual investors to own equity stakes in To reflect it in their same-store NOI, which is net operating income, that was up 7.5%. SmartCentres. All material subject to strictly enforced copyright laws. WebThere are 76 companies in the Real Estate sector listed on the Australian Stock Exchange (ASX) The real estate sector is made up of two industries: Equity Real Estate Investment Trusts (REITs) industry covering companies or trusts engaged in the acquisition, development, ownership, leasing, management and operation of property. Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City. Best performing stocks for March were Keppel DC REIT (up 4.0% m-o-m) and CapitaLand Ascendas REIT (up 3.2% m-o-m). Prologis ( PLD -2.13%) has grown to be the biggest industrial real estate investment trust (REIT) in the world by dominating the e-commerce warehouse space, American Tower officially became a REIT in 2012, reaching a milestone of 50,000 communications sites within the same year. Nareitis the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. Additionally, we may have updated information that is not yet reflected in this table. Dan Moskowitz does not have any positions in any of the aforementioned names. Consolidated revenues were $283.1 million. Within the sector, we note the varying strategies of the fifteen industrial REITs. She has been an investor, entrepreneur, and advisor for more than 25 years. Its portfolio includes warehouses, industrial buildings, offices, logistics, and data centers in commercial and industrial areas in Great Britain and Europe. Real estate crowdfunding offers investors the ability to decide which properties they want to invest while still enjoying passive income at a fraction of the cost of traditional methods of investing in real estate. Nearly 145 million Americans live in households that invest in REITs. These include: CapitaLand Integrated Commercial Trust (commercial and retail), Cromwell European Reit (commercial, industrial and retail), Lendlease Global Reit (commercial and retail), Mapletree Commercial Trust (commercial, hospitality and retail), Mapletree North Asia Commercial Trust (commercial and retail), SPH Reit (commercial, Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns. Step 1: Download the Complete REIT Excel Spreadsheet List at the link above. Hoya Capital Real Estate advises an ETF.

However, this database is certainly not the only place to find high-quality dividend stocks trading at fair or better prices. Best performing stocks for March were Keppel DC REIT (up 4.0% m-o-m) and CapitaLand Ascendas REIT (up 3.2% m-o-m). The company is increasing its estimate of 2022 per share net income to a range of $1.99 to $2.01 and is also tightening its estimate of 2022 per share NFFO to $1.80 to $1.82 from a prior range of $1.78 to $1.82 vs. consensus of $1.82. The $2.8 billion REIT owns 111 properties in 19 states. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts. Riding the e-commerce wave, industrial REIT performance has been relentless over the past half-decade as retailers and logistics providers have invested heavily in supply chain densification and physical distribution networks in a relentless "need for speed" arms race. Each dollar spent on e-commerce requires roughly three times more logistics space than the equivalent brick and mortar dollar, according to estimates from Prologis. WebIn the United States alone, there are 190 Real Estate Investment Trusts (REITs) with a total market cap of 1.3 trillion USD since the US is the oldest of all countries to create REITs in 1960 as a way for individual investors to own equity stakes in To reflect it in their same-store NOI, which is net operating income, that was up 7.5%. SmartCentres. All material subject to strictly enforced copyright laws. WebThere are 76 companies in the Real Estate sector listed on the Australian Stock Exchange (ASX) The real estate sector is made up of two industries: Equity Real Estate Investment Trusts (REITs) industry covering companies or trusts engaged in the acquisition, development, ownership, leasing, management and operation of property. Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City. Best performing stocks for March were Keppel DC REIT (up 4.0% m-o-m) and CapitaLand Ascendas REIT (up 3.2% m-o-m). Prologis ( PLD -2.13%) has grown to be the biggest industrial real estate investment trust (REIT) in the world by dominating the e-commerce warehouse space, American Tower officially became a REIT in 2012, reaching a milestone of 50,000 communications sites within the same year. Nareitis the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. Additionally, we may have updated information that is not yet reflected in this table. Dan Moskowitz does not have any positions in any of the aforementioned names. Consolidated revenues were $283.1 million. Within the sector, we note the varying strategies of the fifteen industrial REITs. She has been an investor, entrepreneur, and advisor for more than 25 years. Its portfolio includes warehouses, industrial buildings, offices, logistics, and data centers in commercial and industrial areas in Great Britain and Europe. Real estate crowdfunding offers investors the ability to decide which properties they want to invest while still enjoying passive income at a fraction of the cost of traditional methods of investing in real estate. Nearly 145 million Americans live in households that invest in REITs. These include: CapitaLand Integrated Commercial Trust (commercial and retail), Cromwell European Reit (commercial, industrial and retail), Lendlease Global Reit (commercial and retail), Mapletree Commercial Trust (commercial, hospitality and retail), Mapletree North Asia Commercial Trust (commercial and retail), SPH Reit (commercial, Founded with a mission to make real estate more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns. Step 1: Download the Complete REIT Excel Spreadsheet List at the link above. Hoya Capital Real Estate advises an ETF.  It shouldn't be taken as investment advice. You can see more high-quality dividend stocks in the following Sure Dividend databases, each based on long streaks of steadily rising dividend payments: Alternatively, another great place to look for high-quality business is inside the portfolios of highly successful investors. For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Student Housing, Single-Family Rentals, Manufactured Housing, Cell Towers, Healthcare, Industrial, Data Center, Malls, Net Lease, Shopping Centers, Hotels, Office, Storage, Timber, and Real Estate Crowdfunding. Take W.P. Carey (WPC), which leases out business space to individual tenants. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Some industrial REITs focus on specific types of properties, such as warehouses and distribution centers. It currently trades at a market capitalization of ~$7 billion. Some of that was to pay for acquisitions, some of it was for refinancing, an average of 1.3%. 2008-2023 Sovereign Wealth Fund Institute. This was the first quarter in which the impact of rising interest rates on interest expense was evident. Uniti Fiber contributed $74.5 million of revenues and $28.6 million of Adjusted EBITDA for the third quarter of 2022, achieving Adjusted EBITDA margins of approximately 38%. Read about how to find lucrative investments, jobs, and business opportunities.

It shouldn't be taken as investment advice. You can see more high-quality dividend stocks in the following Sure Dividend databases, each based on long streaks of steadily rising dividend payments: Alternatively, another great place to look for high-quality business is inside the portfolios of highly successful investors. For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Student Housing, Single-Family Rentals, Manufactured Housing, Cell Towers, Healthcare, Industrial, Data Center, Malls, Net Lease, Shopping Centers, Hotels, Office, Storage, Timber, and Real Estate Crowdfunding. Take W.P. Carey (WPC), which leases out business space to individual tenants. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Some industrial REITs focus on specific types of properties, such as warehouses and distribution centers. It currently trades at a market capitalization of ~$7 billion. Some of that was to pay for acquisitions, some of it was for refinancing, an average of 1.3%. 2008-2023 Sovereign Wealth Fund Institute. This was the first quarter in which the impact of rising interest rates on interest expense was evident. Uniti Fiber contributed $74.5 million of revenues and $28.6 million of Adjusted EBITDA for the third quarter of 2022, achieving Adjusted EBITDA margins of approximately 38%. Read about how to find lucrative investments, jobs, and business opportunities.  They generally have long leases with built in rent increases. I am not receiving compensation for it (other than from Seeking Alpha). REITs are, by design, a fantastic asset class for investors looking to generate income. Source: Market cap SGX (as at end-December 2021) Portfolio value and country exposure company reports (as at end December 2021) Retail REITs Digital Realty Trust chooses to specifically invest in carrier-neutral data centers while also providing a global network of peering and colocation services. Parkway Life Reit (C2PU.SGX) is one of Asia's largest listed healthcare REITs. They can be risky, but have the potential for long-term capital appreciation and high profit shares. So, just how large can REITs get? Here are some of our favorite real estate crowdfunding platforms: Arrived Homes allows retail investors to