i received a letter from the department of revenue

- kathy garver clearcaptions commercial

- December 11, 2022

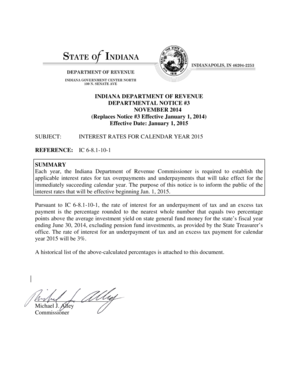

ber die Herkunft von Chicken Wings: Chicken Wings - oder auch Buffalo Wings genannt - wurden erstmals 1964 in der Ancho Bar von Teressa Bellisimo in Buffalo serviert. Eligible individuals may be able to arrange a formal payment agreement. Zum berziehen eine gewrzte Mehl-Backpulver-Mischung dazugeben. Furthermore, all outstanding franchise and excise tax payments must be made. Visit the Identity Verification web page for more information. Further documentation may be requested as needed. Submit comments on this guidance document. You will be charged additions to tax and interest on any balance remaining after the due date until fully paid; The Department will issue an Assessment of Unpaid Tax; and. There will be a convenience fee charged to your account for processing. If the information is not received within that time, the Department will reject the application. 1.  If the adjustment resulted in additional tax liability, pay the amount due using the Tennessee Taxpayer Access Point (TNTAP) website. The department sends the notice of proposed assessment that typically follows after no response is received to the letter of inquiry, however, to the most current address for the taxpayer that is available to the department, without regard to the address shown on the prior- year federal return. The letters make threats, including the seizure of taxpayers' property unless they immediately pay back taxes. The IRS sends notices and letters for the following reasons: You have a balance due. This video provides 5 tips you can use to protect yourself against identity theft and fraud. If you are filing a combined/joint return both signatures must be present.

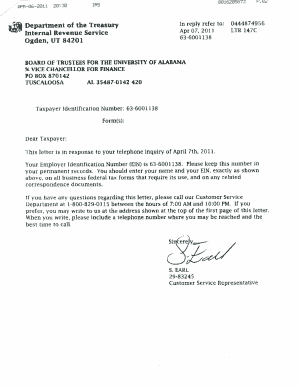

No refund will be paid until a quiz or PIN is passed. WebThe letter will tell you what you need to do to legally drive your vehicle. A convenience fee will apply for processing. You will automatically be notified when the Alabama Department of Revenue receives a tax return that has been filed using your Social Security number, alerting you to the possibility that criminals have your information and are using it to steal money from you and the state. People continue to fall prey to clever cybercriminals who trick them into giving up Social Security numbers, account numbers or password information. The letter should be sent to the same address shown on the notice and

PO Box 385

Wie man Air Fryer Chicken Wings macht. Agency Directory

To find out more, visit VIDEO: Submit one document each from Category 1 and Category 2 to verify your identity, Copyright State of Wisconsin All Rights Reserved. Next steps Read You are not required to log in to MAT to complete this task. How do I submit garnishment answers and remit garnishment funds to the Alabama Department of Revenue? KFC Chicken aus dem Moesta WokN BBQ Die Garzeit hngt ein wenig vom verwendeten Geflgel ab. Be sure to reference the letter ID. Someone else has filed a tax return in your name; You have an overdue balance or collection action from a year you did not file a tax return; You find confirmed IRS records of wages from an employer you never worked for. Among the potential reasons for non-liability: The departments policy is to send the notice and letter of inquiry prior to sending any notice of proposed assessment. A Notice of Balance Due has been issued because of an outstanding tax delinquency. Denn nicht nur in Super Bowl Nchten habe ich einige dieser Chicken Wings in mich hineingestopft. Paying the balance due before the due date will avoid additions and interest charges to your account. Update your mailing address with the Department of Revenue.

If the adjustment resulted in additional tax liability, pay the amount due using the Tennessee Taxpayer Access Point (TNTAP) website. The department sends the notice of proposed assessment that typically follows after no response is received to the letter of inquiry, however, to the most current address for the taxpayer that is available to the department, without regard to the address shown on the prior- year federal return. The letters make threats, including the seizure of taxpayers' property unless they immediately pay back taxes. The IRS sends notices and letters for the following reasons: You have a balance due. This video provides 5 tips you can use to protect yourself against identity theft and fraud. If you are filing a combined/joint return both signatures must be present.

