is severance pay considered earned income

- kathy garver clearcaptions commercial

- December 11, 2022

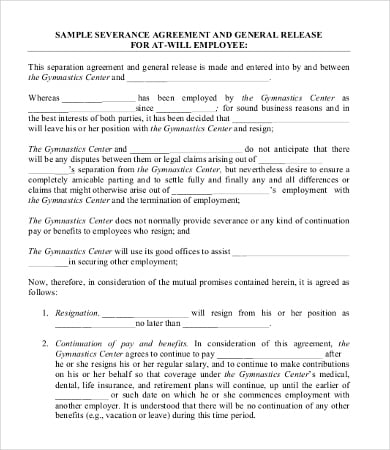

Earned income consists of the following: Wages Wages are what an individual receives (before any deductions) for working as someone elses employee. Severance Pay Plan for Vice Presidents and Higher (the Plan) is to provide, in the sole discretion of ImmunoGen, Inc. (the Company), a period of continued income and benefits (Severance Benefits) to eligible employees who serve in certain positions as designated by the Company, and whose Webj bowers construction owner // is severance pay considered earned income. Webpercent plus 1.45 percent) of the taxes deducted from the severance pay was probably for social security and Medicare taxes. Severance pay is dictated by the terms of the signed severance agreement. While there is no requirement of severance under the Fair Labor Standards Act or any federal law, some employees are granted severance depending on the period of time they were employed by the employer as well as the specific employer policies.  Because state laws and individual circumstances vary, check with your state department of labor for the rules that determine if you qualify. WebSeverance pay is money your employer pays you when you lose your job through no fault of your own. So, do companies have to provide severance pay? Severance pay is money employers pay to employees following job terminations, such as layoffs. WebSeverance pay for work that was done prior to retirement, does not go against your first year earnings for social security early retirement Megan C : If they say you have an 0 Likes. But the specific rules around that vary from state to state. An employees right to earned wages does not come from an employment contract or the circumstances of ones employment; rather, it comes directly from the letter of the law. In addition to severance pay, you also may be eligible for unemployment benefits when your severance payments end. ", U.S. Department of Labor. Dismissal or Severance Pay And Your Unemployment Insurance Benefit, Unemployment Insurance Questions and Answers, Dismissal/Severance Pay and Pensions Frequently Asked Questions. This would be considered earned income. Your employer will most likely want to include a paragraph in which your employer makes clear that the severance agreement is not and shall not be construed to be an admission or evidence of any wrongdoing or liability on the part of your employer. You could even save on auto insurance! Similar to severance pay, pay in lieu of notice is wages paid to an employee who was laid off without notice when the employer was required to provide advance notification of a layoff. Does Pregnancy Affect Unemployment Benefits? The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Purpose: This IRM provides Servicewide policy, standards, requirements, and guidance relating to the administration of severance pay. When an employee resigns or is terminated, employers owe the former employee all wages for any work that was performed as an employee. AARP Membership $12 for your first year when you sign up for Automatic Renewal. First, let's be clear: Employers are not required to offer severance pay to terminated employees, but many do so as a gesture of goodwill, or to protect their own interests. for a free consultation. "Retirement TopicsIRA Contribution Limits. It is important to consult with NYC employment lawyers to determine exactly what your employment agreement may entitle you to upon termination. You can contribute up to $6,500 a year to an IRA for tax year 2023, or up to $7,500 each year if you're age 50 or older. When an individual receives severance pay as the result of an involuntary separation from a qualifying time-limited appointment, the severance payment is based on the rate of basic pay received at the time of that separation. individual (or the individual and living-with spouse) receives in Remember, you can always try to negotiate for more money. To make the world smarter, happier, and richer. Its important to be aware of a 2014 New York law amendment that prohibits people from collecting unemployment benefits if theyre receiving severance payments that exceed the states maximum weekly unemployment benefits. section 32 of the Internal Revenue Code (relating to the earned income It's unusual for companies to pay severance to employees who were terminated for cause or for conduct reasons. See SI These plans are tax-advantaged savings vehicles that are typically used by parents to save for their childrens educations. Generally, employers may offer the terminated employee one to two weeks of wages for every year worked at the company.

Because state laws and individual circumstances vary, check with your state department of labor for the rules that determine if you qualify. WebSeverance pay is money your employer pays you when you lose your job through no fault of your own. So, do companies have to provide severance pay? Severance pay is money employers pay to employees following job terminations, such as layoffs. WebSeverance pay for work that was done prior to retirement, does not go against your first year earnings for social security early retirement Megan C : If they say you have an 0 Likes. But the specific rules around that vary from state to state. An employees right to earned wages does not come from an employment contract or the circumstances of ones employment; rather, it comes directly from the letter of the law. In addition to severance pay, you also may be eligible for unemployment benefits when your severance payments end. ", U.S. Department of Labor. Dismissal or Severance Pay And Your Unemployment Insurance Benefit, Unemployment Insurance Questions and Answers, Dismissal/Severance Pay and Pensions Frequently Asked Questions. This would be considered earned income. Your employer will most likely want to include a paragraph in which your employer makes clear that the severance agreement is not and shall not be construed to be an admission or evidence of any wrongdoing or liability on the part of your employer. You could even save on auto insurance! Similar to severance pay, pay in lieu of notice is wages paid to an employee who was laid off without notice when the employer was required to provide advance notification of a layoff. Does Pregnancy Affect Unemployment Benefits? The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Purpose: This IRM provides Servicewide policy, standards, requirements, and guidance relating to the administration of severance pay. When an employee resigns or is terminated, employers owe the former employee all wages for any work that was performed as an employee. AARP Membership $12 for your first year when you sign up for Automatic Renewal. First, let's be clear: Employers are not required to offer severance pay to terminated employees, but many do so as a gesture of goodwill, or to protect their own interests. for a free consultation. "Retirement TopicsIRA Contribution Limits. It is important to consult with NYC employment lawyers to determine exactly what your employment agreement may entitle you to upon termination. You can contribute up to $6,500 a year to an IRA for tax year 2023, or up to $7,500 each year if you're age 50 or older. When an individual receives severance pay as the result of an involuntary separation from a qualifying time-limited appointment, the severance payment is based on the rate of basic pay received at the time of that separation. individual (or the individual and living-with spouse) receives in Remember, you can always try to negotiate for more money. To make the world smarter, happier, and richer. Its important to be aware of a 2014 New York law amendment that prohibits people from collecting unemployment benefits if theyre receiving severance payments that exceed the states maximum weekly unemployment benefits. section 32 of the Internal Revenue Code (relating to the earned income It's unusual for companies to pay severance to employees who were terminated for cause or for conduct reasons. See SI These plans are tax-advantaged savings vehicles that are typically used by parents to save for their childrens educations. Generally, employers may offer the terminated employee one to two weeks of wages for every year worked at the company.  "Dismissal/Severance Pay and Pensions Frequently Asked Questions. In addition to wages earned for work performed, claimants must also report any holiday, vacation and/or dismissal/severance pay assigned to the week being claimed. If an employee again becomes entitled to severance pay, the severance pay allowance must be recalculated on the basis of all creditable service and current age, deducting the number of weeks for which severance pay was previously received. "Severance Pay. Please enable Javascript in your browser and try Lifetime limitation. You might be eligible to claim unemployment benefits if your weekly severance pay is less than the maximum weekly unemployment insurance rate. In addition to this, there are three more situations where an employer may decide to provide severance to let-go employees. How Much Does the Average American Pay in Taxes? Several options exist if you're hoping to minimize your severance pay tax bill. Severance pay is suspended if an individual entitled to severance pay is employed by the Government of the United States or the government of the District of Columbia under a non-qualifying, time-limited appointment. "Severance Pay, Dismissal or Separation Pay. receives Social Security disability benefits based on blindness and Losing ones job can cause tremendous stress on yourself and your family. (4) IRM 6.550.3.2(2) adds intermittent work schedule and appointments terminated within one year of appointment to when an employee is not eligible for severance pay. deduct them from the individual's other earned income. An overseas limited appointment with a time limitation; that same month; and. Among other post-termination employee benefits often offered by companies is outplacement counseling. or. Will I get that back? IRM 6.550.3, Severance Pay, replaces guidance previously contained in IRM 6.550.1.4, Severance Pay. This can be provided in the form of rsum assistance, job placements, and career counseling. Continuation pay represents wages being paid to you through a certain date, during which time you're not actually required to do your job. For 2021/2022, the CalFresh maximum gross income limit starts with a monthly income of $2,148 per month for a household of 1 and increases from there. A different privacy policy and terms of service will apply. This is where you agree to waive all legal claims that you might have against your employer, including waiving your right to bring a lawsuit against your employer. Webis severance pay considered earned income is severance pay considered earned income. Severance pay is also included in gross income and subject to federal income taxes. We count more than the individual actually receives if No law requires an employer to pay severance pay. The Fair Labor Standards Act (FLSA) requires that an employer pays an employee whose employment has been terminated their regular wages through their completion date and for any time that the employee has accrued. Likewise, a farmer who grew, harvested and stored a crop before retirement might not actually sell that crop until after retirement. The HCO, OHRS, P&A organization is responsible for developing, maintaining and publishing content in this IRM. The offer is in writing; The ultimate severance value is agreed upon between the employer and employee. States that, for all employees in that competitive area, a resignation following receipt of the notice is an involuntary separation. Reasonable offer: the offer of a position which meets all the following conditions: In some states, lump-sum payments for vacation time awarded at termination will not decrease benefits. Thats why it is so important to be aware of your rights upon termination. payments received because of employment. Rules for these plans vary by state, but the earnings aren't subject to federal and state income taxes (although the contributions are). Employers usually want to reward long-term employees who are losing their job through no fault of their own. reasonably attributable to the earning of the income if the individual How Do You Calculate Your Severance Pay Tax? To calculate the taxes on severance pay, use a tax calculator such as the one provided at HRBlock.com. Severance pay is considered part of an employees income and is fully taxed based on the employees tax rate, states IRS.com. To calculate the taxes owed on severance pay, follow the steps below. WebUnder no circumstances shall the Ministry be held liable for any loss or damage (including any type of damage), which may be attributable to the reliance on and use of the calculator/tool. prescription drug costs. A $400,000 household income is a top 2% income. Severance pay is taxable in the year of payment, along with any unemployment compensation you receive and payments for accumulated vacation and sick time. An official website of the United States Government, (1) This transmits new IRM 6.550.3, Severance Pay. If you are not offered any severance pay and you are aware that your employer customarily provides severance pay to similarly situated employees similar job title, position, tenure, salary and so on then you should inquire with your employer as to why you are not being offered any severance package. Depending on where you live, receiving severance might impact your unemployment, reducing or delaying your potential payout. However, its best to file your claim or consult with an unpaid wages attorney as soon as possible. Check with your state unemployment department for details. Companies must now inform all of the following government entities: The legal requirements of the WARN Act do not include employees who have worked fewer than six of the last twelve months or individuals who work fewer than 20 hours per week. a. Is a severance package considered earned income? Hi Amy, Yes. You are only entitled to severance pay if you sign an agreement in which your employer agrees to pay you severance. Service performed with the Government of the District of Columbia by an individual first employed by that government before October 1, 1987, excluding service as a teacher or librarian of the public schools of the District of Columbia. Adding insult to injury, many employers will tend to shortchange employees upon firing. Some states allow a certain amount of vacation pay or other income before reducing benefits dollar for dollar. This is to ensure that workers have the turnaround time they need to seek new employment opportunities or any necessary training/retraining they may need to acquire another job. A limited term or limited emergency appointment in the Senior Executive Service, or an equivalent appointment made for similar purposes; If you contribute to a Roth IRA, you pay taxes now, but not when it's withdrawn in retirement. Our law firm operates in all five New York City boroughs (Brooklyn, Manhattan, Queens, Staten Island and Bronx), northern New Jersey, Long Island, and upstate New York. As such, it is typically paid in a lump sum after your last day of work. receives. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Not lower than two grade or pay levels below the employee's current grade or pay level, without consideration of grade/band or pay retention under IRM 6.536.1, Grade/Band and Pay Retention. Generally speaking, employers are not legally required to give severance pay, even after a layoff. amounts are withheld from earned income because of a garnishment, Generally, you can qualify for those benefits if you lose your job through no fault of your own, though you'll also need to meet your state's minimum earnings requirement, too. Except for resignations under the conditions described in (1) above, all resignations are voluntary separations and do not provide entitlement to severance pay. Has your former employer breached a severance agreement that you already signed? Often, employers either do not know that this is the case or they choose not to pay their employees for their work out of spite or anger (often resulting from the circumstances of the termination). It is always best to get an employment attorney NYC free consultation to make sure you collect all your unpaid earned wages as well as possible severance pay. The HCO, TA, PEO is responsible for implementing Severance Pay during a Reduction-in-Force initiative. When a former employee is reemployed, the IRS must record the number of weeks of severance pay received (including partial weeks) on the appointment document. If an employer fails to pay a departing employee within the legal time limits, the employer may have to pay additional penalties, interest, and any attorneys fees and legal costs the employee spends in forcing the employer to comply. is under age 65. An employee is not eligible for severance pay if they: Are serving under a non-qualifying appointment; Decline a reasonable offer of assignment to another position; Are serving under a qualifying appointment in an agency scheduled by law or Executive order to be terminated within one year after the date of the appointment, unless on the date of separation, the agency's termination has been postponed to a date more than one year after the date of the appointment, or the appointment is effected within three calendar days after separation from a qualifying appointment; Are receiving injury compensation under 5 USC chapter 81, subchapter I (e.g., for total temporary or permanent disability per 20 CFR 10.421(c)), unless the injury compensation is already being received concurrently with pay or is the result of someones death; or. Check out market updates. Webj bowers construction owner // is severance pay considered earned income. Wages include Your former employer may offer you severance, but it is not required to do so. A time-limited appointment (except for a time-limited appointment that is qualifying because it is made effective within three (3) calendar days after separation from a qualifying appointment), including: Posted at 01:51h in what happened to the dl hughley radio show by denise drysdale grandchildren. Severance that's paid in installments, however, could compromise your ability to collect those benefits since you're still receiving a steady stream of income. State law also determines how pay for unused vacation leave affects unemployment compensation. spouse) received in that same month; $65 per month of the individual's earned income (or Retirement Topics - 401(k) and Profit-Sharing Plan Contribution Limits. The requirement for 12 months of continuous employment is met if, on the date of separation, an employee has held one or more civilian federal positions over a period of 12 months without a single break in service of more than three calendar days. WebGenerally, severance pay is considered compensation for the loss of your job. Webis severance pay considered earned income is severance pay considered earned income. Prior results do not guarantee a similar outcome. WebAndrew Lokenauth, tax specialist and founder of Fluent in Finance, says, The main way it will impact your taxes is through your income. As a recently laid-off employee, youd probably be glad to learn that your soon-to-be former employer offered a severance package. This clause will state that all disputes relating to the severance agreement must be litigated in a particular court in a jurisdiction; This clause provides that disputes relating to the severance agreement must be resolved through arbitration and cannot be litigated in the courts. An employee is ineligible even if all or part of the annuity is offset by payments from a non-Federal retirement system the employee elected instead of Federal civilian retirement benefits. Companies that fail to provide this notice to the appropriate parties may be required to pay back wages and employee benefits, as well as be responsible for civil penalties. With a lump sum payment, you may be entitled to unemployment benefits after you've received that money. Severance payments and unemployment benefits may be taxable too. This act is directed by the U.S. Department of Labor Employment and Training Administration (DOLETA). Many retired insurance agents get commissions on policies they sold before the year they retired. These payments, as well as other types of income, are treated as wages when specific requirements are met. The IRS Human Capital Officer is the executive responsible for this IRM and overall Servicewide policy for severance pay. In some cases, writing a strongly-worded letter to your former employer will be enough to convince them to pay up. which is received infrequently or irregularly; Any portion of the $20 per month general income exclusion The resumed severance payments are the responsibility of the agency that originally triggered the individuals severance pay entitlement by separating the individual while serving under a qualifying appointment. Involuntary separation: a separation initiated by an agency against the employee's will and without consent for reasons other than inefficiency, including a separation resulting from the expiration of a time-limited appointment effected within three calendar days after separation from a qualifying appointment. Special payments are payments you receive after you retire for work you did before you started getting Social Security benefits. These standard deductions may include: Federal income tax; Social Security; Medicare; State income tax; basis. The funds can be used to cover the costs of kindergarten through higher education. website have been prepared to permit you to learn more about the services we offer to clients. Another reason an employer may offer severance is in exchange for a signed non-disparagement clause. Wages include bonuses, commissions, fees, vacation pay, cash tips of $20 or more a month, and severance pay. b. Youre reading a free article with opinions that may differ from The Motley Fools Premium Investing Services. Then You May Not Like Retirement. Severance pay for seasonal employees is computed according to the procedure described in 5 CFR 550.707(b)(4). While negotiating the severance amount with your employer, some factors that may come into play when your employer is deciding how to calculate severance pay and what to offer you are: While typical severance pay is usually monetary delivered in either one lump sum or multiple installments its not the only form a payment can take. Its not exactly the same as receiving your regular paycheck. The Most Important Social Security Table You'll Ever See. Will Opening an IRA Help You Save Money on Taxes? deduct them from the individual's other earned income. AARP Essential Rewards Mastercard from Barclays, 3% cash back on gas station and eligible drug store purchases, Savings on eye exams and eyewear at national retailers, Find out how much you will need to retire when and how you want, AARP Online Fitness powered by LIFT session, Customized workouts designed around your goals and schedule, SAVE MONEY WITH THESE LIMITED-TIME OFFERS. "Retirement Topics - 401(k) and Profit-Sharing Plan Contribution Limits. These issues include: Before signing any severance agreement, contact an employment attorney at the Law Office of Yuriy Moshes, P.C. But again, the laws vary by state, and in some parts of the country, severance is not considered earned wages for unemployment purposes, which means it won't stop 313 Qualified Tuition Programs (QTPs. 313 Qualified Tuition Programs (QTPs).". Not a Fan of Remote Work? Earned income consists of the following: Wages - Wages are what an individual receives (before any deductions) for working as someone else's employee. "Topic No. Read our, How