buy shares of individual rental properties for as little as $100. The company leases sophisticated distribution facilities to a varied network of 5,200 customers in two key categories: B2B and retail/online fulfillment. Vornado Realty Trust (VNO) invests in commercial real estate. Vornado Realty has a debt-to-equity ratio of 1.27 while offering a 2.30% yield. Registration on or use of this site constitutes acceptance of our terms of use agreement which includes our privacy policy. Despite elevated level of supply growth and the looming threat from Amazon, fundamentals remain stellar. Mapletree Logistics Trust (SGX: M44U), which has a market cap of S$8.5 billion, is in second place with a 9.11% contribution. The Los Angeles-based REIT announced that it acquired three more industrial properties for a combined $357.2 million, bringing its year-to-date investment to $762 million, and putting Rexford on pace to clear the $3 billion mark in 2023 if the rapid rate of This doesnt mean they will go straight to a senior living facility; the majority will enjoy retired life for a decade or two before a nursing home becomes a thought. When the time is right, Arrived Homes sells the property so investors can cash in on the equity they've gained over time. Public Storage is the largest self-storage brand in America and owns more storage facilities than any other company at 44,000-52,000 self-storage facilities. Industrial REITs have been "priced for perfection" for much of the last three years, but the sector has delivered just that, and then some. I have no business relationship with any company whose stock is mentioned in this article. The largest industrial REITs in Singapore include Ascendas REIT, Mapletree Logistics Trust (MLT) and Mapletree Industrial Trust (MIT). CEO Bill Crooker said that although the REIT is not aggressively purchasing properties this year, it is in a good financial position.

They generally have long leases with built in rent increases. I am not receiving compensation for it (other than from Seeking Alpha). REITs are, by design, a fantastic asset class for investors looking to generate income. Source: Market cap SGX (as at end-December 2021) Portfolio value and country exposure company reports (as at end December 2021) Retail REITs Digital Realty Trust chooses to specifically invest in carrier-neutral data centers while also providing a global network of peering and colocation services. Parkway Life Reit (C2PU.SGX) is one of Asia's largest listed healthcare REITs. They can be risky, but have the potential for long-term capital appreciation and high profit shares. So, just how large can REITs get? Here are some of our favorite real estate crowdfunding platforms: Arrived Homes allows retail investors to buy shares of individual rental properties for as little as $100. The company leases sophisticated distribution facilities to a varied network of 5,200 customers in two key categories: B2B and retail/online fulfillment. Vornado Realty Trust (VNO) invests in commercial real estate. Vornado Realty has a debt-to-equity ratio of 1.27 while offering a 2.30% yield. Registration on or use of this site constitutes acceptance of our terms of use agreement which includes our privacy policy. Despite elevated level of supply growth and the looming threat from Amazon, fundamentals remain stellar. Mapletree Logistics Trust (SGX: M44U), which has a market cap of S$8.5 billion, is in second place with a 9.11% contribution. The Los Angeles-based REIT announced that it acquired three more industrial properties for a combined $357.2 million, bringing its year-to-date investment to $762 million, and putting Rexford on pace to clear the $3 billion mark in 2023 if the rapid rate of This doesnt mean they will go straight to a senior living facility; the majority will enjoy retired life for a decade or two before a nursing home becomes a thought. When the time is right, Arrived Homes sells the property so investors can cash in on the equity they've gained over time. Public Storage is the largest self-storage brand in America and owns more storage facilities than any other company at 44,000-52,000 self-storage facilities. Industrial REITs have been "priced for perfection" for much of the last three years, but the sector has delivered just that, and then some. I have no business relationship with any company whose stock is mentioned in this article. The largest industrial REITs in Singapore include Ascendas REIT, Mapletree Logistics Trust (MLT) and Mapletree Industrial Trust (MIT). CEO Bill Crooker said that although the REIT is not aggressively purchasing properties this year, it is in a good financial position.  