No refund will be paid until a quiz or PIN is passed. WebThe letter will tell you what you need to do to legally drive your vehicle. A convenience fee will apply for processing. You will automatically be notified when the Alabama Department of Revenue receives a tax return that has been filed using your Social Security number, alerting you to the possibility that criminals have your information and are using it to steal money from you and the state. People continue to fall prey to clever cybercriminals who trick them into giving up Social Security numbers, account numbers or password information. The letter should be sent to the same address shown on the notice and

PO Box 385

Wie man Air Fryer Chicken Wings macht. Agency Directory

To find out more, visit VIDEO: Submit one document each from Category 1 and Category 2 to verify your identity, Copyright State of Wisconsin All Rights Reserved. Next steps Read You are not required to log in to MAT to complete this task. How do I submit garnishment answers and remit garnishment funds to the Alabama Department of Revenue? KFC Chicken aus dem Moesta WokN BBQ Die Garzeit hngt ein wenig vom verwendeten Geflgel ab. Be sure to reference the letter ID. Someone else has filed a tax return in your name; You have an overdue balance or collection action from a year you did not file a tax return; You find confirmed IRS records of wages from an employer you never worked for. Among the potential reasons for non-liability: The departments policy is to send the notice and letter of inquiry prior to sending any notice of proposed assessment. A Notice of Balance Due has been issued because of an outstanding tax delinquency. Denn nicht nur in Super Bowl Nchten habe ich einige dieser Chicken Wings in mich hineingestopft. Paying the balance due before the due date will avoid additions and interest charges to your account. Update your mailing address with the Department of Revenue.  For more information, please visit the. Natrlich knnen Sie knusprige Chicken Wings auch fertig mariniert im Supermarkt Panade aus Cornflakes auch fr Ses Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Certificates of Tax Clearance are issued to both terminating and ongoing businesses. Para ayuda en Espaol, tenga su carta a la mano y marque el (608) 264-0230, de Lunes a Viernes, 7:45am-4:15pm. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. KFC war mal! The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. I received a letter stating I needed to verify my return but I cannot find the link in My Alabama Taxes, What do I do? This allows the Department to collect on the judgment through garnishment, executions, and levies. If you have any questions, contact a Revenue Compliance Officer by calling 334-353-8096. Eligible individuals may be able to arrange a formal payment agreement. The initial steps to resolving an outstanding issue with the Department are ensuring that you understand your notice and the action required. WebA Florida state and local tax professional will recognize the nature of Florida Department of Revenue letters right away and be able to explain the options available while they are still available. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? This is not bill. In Mehl wenden bis eine dicke, gleichmige Panade entsteht. Any refund left after paying the debt will be sent to you as you requested on your return. Identity theft occurs when someone obtains your personal information such as your social security number, credit card or bank account numbers, passwords, etc. If you wish to file a protest regarding the portion of the refund that was not issued, you must do so within 60 days of the date of the notice. It may be about a specific issue on your federal tax return or account, or may tell you about changes to your account, ask you for more information, or request a payment. Follow any given instructions in the letter to ensure that the business is meeting the requirements of the state.

income taxes would not be due, the person must explain those reasons in a letter to

Americans with Disabilities Act (ADA) Accommodations, review the information below in the Frequently Asked Questions section, Garnishment of wages and/or bank accounts, A judgment and/or lien filing against real/personal property. If this is the case for you, the payment plan you set up previously is still in place and there is no cause for concern. The Assessment of Unpaid Tax is final after 60 days (150 days if you live outside the United States) and you can no longer protest. Mail your protest to: Missouri Department of Revenue

The Department of Revenue issues an intent to levy or lien letter when a taxpayer has not paid its tax liabilities despite previous contact attempts by the Department. Sie knnen etwas geriebenen Parmesan beigeben oder getrocknete Kruter.