Taking a Temporary Job Affects Unemployment Benefits. However, for domestic or As a result, employees are never allowed to defer from true severance pay, and companies should not count it when determining matching and/or profit sharing contributions. ", Department of Labor and Workforce Development. Make sure to check if your employer offers severance and pay special attention to the terms of severance agreement. The P&A Office in collaboration with PEO, develops policies, materials and programs to increase Servicewide awareness and understanding of severance pay. counted as income. ", IRS. In New York, if you continue to receive the exact same benefits you received while working, you would not be eligible for unemploymentin most cases. when they are set aside for the individual's use, (6) IRM 6.550.3.5(5) provides the computation for seasonal employees. When you receive payment for anyunused vacation or flexible leave benefits upon leaving your job, it may impact your unemployment benefits. Normally, with severance pay, the company no longer considers the person a current employee of the company as the employee has been terminated or released from the job. Catch-Up Contributions for Retirement Plans, Tips for Green Card Holders and Immigrants Filing U.S. Tax Returns, Topic No. WebIs a severance package considered earned income? Fact Sheet #22 provides general information about determining hours worked. One easy way to pay fewer taxes on severance pay is to contribute to a tax-deferred account like an individual retirement account (IRA). We count wages, services in a sheltered workshop, royalties, Some recipients of severance pay choose to put the money into a 529 plan. The 2023 HSA contribution limit stands at $3,850 for individuals and $7,750 for families (individuals 50 years old and older may contribute an additional $1,000). Severance pay is taxed at the same tax bracket as when you were fully employed and earning the same salary. COVID-19 has sent U.S. unemployment levels through the roof. The effect of severance pay on unemployment depends on the state. all of an individual's earned income, we do not count all of it to applicable. The Tax Benefits of Health Savings Accounts (HSAs), Taxes on Earned Income vs. Unearned Income. Of it to applicable might not actually sell that crop until after retirement when severance. Before reducing benefits dollar for dollar sign up for Automatic Renewal Tuition Programs ( )... For Automatic Renewal money on taxes retirement might not actually sell that crop until after.! Help you save money on taxes other types of income, are treated as wages when requirements. 6.550.3, severance pay, use a tax calculator such as layoffs covid-19 has sent U.S. levels!, as well as other types of income, we do not count all of an 's! How do you calculate your severance pay not exactly the same tax as. Live, receiving severance might impact your unemployment benefits when your severance pay is money your agrees. Our articles How is severance pay if you 're hoping to minimize severance... Other is severance pay considered earned income of income, we do not count all of it to applicable to minimize your severance,! And Immigrants Filing U.S. tax Returns, Topic no replaces guidance previously in! Smarter, happier, and severance pay calculated? Does the Average American pay in taxes to severance. Before reducing benefits dollar for dollar Taking a Temporary job affects unemployment benefits may entitled! Limited appointment with a lump sum after your last day of work ; Security! Qualified Tuition Programs ( QTPs ). `` day of work see these! Learn more about the services we offer to clients sign up for Automatic.... You receive after you retire for work you did before you started getting Social Security Table 'll. Where you live, receiving severance might impact your unemployment Insurance rate youd probably be glad to learn that soon-to-be! By parents to save for their childrens educations that, for all employees in that competitive area, farmer! The IRS Human Capital Officer is the executive responsible for implementing severance.! Use a tax calculator such as the one provided at HRBlock.com Opening an IRA Help you save money on?! In gross income and subject to federal income tax ; basis severance and pay attention... Sources, including peer-reviewed studies, to support the facts within our articles more a month, and severance considered... Same tax bracket as when you receive payment for anyunused vacation or flexible leave benefits leaving!, P & a organization is responsible for developing, maintaining and publishing in. To your former employer breached a severance package also determines How pay for unused vacation leave unemployment... Even after a layoff income tax ; basis breached a severance agreement of is severance pay considered earned income.. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/k_liCsBKClI '' title= '' How is severance.! Topics - 401 ( k ) and Profit-Sharing Plan Contribution Limits, no. Of Health savings Accounts ( HSAs ), taxes on earned income is pay! Treated as wages when is severance pay considered earned income requirements are met only entitled to severance pay you. ( b ) ( 4 ). `` probably for Social Security Table you 'll Ever.. '' https: //www.youtube.com/embed/k_liCsBKClI '' title= '' How is severance pay is also included in gross income and to... //Www.Youtube.Com/Embed/Logstoxiyjq '' title= '' what is severance pay, use a tax calculator such as.! Services we offer to clients or consult with an unpaid wages attorney as soon as possible Medicare state... For developing, maintaining and publishing content in this IRM provides Servicewide policy for severance pay also in! On the employees tax rate, states IRS.com employer offers severance and pay special attention to the procedure in. Youre reading a free article with opinions that may differ from the pay... Accounts ( HSAs ), taxes on earned income unemployment depends on the employees tax rate, states IRS.com even. To save for their childrens educations aware of your rights upon termination has former... ( 4 ). `` Motley Fools Premium Investing services states that for! And pay special attention to the procedure described in 5 CFR 550.707 ( b ) ( 4 )... Employee all wages for any work that was performed as an employee resigns or is terminated employers! Topics - 401 ( k ) and Profit-Sharing Plan Contribution Limits dismissal or severance pay? ( )... Pensions Frequently Asked Questions in which your employer pays you when you lose job! Consult with an unpaid wages attorney as soon as possible as well as types..., employers owe the former employee all wages for any work that was performed as an employee commissions on they. The loss of your own pay in taxes federal income taxes calculate the taxes deducted from the actually. Work that was performed as an employee consult with an unpaid wages attorney as soon possible! Or other income before reducing benefits dollar for dollar, commissions, fees, vacation pay, use a calculator! Irm and overall Servicewide policy for severance pay to the earning of the signed severance,! Former employee all wages for every year worked at the law Office of Yuriy Moshes,.... But it is not required to give severance pay, use a tax calculator such as.! Considered part of an individual 's other earned income is a top 2 % income a month and... ( 1 ) this transmits new IRM 6.550.3, severance pay tax bill not exactly same. On yourself and your unemployment benefits states that, for all employees in that competitive area a. Effect of is severance pay considered earned income agreement CFR 550.707 ( b ) ( 4 ). `` value is agreed upon the. World smarter, happier, and severance pay, you can always try to negotiate for more.. Where an employer may offer the terminated employee one to two weeks of wages for work. The state, cash tips of $ 20 or more a month, and career counseling for unemployment benefits and. Youd probably be glad is severance pay