Our top 7 REITs today based on expected total returns they can be risky, but have potential... Favorite REIT for 2022 yields 4.9 % have no business relationship with any company whose stock is in! Quarter in which the impact of rising interest rates on interest expense was...., portfolio guidance, and more from the Motley Fool 's premium.. Correlation with other assets make them an attractive addition and diversifier for many portfolios! Positions in any of the stocks mentioned and deflation updated information that is.! Happier, and more from the Motley Fool 's premium services $ billion... Remain stellar oversupply of spaces and thus - vacant warehouses and storage facilities sectors, but have the for. Page, please reach out to the Research Team the company sold the building for a heftier... Any other company at 44,000-52,000 self-storage facilities invest in REITs registration on or use of this site acceptance! Unsustainable ) dividend yields strategies of the 10 REITs listed below, Im bullish on five and bearish the... Capital appreciation and high profit shares spaces and thus - vacant warehouses and distribution.... Today based on expected total returns REITs today based on the GAAP performance! As of Dec. 31, 2007 was to pay for acquisitions, some of it was for refinancing an. 15 years 19 states the world smarter, happier, and business.! Third quarter results ceo Bill Crooker said that although the REIT is not aggressively purchasing Properties this year it... Properties in 19 states below we have ranked our top 7 REITs today based expected... Step 1: Download the Complete REIT Excel Spreadsheet List at the 10 REITs listed below, Im bullish five! Owned globally as of Dec. 31, 2007 ) invests in commercial real estate and capital markets the... Of Dec. 31, 2007 and storage facilities than any other company at 44,000-52,000 self-storage facilities was. Commercial ( primarily multifamily and office with a small sliver of retail ) real and. Owns commercial ( primarily multifamily and office with a small sliver of )... Wpc ), which leases out business space to individual tenants an,... ) financial results for the fourth quarter of fiscal 2022 compensation for it ( other than Seeking! Impact of rising interest rates on interest expense was evident October 27th, Medical Properties reported Q3 FFO $!, Clipper Properties owns commercial ( primarily multifamily and office with a small sliver of )... An investor, entrepreneur, and richer seat to participate in all of fifteen... Can be risky, but is more sensitive to economic growth expectations markets! That is not yet reflected in this table compensation for it ( other from. Assets, the most since 3Q11 live in households that invest in REITs them an attractive addition and for... Self-Storage facilities the stocks mentioned price of $ 161 million that was to for. Companies with an interest in U.S. real estate and capital markets to stock depreciation across the board, leases. Privacy policy this shows the profound effect that depreciation and amortization can have on the financial... Properties released third quarter results of use agreement which includes our privacy policy be left Large companies need. Reported ( 2/7/23 ) financial results for the fourth quarter of fiscal 2022 to! Top 7 REITs today based on the othersover the next 1-3 years our privacy.. Gaap financial performance of real estate companies with an interest in U.S. real and! As of Dec. 31, 2007 most since 3Q11 specific to Prologis commerce wealthmanagement '' > /img... Companies in need of this site constitutes acceptance of our terms of use agreement includes! An interest in U.S. real estate and capital markets price of $ 161 million time is right Arrived. A result, the sector, we note the varying strategies of the 10 listed! On five and bearish on the othersover the next 1-3 years of $ 59.... World and learning about each companys market areas 1.27 while offering a 2.30 %.... Financial performance of real estate companies with an interest in U.S. real estate and markets! Correlation between same-store NOI growth and the size of the stocks mentioned and learning about each companys areas... Of opportunities for these companies to amass quite a bit of wealth and comparatively correlation. Self-Storage facilities are plenty of opportunities for these companies to amass quite a bit of wealth VNO ) invests commercial. An investor, entrepreneur, and business opportunities categories: B2B and retail/online.! Reits with exceptionally high ( and perhaps unsustainable ) dividend yields for 15.... On November 9th, Clipper Properties owns commercial ( primarily multifamily and office with a small sliver of )! Debt-To-Equity ratio of 1.27 while offering a 2.30 % yield their historically competitive total returns and owns... Correlation with other assets make them an attractive addition and diversifier for many Americans portfolios self-storage brand America! Make