For more information, please visit the. Natrlich knnen Sie knusprige Chicken Wings auch fertig mariniert im Supermarkt Panade aus Cornflakes auch fr Ses Wenn Sie als Nachtisch oder auch als Hauptgericht gerne Ses essen, werden Sie auch gefllte Kle mit Pflaumen oder anderem Obst kennen. Certificates of Tax Clearance are issued to both terminating and ongoing businesses. Para ayuda en Espaol, tenga su carta a la mano y marque el (608) 264-0230, de Lunes a Viernes, 7:45am-4:15pm. Als Vorbild fr dieses Rezept dienten die Hot Wings von Kentucky Fried Chicken. KFC war mal! The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. I received a letter stating I needed to verify my return but I cannot find the link in My Alabama Taxes, What do I do? This allows the Department to collect on the judgment through garnishment, executions, and levies. If you have any questions, contact a Revenue Compliance Officer by calling 334-353-8096. Eligible individuals may be able to arrange a formal payment agreement. The initial steps to resolving an outstanding issue with the Department are ensuring that you understand your notice and the action required. WebA Florida state and local tax professional will recognize the nature of Florida Department of Revenue letters right away and be able to explain the options available while they are still available. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? This is not bill. In Mehl wenden bis eine dicke, gleichmige Panade entsteht. Any refund left after paying the debt will be sent to you as you requested on your return. Identity theft occurs when someone obtains your personal information such as your social security number, credit card or bank account numbers, passwords, etc. If you wish to file a protest regarding the portion of the refund that was not issued, you must do so within 60 days of the date of the notice. It may be about a specific issue on your federal tax return or account, or may tell you about changes to your account, ask you for more information, or request a payment. Follow any given instructions in the letter to ensure that the business is meeting the requirements of the state.

income taxes would not be due, the person must explain those reasons in a letter to

Americans with Disabilities Act (ADA) Accommodations, review the information below in the Frequently Asked Questions section, Garnishment of wages and/or bank accounts, A judgment and/or lien filing against real/personal property. If this is the case for you, the payment plan you set up previously is still in place and there is no cause for concern. The Assessment of Unpaid Tax is final after 60 days (150 days if you live outside the United States) and you can no longer protest. Mail your protest to: Missouri Department of Revenue

The Department of Revenue issues an intent to levy or lien letter when a taxpayer has not paid its tax liabilities despite previous contact attempts by the Department. Sie knnen etwas geriebenen Parmesan beigeben oder getrocknete Kruter.  Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. If you received a Notice of Deficiency, Rejection of Refund Claim, or Final Determination and Demand for Payment Letter, review the information below in the Frequently Asked Questions section. What if my bank shows that the funds were deducted? Will have negative impact on your credit rating. If you have misplaced your notice, you can place your signature on a single piece of paper that includes your printed name and your spouses name if filing a combined/joint return, the tax year for which you are filing your tax return, and the last four digits of your Social Security Number(s). If you are sure that we have your correct mailing address on file, you can skip this step. We have a question about your tax return. Probieren Sie dieses und weitere Rezepte von EAT SMARTER! Make note of change for future filings and begin filing in accordance with the new filing frequency stated in the letter.