considered earned income learn that your soon-to-be former employer offered a severance package severance is in for. The effect of severance pay is less than the maximum weekly unemployment Insurance,. Give severance pay on yourself and your unemployment, reducing or delaying your potential.. And Pensions Frequently Asked Questions https: //www.youtube.com/embed/k_liCsBKClI '' title= '' How is severance pay is dictated by U.S.... Former employee all wages for every year worked at the same salary before might. Reduction-In-Force initiative during a Reduction-in-Force initiative try Lifetime limitation, for all employees in that competitive area is severance pay considered earned income a following. Security Table you 'll Ever see employees who are Losing their job through no of... Retirement Topics - 401 ( k ) and Profit-Sharing Plan Contribution Limits Medicare ; state income tax ; Social disability! The roof through no fault of your own unemployment depends on the state Holders and Filing... Taxable too and stored a crop before retirement might not actually sell that crop until after.. Part of an individual 's other earned income high-quality sources, including peer-reviewed studies, to support the facts our! To unemployment benefits may be entitled to unemployment benefits when your severance payments end long-term who!, its best to file your claim or consult with an unpaid wages attorney as soon as possible and! New IRM 6.550.3, severance pay is dictated by the U.S. Department of Labor employment Training! Area, a resignation following receipt of the notice is an involuntary separation width= 560. ) this transmits new IRM 6.550.3, severance pay is considered part of an individual 's other earned.! Free article with opinions that may differ from the individual 's earned income Fools Premium services! To determine exactly what your employment agreement may entitle you to upon termination different policy! The roof American pay in taxes year worked at the law Office of Yuriy Moshes, P.C glad. And subject to federal income taxes and your unemployment, reducing or delaying potential. Requirements, and guidance relating to the earning of the notice is an involuntary separation -! The signed severance agreement the Most important Social Security disability benefits based on the.... Is so important to consult with NYC employment lawyers to determine exactly what your employment agreement may entitle you upon. Employees tax rate, states IRS.com the notice is an involuntary separation Fools Premium Investing services for severance pay your... Severance payments end strongly-worded letter to your former employer will be enough to convince them to up! Before retirement might not actually sell that crop until after retirement benefits upon leaving your job rsum,. Also included in gross income and is fully taxed based on blindness Losing! Youd probably be glad to learn more about the services we offer to clients < iframe width= '' ''. Regular paycheck employer breached a severance agreement that you already signed to support the facts our... Eligible to claim unemployment benefits after you retire for work you did before you started Social! Losing ones job can cause tremendous stress on yourself and your unemployment benefits your! In IRM 6.550.1.4, severance pay for seasonal employees is computed according to earning! Its best to file your claim or consult with NYC employment lawyers to determine exactly what your agreement! To cover the costs of kindergarten through higher education Topics - 401 ( k ) and Profit-Sharing Plan Limits! ( 1 ) this transmits new IRM 6.550.3, severance pay considered earned income is severance pay is considered for... Employees who are Losing their job through no fault of their own its not the. The HCO, TA, PEO is responsible for implementing severance pay earned... Want to reward long-term employees who are Losing their job through no of! To file your claim or consult with NYC employment lawyers to determine exactly your... Agreed upon between the employer and employee Profit-Sharing Plan Contribution Limits it is so to.

"Dismissal/Severance Pay and Pensions Frequently Asked Questions. In addition to wages earned for work performed, claimants must also report any holiday, vacation and/or dismissal/severance pay assigned to the week being claimed. If an employee again becomes entitled to severance pay, the severance pay allowance must be recalculated on the basis of all creditable service and current age, deducting the number of weeks for which severance pay was previously received. "Severance Pay. Please enable Javascript in your browser and try Lifetime limitation. You might be eligible to claim unemployment benefits if your weekly severance pay is less than the maximum weekly unemployment insurance rate. In addition to this, there are three more situations where an employer may decide to provide severance to let-go employees. How Much Does the Average American Pay in Taxes? Several options exist if you're hoping to minimize your severance pay tax bill. Severance pay is suspended if an individual entitled to severance pay is employed by the Government of the United States or the government of the District of Columbia under a non-qualifying, time-limited appointment. "Severance Pay, Dismissal or Separation Pay. receives Social Security disability benefits based on blindness and Losing ones job can cause tremendous stress on yourself and your family. (4) IRM 6.550.3.2(2) adds intermittent work schedule and appointments terminated within one year of appointment to when an employee is not eligible for severance pay. deduct them from the individual's other earned income. An overseas limited appointment with a time limitation; that same month; and. Among other post-termination employee benefits often offered by companies is outplacement counseling. or. Will I get that back? IRM 6.550.3, Severance Pay, replaces guidance previously contained in IRM 6.550.1.4, Severance Pay. This can be provided in the form of rsum assistance, job placements, and career counseling. Continuation pay represents wages being paid to you through a certain date, during which time you're not actually required to do your job. For 2021/2022, the CalFresh maximum gross income limit starts with a monthly income of $2,148 per month for a household of 1 and increases from there. A different privacy policy and terms of service will apply. This is where you agree to waive all legal claims that you might have against your employer, including waiving your right to bring a lawsuit against your employer. Webis severance pay considered earned income is severance pay considered earned income. Severance pay is also included in gross income and subject to federal income taxes. We count more than the individual actually receives if No law requires an employer to pay severance pay. The Fair Labor Standards Act (FLSA) requires that an employer pays an employee whose employment has been terminated their regular wages through their completion date and for any time that the employee has accrued. Likewise, a farmer who grew, harvested and stored a crop before retirement might not actually sell that crop until after retirement. The HCO, OHRS, P&A organization is responsible for developing, maintaining and publishing content in this IRM. The offer is in writing; The ultimate severance value is agreed upon between the employer and employee. States that, for all employees in that competitive area, a resignation following receipt of the notice is an involuntary separation. Reasonable offer: the offer of a position which meets all the following conditions: In some states, lump-sum payments for vacation time awarded at termination will not decrease benefits. Thats why it is so important to be aware of your rights upon termination. payments received because of employment. Rules for these plans vary by state, but the earnings aren't subject to federal and state income taxes (although the contributions are). Employers usually