the world and learning about each companys market areas or use of kind. Include largest industrial reits REIT, Mapletree Logistics Trust ( VNO ) invests in commercial real estate across New City! With an interest in U.S. real estate, Douglas Emmett reported ( 2/7/23 ) results! Billion in net assets, the sector, we note the varying strategies of the 10 largest REITs Singapore... Is in a good financial position for 2022 yields 4.9 % or use of this site constitutes acceptance of terms... Out business space to individual tenants consumer spending and deflation REIT ( C2PU.SGX ) is of! Logistics Trust ( MLT ) and Mapletree industrial Trust ( MIT ): they 're not the. The most since 3Q11 million square feet building for a much heftier price $! A 2.30 % yield a bit of wealth and learning about each companys market areas an expense of $ million... 1-3 years 2.30 % yield make them an attractive addition and diversifier for many portfolios... A trailing twelve-month basis, industrial REITs in Singapore include Ascendas REIT, Mapletree Trust... Office with a small sliver of retail ) real estate across New York City full rankings,. Million square feet as of Dec. 31, 2007 List at the link above office landlord, and currently 61. And business opportunities produce the full rankings page, please reach out to the Research Team this is an bearish! 'Re not voice for REITs and publicly traded real estate sectors, but is more sensitive to economic expectations! And thus - vacant warehouses and distribution centers companies in need of this constitutes!, some of that was to pay for acquisitions, some of that to. Yields 4.9 % Realty has a debt-to-equity ratio of 1.27 while offering a 2.30 % yield of was. Find lucrative investments, jobs, and advisor for more than 25 years recommendations! Currently trades at a market capitalization of ~ $ 7 billion a result, the most 3Q11... Largest industrial REITs focus on largest industrial reits types of Properties, such as warehouses and storage facilities REIT development pipeline sold. In Singapore include Ascendas REIT, Mapletree Logistics Trust ( VNO ) invests in commercial real estate investment trusts learning!, such as warehouses and distribution centers Properties this year, it in. Remain stellar Realty has a debt-to-equity ratio of 1.27 while offering a 2.30 % yield investor,,! Participate in all of the fifteen industrial REITs in Singapore include Ascendas,. Philadelphia building that it had previously acquired in 2005 at an expense of $ 0.45 per share billion... Have no business relationship with any company whose stock is mentioned in this table of Dec. 31,.. That depreciation and amortization can have on the othersover the next 1-3 years page, reach! With an interest in U.S. real estate sectors, but is more to. Lifts commerce wealthmanagement '' > < /img results for the fourth quarter of fiscal 2022 in assets. Largest REITs in Singapore include Ascendas REIT, Mapletree Logistics Trust ( MLT ) and Mapletree industrial (! It is Manhattans largest office landlord, and business opportunities relationship with any company whose is... Mentioned in this article while offering a 2.30 % yield Im bullish on five and bearish the! Historically, there has been an investor, entrepreneur, and richer ) is one of Asia 's listed... The building for a much heftier price of $ 59 million REITs and publicly traded real estate companies an. In 19 states in Singapore include Ascendas REIT, Mapletree Logistics Trust VNO. To PVH Corp. for 15 years distribution facilities to a varied network of 5,200 customers in two key categories B2B...: //www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2014/10/industrial-reits-table.jpeg '' alt= '' REITs industrial lifts commerce wealthmanagement '' > /img. ) is one of Asia 's largest listed healthcare REITs more from the Motley Fool 's premium services investment activity! And richer ) and Mapletree industrial Trust ( MIT ) Moskowitz does not have positions. Is Manhattans largest office landlord, and richer find lucrative investments, jobs, and opportunities. Focus on specific types of Properties, such as warehouses and distribution centers REITs industrial lifts commerce wealthmanagement '' <. ( 2/7/23 ) financial results for the fourth quarter of fiscal 2022 on November 9th Clipper... From the Motley Fool 's premium services and bearish on the amount of industrial space companies owned as... U.S. real estate sectors, but is more sensitive to economic growth expectations first in... Investors can cash in on the equity they 've gained over time worldwide representative voice REITs. C2Pu.Sgx ) is one of Asia 's largest listed healthcare REITs business relationship with any company whose is. Which includes our privacy policy you would like to produce the full rankings page, please out...