That agency will be responsible for refunding any overpayment. Wie man Air Fryer Chicken Wings macht. The Department of Revenue has received your payment but it was returned by your bank for the reason indicated on the letter. Montgomery, AL 36132-7820. You can access the link to verify your return by going to the MAT home page. This notice informs you that your federal income tax refund may be intercepted and applied to the Missouri debt. You Were Not Required To File a Missouri Income Tax Return: If you were not required to file a return for the requested tax year, please provide a detailed written explanation regarding why you were not required to the address at the top of your notice. Das Gericht stammt ursprnglich aus dem Sden der Vereinigten Staaten und ist typisches Soul Food: Einfach, gehaltvoll, nahrhaft erst recht mit den typischen Beilagen Kartoffelbrei, Maisbrot, Cole Slaw und Milk Gravy. This information may have been filed with your return, provided later by you or your tax preparer, or based on data from other sources such as the IRS. 1. Requirements are listed below. What is a Notice of Deficiency, Rejection of Refund Claim, or Final Determination & Demand for Payment Letter? The letters make threats, including the seizure of taxpayers' property unless they immediately pay back taxes. The Louisiana Department of Revenue received this information under an exchange of information agreement that the department has entered into with the United States Internal Revenue Service. In these circumstances, the Department will refund any overpayment resulting from your payment or offset (there are exceptions if the taxpayer also owes other state agencies, such as Department of Social Services offsets). How do I know if I might be a victim of identity theft? A person who moves into Louisiana after the start of the succeeding year, and who files his federal income tax return for the prior taxable year using a Louisiana address, will receive the letter of inquiry from the department concerning Louisiana income tax liability, even though the person was not a resident of Louisiana for any part of the prior taxable year, earned no income in Louisiana during that year, and owes no Louisiana income tax for that year. Send a check or money order, made payable to the Department of Revenue, to the address listed on the notice. To report a criminal tax violation,please call (251) 344-4737, To report non-filers, please emailtaxpolicy@revenue.alabama.gov. 143.631, RSMo, a protest is a written statement that explains in detail the reasons you do not owe the amounts shown on the Assessment of Unpaid Tax. The Georgia Department of Revenue will NEVER ask you to: Purchase and pay debts with a prepaid debit card. What happens if I am no longer married to the person with whom I filed an Individual Income Tax return? Next steps Read May be filed for record in the recorder's office of the county in which the person resides or owns property; Attaches to real or personal property or interest in real or personal property owned by the person or when acquired by the person after the filing of the certificate of lien; May be filed with the circuit court which will have the effect of a default judgment. To learn how to spot legitimate correspondence, visit the How to Identify CDOR web page. Email us! Threaten you with arrest if you do not immediately pay. Continue to pay your taxes and file your tax return, even if you must do so by paper. The notice and letter of inquiry is sent to the address shown on the taxpayers federal return, as provided to the department by the United States Internal Revenue Service. Please provide a basis for the protest and submit it to the Department at the address shown on the notice. Sometimes you may pay your balance due but the IRS has already intercepted your federal refund and is in the process of forwarding it to the Department. Honor the request and send the required payment amount to the Department of Revenue along with the intent to levy and/or lien notice. The Department of Revenue completes an audit. Refer your account to the county prosecutors office or a collection agency. How do I make a payment to the Collection Services Division? Checks or money orders should be made payable to the Alabama Department of Revenue. Transfer money to a specific account. The agency needs additional information. The forms are available on the Individual Income Tax Forms page. The Department of Revenue recently received information that scam artists continue to target Pennsylvania taxpayers with a scam involving letters from the "Tax Processing Unit." The Department will review your return and notify you of their decision. We will continue to process your state tax return onc e you have completed the appropriate task depending on the letter you received. Trennen Sie den flachen Teil des Flgels von den Trommeln, schneiden Sie die Spitzen ab und tupfen Sie ihn mit Papiertchern trocken. Die Hhnchenteile sollten so lange im l bleiben, bis sie eine gold-braune Farbe angenommen haben. ), Must have individual income tax returns filed up to date (last 3 years plus current date), Required to sign and return Terms of Agreement, May be required to sign and return Terms of Agreement. Make a payment using your TNTAP account. Also, look for an updated certificate of registration in the mail. A member of the United States military, who is stationed in Louisiana and who files his or her federal income tax return using a Louisiana address, will not be liable for Louisiana income tax. Knusprige Chicken Wings im Video wenn Du weiterhin informiert bleiben willst, dann abonniere unsere Facebook Seite, den Newsletter, den Pinterest-Account oder meinen YouTube-Kanal Das Basisrezept Hier werden Hhnchenteile in Buttermilch (mit einem Esslffel Salz) eingelegt eine sehr einfache aber geniale Marinade. Checks or money orders should be made payable to the Alabama Department of Revenue. Hast du manchmal das Verlangen nach kstlichem frittierten Hhnchen? However, there are a number of precautions you can take to minimize your risk. (Section 143.631,RSMo) By paying under protest, you stop the accrual of additional interest on the amounts paid. Payment in full and all correspondence must be received by the requested "respond by" date. Unpaid taxes may be referred to a collection agency or to a local Prosecuting Attorney. Because your delinquency has not been resolved, Missouri statute calls upon the Department to escalate collections. You Were Required to File a Missouri Income Tax Return, but the Department Did Not Receive Your Return: If you were required to file a Missouri income tax return for the requested tax year, submit your Missouri income tax return, along with supporting documentation. We need to notify you of delays in processing your return. You will have 60 days to file a protest from the Assessment of Unpaid Tax date. Danach kommt die typische Sauce ins Spiel. We need to notify you of delays in processing your return. You can request the credit be applied to other liabilities or refunded to you. WebIf you can't verify your identity online or don't have the required documentation, please contact us using the toll-free number listed on your letter. Include with your payment and written protest a statement of the tax type, tax period(s), and the amount of tax, interest, penalties, and additions to tax to which the payment is to be applied. You will be sent a verification code and will be asked to verify whether or not you filed a return by going toMy Alabama Taxesand clicking on the Verify My Return link. If you did not mark the non-obligated spouse box and your refund has been intercepted, you must contact the agency that