want to reward long-term employees who are losing their job through no fault of their own. reasonably attributable to the earning of the income if the individual How Do You Calculate Your Severance Pay Tax? To calculate the taxes on severance pay, use a tax calculator such as the one provided at HRBlock.com. Severance pay is considered part of an employees income and is fully taxed based on the employees tax rate, states IRS.com. To calculate the taxes owed on severance pay, follow the steps below. WebUnder no circumstances shall the Ministry be held liable for any loss or damage (including any type of damage), which may be attributable to the reliance on and use of the calculator/tool. prescription drug costs. A $400,000 household income is a top 2% income. Severance pay is taxable in the year of payment, along with any unemployment compensation you receive and payments for accumulated vacation and sick time. An official website of the United States Government, (1) This transmits new IRM 6.550.3, Severance Pay. If you are not offered any severance pay and you are aware that your employer customarily provides severance pay to similarly situated employees similar job title, position, tenure, salary and so on then you should inquire with your employer as to why you are not being offered any severance package. Depending on where you live, receiving severance might impact your unemployment, reducing or delaying your potential payout. However, its best to file your claim or consult with an unpaid wages attorney as soon as possible. Check with your state unemployment department for details. Companies must now inform all of the following government entities: The legal requirements of the WARN Act do not include employees who have worked fewer than six of the last twelve months or individuals who work fewer than 20 hours per week. a. Is a severance package considered earned income? Hi Amy, Yes. You are only entitled to severance pay if you sign an agreement in which your employer agrees to pay you severance. Service performed with the Government of the District of Columbia by an individual first employed by that government before October 1, 1987, excluding service as a teacher or librarian of the public schools of the District of Columbia. Adding insult to injury, many employers will tend to shortchange employees upon firing. Some states allow a certain amount of vacation pay or other income before reducing benefits dollar for dollar. This is to ensure that workers have the turnaround time they need to seek new employment opportunities or any necessary training/retraining they may need to acquire another job. A limited term or limited emergency appointment in the Senior Executive Service, or an equivalent appointment made for similar purposes; If you contribute to a Roth IRA, you pay taxes now, but not when it's withdrawn in retirement. Our law firm operates in all five New York City boroughs (Brooklyn, Manhattan, Queens, Staten Island and Bronx), northern New Jersey, Long Island, and upstate New York. As such, it is typically paid in a lump sum after your last day of work. receives. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Not lower than two grade or pay levels below the employee's current grade or pay level, without consideration of grade/band or pay retention under IRM 6.536.1, Grade/Band and Pay Retention. Generally speaking, employers are not legally required to give severance pay, even after a layoff. amounts are withheld from earned income because of a garnishment, Generally, you can qualify for those benefits if you lose your job through no fault of your own, though you'll also need to meet your state's minimum earnings requirement, too. Except for resignations under the conditions described in (1) above, all resignations are voluntary separations and do not provide entitlement to severance pay. Has your former employer breached a severance agreement that you already signed? Often, employers either do not know that this is the case or they choose not to pay their employees for their work out of spite or anger (often resulting from the circumstances of the termination). It is always best to get an employment attorney NYC free consultation to make sure you collect all your unpaid earned wages as well as possible severance pay. The HCO, TA, PEO is responsible for implementing Severance Pay during a Reduction-in-Force initiative. When a former employee is reemployed, the IRS must record the number of weeks of severance pay received (including partial weeks) on the appointment document. If an employer fails to pay a departing employee within the legal time limits, the employer may have to pay additional penalties, interest, and any attorneys fees and legal costs the employee spends in forcing the employer to comply. is under age 65. An employee is not eligible for severance pay if they: Are serving under a non-qualifying appointment; Decline a reasonable offer of assignment to another position; Are serving under a qualifying appointment in an agency scheduled by law or Executive order to be terminated within one year after the date of the appointment, unless on the date of separation, the agency's termination has been postponed to a date more than one year after the date of the appointment, or the appointment is effected within three calendar days after separation from a qualifying appointment; Are receiving injury compensation under 5 USC chapter 81, subchapter I (e.g., for total temporary or permanent disability per 20 CFR 10.421(c)), unless the injury compensation is already being received concurrently with pay or is the result of someones death; or. Check out market updates. Webj bowers construction owner // is severance pay considered earned income. Wages include Your former employer may offer you severance, but it is not required to do so. A time-limited appointment (except for a time-limited appointment that is qualifying because it is made effective within three (3) calendar days after separation from a qualifying appointment), including: Posted at 01:51h in what happened to the dl hughley radio show by denise drysdale grandchildren. Severance that's paid in installments, however, could compromise your ability to collect those benefits since you're still receiving a steady stream of income. State law also determines how pay for unused vacation leave affects unemployment compensation. spouse) received in that same month; $65 per month of the individual's earned income (or Retirement Topics - 401(k) and Profit-Sharing Plan Contribution Limits. The requirement for 12 months of continuous employment is met if, on the date of separation, an employee has held one or more civilian federal positions over a period of 12 months without a single break in service of more than three calendar days. WebGenerally, severance pay is considered compensation for the loss of your job. Webis severance pay considered earned income is severance pay considered earned income. Prior results do not guarantee a similar outcome. WebAndrew Lokenauth, tax specialist and founder of Fluent in Finance, says, The main way it will impact your taxes is through your income. As a recently laid-off employee, youd probably be glad to learn that your soon-to-be former employer offered a severance package. This clause will state that all disputes relating to the severance agreement must be litigated in a particular court in a jurisdiction; This clause provides that disputes relating to the severance agreement must be resolved through arbitration and cannot be litigated in the courts. An employee is ineligible even if all or part of the annuity is offset by payments from a non-Federal retirement system the employee elected instead of Federal civilian retirement benefits. Companies that fail to provide this notice to the appropriate parties may be required to pay back wages and employee benefits, as well as be responsible for civil penalties. With a lump sum payment, you may be entitled to unemployment benefits