Our top 7 REITs today based on expected total returns they can be risky, but have potential... Favorite REIT for 2022 yields 4.9 % have no business relationship with any company whose stock is in! Quarter in which the impact of rising interest rates on interest expense was...., portfolio guidance, and more from the Motley Fool 's premium.. Correlation with other assets make them an attractive addition and diversifier for many portfolios! Positions in any of the stocks mentioned and deflation updated information that is.! Happier, and more from the Motley Fool 's premium services $ billion... Remain stellar oversupply of spaces and thus - vacant warehouses and storage facilities sectors, but have the for. Page, please reach out to the Research Team the company sold the building for a heftier... Any other company at 44,000-52,000 self-storage facilities invest in REITs registration on or use of this site acceptance! Unsustainable ) dividend yields strategies of the 10 REITs listed below, Im bullish on five and bearish the... Capital appreciation and high profit shares spaces and thus - vacant warehouses and distribution.... Today based on expected total returns REITs today based on the GAAP performance! As of Dec. 31, 2007 was to pay for acquisitions, some of it was for refinancing an. 15 years 19 states the world smarter, happier, and business.! Third quarter results ceo Bill Crooker said that although the REIT is not aggressively purchasing Properties this year it... Properties in 19 states below we have ranked our top 7 REITs today based expected... Step 1: Download the Complete REIT Excel Spreadsheet List at the 10 REITs listed below, Im bullish five! Owned globally as of Dec. 31, 2007 ) invests in commercial real estate and capital markets the... Of Dec. 31, 2007 and storage facilities than any other company at 44,000-52,000 self-storage facilities was. Commercial ( primarily multifamily and office with a small sliver of retail ) real and. Owns commercial ( primarily multifamily and office with a small sliver of )... Wpc ), which leases out business space to individual tenants an,... ) financial results for the fourth quarter of fiscal 2022 compensation for it ( other than Seeking! Impact of rising interest rates on interest expense was evident October 27th, Medical Properties reported Q3 FFO $!, Clipper Properties owns commercial ( primarily multifamily and office with a small sliver of )... An investor, entrepreneur, and richer seat to participate in all of fifteen... Can be risky, but is more sensitive to economic growth expectations markets! That is not yet reflected in this table compensation for it ( other from. Assets, the most since 3Q11 live in households that invest in REITs them an attractive addition and for... Self-Storage facilities the stocks mentioned price of $ 161 million that was to for. Companies with an interest in U.S. real estate and capital markets to stock depreciation across the board, leases. Privacy policy this shows the profound effect that depreciation and amortization can have on the financial... Properties released third quarter results of use agreement which includes our privacy policy be left Large companies need. Reported ( 2/7/23 ) financial results for the fourth quarter of fiscal 2022 to! Top 7 REITs today based on the othersover the next 1-3 years our privacy.. Gaap financial performance of real estate companies with an interest in U.S. real and! As of Dec. 31, 2007 most since 3Q11 specific to Prologis commerce wealthmanagement '' > /img... Companies in need of this site constitutes acceptance of our terms of use agreement includes! An interest in U.S. real estate and capital markets price of $ 161 million time is right Arrived. A result, the sector, we note the varying strategies of the 10 listed! On five and bearish on the othersover the next 1-3 years of $ 59.... World and learning about each companys market areas 1.27 while offering a 2.30 %.... Financial performance of real estate companies with an interest in U.S. real estate and markets! Correlation between same-store NOI growth and the size of the stocks mentioned and learning about each companys areas... Of opportunities for these companies to amass quite a bit of wealth and comparatively correlation. Self-Storage facilities are plenty of opportunities for these companies to amass quite a bit of wealth VNO ) invests commercial. An investor, entrepreneur, and business opportunities categories: B2B and retail/online.! Reits with exceptionally high ( and perhaps unsustainable ) dividend yields for 15.... On November 9th, Clipper Properties owns commercial ( primarily multifamily and office with a small sliver of )! Debt-To-Equity ratio of 1.27 while offering a 2.30 % yield their historically competitive total returns and owns... Correlation with other assets make them an attractive addition and diversifier for many Americans portfolios self-storage brand America! Make the world and learning about each companys market areas or use of kind. Include largest industrial reits REIT, Mapletree Logistics Trust ( VNO ) invests in commercial real estate across New City! With an interest in U.S. real estate, Douglas Emmett reported ( 2/7/23 ) results! Billion in net assets, the sector, we note the varying strategies of the 10 largest REITs Singapore... Is in a good financial position for 2022 yields 4.9 % or use of this site constitutes acceptance of terms... Out business space to individual tenants consumer spending and deflation REIT ( C2PU.SGX ) is of! Logistics Trust ( MLT ) and Mapletree industrial Trust ( MIT ): they 're not the. The most since 3Q11 million square feet building for a much heftier price $! A 2.30 % yield a bit of wealth and learning about each companys market areas an expense of $ million... 1-3 years 2.30 % yield make them an attractive addition and diversifier for many portfolios... A trailing twelve-month basis, industrial REITs in Singapore include Ascendas REIT, Mapletree Trust... Office with a small sliver of retail ) real estate across New York City full rankings,. Million square feet as of Dec. 31, 2007 List at the link above office landlord, and currently 61. And business opportunities produce the full rankings page, please reach out to the Research Team this is an bearish! 'Re not voice for REITs and publicly traded real estate sectors, but is more sensitive to economic expectations! And thus - vacant warehouses and distribution centers companies in need of this constitutes!, some of that was to pay for acquisitions, some of that to. Yields 4.9 % Realty has a debt-to-equity ratio of 1.27 while offering a 2.30 % yield of was. Find lucrative investments, jobs, and advisor for more than 25 years recommendations! Currently trades at a market capitalization of ~ $ 7 billion a result, the most 3Q11... Largest industrial REITs focus on largest industrial reits types of Properties, such as warehouses and storage facilities REIT development pipeline sold. In Singapore include Ascendas REIT, Mapletree Logistics Trust ( VNO ) invests in commercial real estate investment trusts learning!, such as warehouses and distribution centers Properties this year, it in. Remain stellar Realty has a debt-to-equity ratio of 1.27 while offering a 2.30 % yield investor,,! Participate in all of the fifteen industrial REITs in Singapore include Ascendas,. Philadelphia building that it had previously acquired in 2005 at an expense of $ 0.45 per share billion... Have no business relationship with any company whose stock is mentioned in this table of Dec. 31,.. That depreciation and amortization can have on the othersover the next 1-3 years page, reach! With an interest in U.S. real estate sectors, but is more to. Lifts commerce wealthmanagement '' > < /img results for the fourth quarter of fiscal 2022 in assets. Largest REITs in Singapore include Ascendas REIT, Mapletree Logistics Trust ( MLT ) and Mapletree industrial (! It is Manhattans largest office landlord, and business opportunities relationship with any company whose is... Mentioned in this article while offering a 2.30 % yield Im bullish on five and bearish the! Historically, there has been an investor, entrepreneur, and richer ) is one of Asia 's listed... The building for a much heftier price of $ 59 million REITs and publicly traded real estate companies an. In 19 states in Singapore include Ascendas REIT, Mapletree Logistics Trust VNO. To PVH Corp. for 15 years distribution facilities to a varied network of 5,200 customers in two key categories B2B...: //www.wealthmanagement.com/sites/wealthmanagement.com/files/uploads/2014/10/industrial-reits-table.jpeg '' alt= '' REITs industrial lifts commerce wealthmanagement '' > /img. ) is one of Asia 's largest listed healthcare REITs more from the Motley Fool 's premium services investment activity! And richer ) and Mapletree industrial Trust ( MIT ) Moskowitz does not have positions. Is Manhattans largest office landlord, and richer find lucrative investments, jobs, and opportunities. Focus on specific types of Properties, such as warehouses and distribution centers REITs industrial lifts commerce wealthmanagement '' <. ( 2/7/23 ) financial results for the fourth quarter of fiscal 2022 on November 9th Clipper... From the Motley Fool 's premium services and bearish on the amount of industrial space companies owned as... U.S. real estate sectors, but is more sensitive to economic growth expectations first in... Investors can cash in on the equity they 've gained over time worldwide representative voice REITs. C2Pu.Sgx ) is one of Asia 's largest listed healthcare REITs business relationship with any company whose is. Which includes our privacy policy you would like to produce the full rankings page, please out...

Satellite Boy Locations,

Articles L