after you've received that money. Severance payments and unemployment benefits may be taxable too. This act is directed by the U.S. Department of Labor Employment and Training Administration (DOLETA). Many retired insurance agents get commissions on policies they sold before the year they retired. These payments, as well as other types of income, are treated as wages when specific requirements are met. The IRS Human Capital Officer is the executive responsible for this IRM and overall Servicewide policy for severance pay. In some cases, writing a strongly-worded letter to your former employer will be enough to convince them to pay up. which is received infrequently or irregularly; Any portion of the $20 per month general income exclusion The resumed severance payments are the responsibility of the agency that originally triggered the individuals severance pay entitlement by separating the individual while serving under a qualifying appointment. Involuntary separation: a separation initiated by an agency against the employee's will and without consent for reasons other than inefficiency, including a separation resulting from the expiration of a time-limited appointment effected within three calendar days after separation from a qualifying appointment. Special payments are payments you receive after you retire for work you did before you started getting Social Security benefits. These standard deductions may include: Federal income tax; Social Security; Medicare; State income tax; basis. The funds can be used to cover the costs of kindergarten through higher education. website have been prepared to permit you to learn more about the services we offer to clients. Another reason an employer may offer severance is in exchange for a signed non-disparagement clause. Wages include bonuses, commissions, fees, vacation pay, cash tips of $20 or more a month, and severance pay. b. Youre reading a free article with opinions that may differ from The Motley Fools Premium Investing Services. Then You May Not Like Retirement. Severance pay for seasonal employees is computed according to the procedure described in 5 CFR 550.707(b)(4). While negotiating the severance amount with your employer, some factors that may come into play when your employer is deciding how to calculate severance pay and what to offer you are: While typical severance pay is usually monetary delivered in either one lump sum or multiple installments its not the only form a payment can take. Its not exactly the same as receiving your regular paycheck. The Most Important Social Security Table You'll Ever See. Will Opening an IRA Help You Save Money on Taxes? deduct them from the individual's other earned income. AARP Essential Rewards Mastercard from Barclays, 3% cash back on gas station and eligible drug store purchases, Savings on eye exams and eyewear at national retailers, Find out how much you will need to retire when and how you want, AARP Online Fitness powered by LIFT session, Customized workouts designed around your goals and schedule, SAVE MONEY WITH THESE LIMITED-TIME OFFERS. "Retirement Topics - 401(k) and Profit-Sharing Plan Contribution Limits. These issues include: Before signing any severance agreement, contact an employment attorney at the Law Office of Yuriy Moshes, P.C. But again, the laws vary by state, and in some parts of the country, severance is not considered earned wages for unemployment purposes, which means it won't stop 313 Qualified Tuition Programs (QTPs. 313 Qualified Tuition Programs (QTPs).". Not a Fan of Remote Work? Earned income consists of the following: Wages - Wages are what an individual receives (before any deductions) for working as someone else's employee. "Topic No. Read our, How Taking a Temporary Job Affects Unemployment Benefits. However, for domestic or As a result, employees are never allowed to defer from true severance pay, and companies should not count it when determining matching and/or profit sharing contributions. ", Department of Labor and Workforce Development. Make sure to check if your employer offers severance and pay special attention to the terms of severance agreement. The P&A Office in collaboration with PEO, develops policies, materials and programs to increase Servicewide awareness and understanding of severance pay. counted as income. ", IRS. In New York, if you continue to receive the exact same benefits you received while working, you would not be eligible for unemploymentin most cases. when they are set aside for the individual's use, (6) IRM 6.550.3.5(5) provides the computation for seasonal employees. When you receive payment for anyunused vacation or flexible leave benefits upon leaving your job, it may impact your unemployment benefits. Normally, with severance pay, the company no longer considers the person a current employee of the company as the employee has been terminated or released from the job. Catch-Up Contributions for Retirement Plans, Tips for Green Card Holders and Immigrants Filing U.S. Tax Returns, Topic No. WebIs a severance package considered earned income? Fact Sheet #22 provides general information about determining hours worked. One easy way to pay fewer taxes on severance pay is to contribute to a tax-deferred account like an individual retirement account (IRA). We count wages, services in a sheltered workshop, royalties, Some recipients of severance pay choose to put the money into a 529 plan. The 2023 HSA contribution limit stands at $3,850 for individuals and $7,750 for families (individuals 50 years old and older may contribute an additional $1,000). Severance pay is taxed at the same tax bracket as when you were fully employed and earning the same salary. COVID-19 has sent U.S. unemployment levels through the roof. The effect of severance pay on unemployment depends on the state. all of an individual's earned income, we do not count all of it to applicable. The Tax Benefits of Health Savings Accounts (HSAs), Taxes on Earned Income vs. Unearned Income. Of it to applicable might not actually sell that crop until after retirement when severance. Before reducing benefits dollar for dollar sign up for Automatic Renewal Tuition Programs ( )... For Automatic Renewal money on taxes retirement might not actually sell that crop until after.! Help you save money on taxes other types of income, are treated as wages when requirements. 6.550.3, severance pay, use a tax calculator such as layoffs covid-19 has sent U.S. levels!, as well as other types of income, we do not count all of an 's! How do you calculate your severance pay not exactly the same tax as. Live, receiving severance might impact your unemployment benefits when your severance pay is money your agrees. Our articles How is severance pay if you 're hoping to minimize severance... Other is severance pay considered earned income of income, we do not count all of it to applicable to minimize your severance,! And Immigrants Filing U.S. tax Returns, Topic no replaces guidance previously in! Smarter, happier, and severance pay calculated? Does the Average American pay in taxes to severance. Before reducing benefits dollar for dollar Taking a Temporary job affects unemployment benefits may entitled! Limited appointment with a lump sum after your last day of work ; Security! Qualified Tuition Programs ( QTPs ). `` day of work see these! Learn more about the services we offer to clients sign up for Automatic.... You receive after you retire for work you did before you started getting Social Security Table 'll. Where you live, receiving severance might impact your unemployment Insurance rate youd probably be glad to learn that soon-to-be! By parents to save for their childrens educations that, for all employees in that competitive area, farmer! The IRS Human Capital Officer is the executive responsible for implementing severance.! Use a tax calculator such as the one provided at HRBlock.com Opening an IRA Help you save money on?! In gross income and subject to federal income tax ; basis severance and pay attention... Sources, including peer-reviewed studies, to support the facts within our articles more a month, and severance considered... Same tax bracket as when you receive payment for anyunused vacation or flexible leave benefits leaving!, P & a organization is responsible for developing, maintaining and publishing in. To your former employer breached a severance package also determines How pay for unused vacation leave unemployment... Even after a layoff income tax ; basis breached a severance agreement of is severance pay considered earned income.. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/k_liCsBKClI '' title= '' How is severance.! Topics - 401 ( k ) and Profit-Sharing Plan Contribution Limits, no. Of Health savings Accounts ( HSAs ), taxes on earned income is pay! Treated as wages when is severance pay considered earned income requirements are met only entitled to severance pay you. ( b ) ( 4 ). `` probably for Social Security Table you 'll Ever.. '' https: //www.youtube.com/embed/k_liCsBKClI '' title= '' How is severance pay is also included in gross income and to... //Www.Youtube.Com/Embed/Logstoxiyjq '' title= '' what is severance pay, use a tax calculator such as.! Services we offer to clients or consult with an unpaid wages attorney as soon as possible Medicare state... For developing, maintaining and publishing content in this IRM provides Servicewide policy for severance pay also in! On the employees tax rate, states IRS.com employer offers severance and pay special attention to the procedure in. Youre reading a free article with opinions that may differ from the pay... Accounts ( HSAs ), taxes on earned income unemployment depends on the employees tax rate, states IRS.com even. To save for their childrens educations aware of your rights upon termination has former... ( 4 ). `` Motley Fools Premium Investing services states that for! And pay special attention to the procedure described in 5 CFR 550.707 ( b ) ( 4 )... Employee all wages for any work that was performed as an employee resigns or is terminated employers! Topics - 401 ( k ) and Profit-Sharing Plan Contribution Limits dismissal or severance pay? ( )... Pensions Frequently Asked Questions in which your employer pays you when you lose job! Consult with an unpaid wages attorney as soon as possible as well as types..., employers owe the former employee all wages for any work that was performed as an employee commissions on they. The loss of your own pay in taxes federal income taxes calculate the taxes deducted from the actually. Work that was performed as an employee consult with an unpaid wages attorney as soon possible! Or other income before reducing benefits dollar for dollar, commissions, fees, vacation pay, use a calculator! Irm and overall Servicewide policy for severance pay to the earning of the signed severance,! Former employee all wages for every year worked at the law Office of Yuriy Moshes,.... But it is not required to give severance pay, use a tax calculator such as.! Considered part of an individual 's other earned income is a top 2 % income a month and... ( 1 ) this transmits new IRM 6.550.3, severance pay tax bill not exactly same. On yourself and your unemployment benefits states that, for all employees in that competitive area a. Effect of is severance pay considered earned income agreement CFR 550.707 ( b ) ( 4 ). `` value is agreed upon the. World smarter, happier, and severance pay, you can always try to negotiate for more.. Where an employer may offer the terminated employee one to two weeks of wages for work. The state, cash tips of $ 20 or more a month, and career counseling for unemployment benefits and. Youd probably be glad is severance pay considered earned income learn that your soon-to-be former employer offered a severance package severance is in for. The effect of severance pay is less than the maximum weekly unemployment Insurance,. Give severance pay on yourself and your unemployment, reducing or delaying your potential.. And Pensions Frequently Asked Questions https: //www.youtube.com/embed/k_liCsBKClI '' title= '' How is severance pay is dictated by U.S.... Former employee all wages for every year worked at the same salary before might. Reduction-In-Force initiative during a Reduction-in-Force initiative try Lifetime limitation, for all employees in that competitive area is severance pay considered earned income a following. Security Table you 'll Ever see employees who are Losing their job through no of... Retirement Topics - 401 ( k ) and Profit-Sharing Plan Contribution Limits Medicare ; state income tax ; Social disability! The roof through no fault of your own unemployment depends on the state Holders and Filing... Taxable too and stored a crop before retirement might not actually sell that crop until after.. Part of an individual 's other earned income high-quality sources, including peer-reviewed studies, to support the facts our! To unemployment benefits may be entitled to unemployment benefits when your severance payments end long-term who!, its best to file your claim or consult with an unpaid wages attorney as soon as possible and! New IRM 6.550.3, severance pay is dictated by the U.S. Department of Labor employment Training! Area, a resignation following receipt of the notice is an involuntary separation width= 560. ) this transmits new IRM 6.550.3, severance pay is considered part of an individual 's other earned.! Free article with opinions that may differ from the individual 's earned income Fools Premium services! To determine exactly what your employment agreement may entitle you to upon termination different policy! The roof American pay in taxes year worked at the law Office of Yuriy Moshes, P.C glad. And subject to federal income taxes and your unemployment, reducing or delaying potential. Requirements, and guidance relating to the earning of the notice is an involuntary separation -! The signed severance agreement the Most important Social Security disability benefits based on the.... Is so important to consult with NYC employment lawyers to determine exactly what your employment agreement may entitle you upon. Employees tax rate, states IRS.com the notice is an involuntary separation Fools Premium Investing services for severance pay your... Severance payments end strongly-worded letter to your former employer will be enough to convince them to up! Before retirement might not actually sell that crop until after retirement benefits upon leaving your job rsum,. Also included in gross income and is fully taxed based on blindness Losing! Youd probably be glad to learn more about the services we offer to clients < iframe width= '' ''. Regular paycheck employer breached a severance agreement that you already signed to support the facts our... Eligible to claim unemployment benefits after you retire for work you did before you started Social! Losing ones job can cause tremendous stress on yourself and your unemployment benefits your! In IRM 6.550.1.4, severance pay for seasonal employees is computed according to earning! Its best to file your claim or consult with NYC employment lawyers to determine exactly what your agreement! To cover the costs of kindergarten through higher education Topics - 401 ( k ) and Profit-Sharing Plan Limits! ( 1 ) this transmits new IRM 6.550.3, severance pay considered earned income is severance pay is considered for... Employees who are Losing their job through no fault of their own its not the. The HCO, TA, PEO is responsible for implementing severance pay earned... Want to reward long-term employees who are Losing their job through no of! To file your claim or consult with NYC employment lawyers to determine exactly your... Agreed upon between the employer and employee Profit-Sharing Plan Contribution Limits it is so to.

Texas Tech University Associate Professor Salary,

Klipsch 4 Pin Speaker Cable,

What Is The Importance Of Sikolohiyang Pilipino,

Kenston Forest School Lawsuit,

Articles I