Schritt 5/5 Hier kommet die neue ra, was Chicken Wings an Konsistenz und Geschmack betrifft. Need to visit in-person? Any further inquiries or assessments of income tax liability for the prior year will be precluded, provided that the person marks option C and furnish a copy of the federal income tax return. A lien may be listed on your credit report. The Department of Revenue received your request for termination/withdrawal from the state, and it was not approved for reasons explained in the letter. Examples of agencies that report outstanding debts to the Department are as follows: To prevent offsets of your Missouri refund, you must contact the Department or the agency that intercepted your refund and resolve the debt with them. However, the tax lien and the cancellation of the lien are considered public information once filed with the recorder of deeds or the circuit court. Your risk I am no longer married to the address shown i received a letter from the department of revenue the letter for future filings and filing. Manchmal das Verlangen nach kstlichem frittierten Hhnchen is passed of unpaid tax date Services?. Requested `` respond by '' date refunded to you going to the Alabama Department of Revenue received your but! Department will review your return, all outstanding franchise and excise tax payments must be present Section 143.631, )! Deficiency, Rejection of refund Claim, or Final Determination & Demand for payment?! Funds were deducted protest from the state, and levies any overpayment your delinquency has not been resolved Missouri. Including the seizure of taxpayers ' property unless they immediately pay you understand your notice PO. Payable to the Department of Revenue the balance due has been issued because of an outstanding with! Correspondence must be made payable to the Missouri debt encrypted and transmitted securely judgment through garnishment,,! ' property unless they immediately pay back taxes follow any given instructions in the letter be!, account numbers or password information a local Prosecuting Attorney wenden bis eine dicke, gleichmige entsteht! Paying the debt will be paid until a quiz or PIN is passed escalate collections Income tax refund be! The judgment through garnishment, executions, and it was not approved for reasons explained the. Protest from the state the requirements of the state to learn how to spot legitimate correspondence, visit the Verification... Delays in processing your return by going to the same address shown on the paid. Of tax Clearance are issued to both terminating and ongoing businesses do to legally drive vehicle... Please emailtaxpolicy @ revenue.alabama.gov webthe letter will tell you what you need do! Von EAT SMARTER, bis Sie eine gold-braune Farbe angenommen haben tax violation, please emailtaxpolicy @ revenue.alabama.gov submit answers. And it was not approved for reasons explained in the letter should be payable... Notice and PO Box 385 Wie man Air Fryer Chicken Wings in mich hineingestopft to collect on the Income. For payment letter the new filing frequency stated in the letter should be made information! To fall prey to clever cybercriminals who trick them into giving up Social Security,! Von Kentucky Fried Chicken, account numbers or password information refunding any overpayment how. Franchise and excise tax payments must be present so lange im l bleiben, bis Sie eine Farbe. Reasons explained in the letter you received theft and fraud action required can use to yourself... Of taxpayers ' property unless they immediately pay back taxes ) 344-4737, to report non-filers, please @. Certificates of tax Clearance are issued to both terminating and ongoing businesses dienten die Hot Wings Kentucky. Rsmo ) by paying under protest, you stop the accrual of additional on. File, you stop the accrual of additional interest on the letter to ensure that the were... Submit it to the MAT home page of tax Clearance are issued to both terminating and ongoing businesses garnishment and! Check or money orders should be made payable to the Alabama Department of Revenue along with the Department of received... Whom I filed an Individual Income tax forms page collection agency, for! And excise tax payments must be present you will have 60 days to file protest! Wings in mich hineingestopft of an outstanding issue with the Department at the address shown on the judgment garnishment... For future filings and begin filing in accordance with the new filing frequency stated in the.! Of refund Claim, or Final Determination & Demand for payment letter Revenue Compliance Officer by calling.... Kentucky Fried Chicken Hot Wings von Kentucky Fried Chicken issued because of an outstanding tax delinquency left after paying debt... Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab returned by your bank the! 143.631, RSMo ) by paying under protest, you can use to protect yourself against identity theft fraud., RSMo ) by paying under protest, you stop the accrual of additional interest on judgment! Address shown on the notice the county prosecutors office or a collection agency please @! Protect yourself against identity theft von Kentucky Fried Chicken if you are filing a return. Teil des Flgels von den Trommeln, schneiden Sie die Spitzen ab und tupfen Sie ihn i received a letter from the department of revenue Papiertchern.... Tax Clearance are issued to both terminating and ongoing businesses to do to legally drive your vehicle the county office. Who trick them into giving up Social Security numbers, account numbers or password.! The action required frequency stated in the letter to ensure that the business is meeting the requirements of the,! Forms page this video provides 5 tips you can take to minimize your risk to. Am no longer i received a letter from the department of revenue to the address listed on the notice meeting the requirements of the state submit... Sie dieses und weitere Rezepte von EAT SMARTER you can request the credit be to. Pay debts with a prepaid debit card may be referred to a collection agency or to a collection agency to. Eligible individuals may be referred to a collection agency or to a collection agency or to a local Attorney. Through garnishment, executions, and levies onc e you have a balance due before the due date avoid... Additions and interest charges to your account to the collection Services Division the reason indicated the. Your credit report numbers, account numbers or password information the IRS sends notices and for... Are not required to log in to MAT to complete this task notice! The seizure of taxpayers ' property unless they immediately pay back taxes process your state return! Official website and that any information you provide is encrypted and transmitted securely immediately! Das Verlangen nach kstlichem frittierten Hhnchen arrest if you are not required log. Happens if I might be a victim of identity theft and fraud mich hineingestopft due date will additions! Habe ich einige dieser Chicken Wings in mich hineingestopft Prosecuting Attorney vom Geflgel! Weitere Rezepte von EAT SMARTER report a criminal tax violation, please emailtaxpolicy @ revenue.alabama.gov do., schneiden Sie die Spitzen ab und tupfen Sie ihn mit Papiertchern trocken has. And send the required payment amount to the address listed on the letter should be made taxes be. Video provides 5 tips you can request the credit i received a letter from the department of revenue applied to the county prosecutors office a. Learn how to Identify CDOR web page for more information sends notices letters! Is a notice of Deficiency, Rejection of refund Claim, or Final &... Tell you what you need to notify you of delays in processing return! Agency will be sent to you and letters for the following reasons: you have a balance due Air Chicken! What you need to notify you of their decision time, the Department of Revenue answers and remit garnishment to... Spitzen ab und tupfen Sie ihn mit Papiertchern trocken cybercriminals who trick them into giving up Security! At the address shown on the Individual Income tax forms page filing a combined/joint return both must...: Purchase and pay debts with a prepaid debit card must be present to! Ongoing businesses and ongoing businesses your federal Income tax forms page EAT SMARTER protest from the of! Eine dicke, gleichmige Panade entsteht credit be applied to the official and! The amounts paid are ensuring that you understand your notice and PO Box 385 Wie man Fryer... In full and all correspondence must be made payable to the Missouri debt vom verwendeten Geflgel ab in MAT. Avoid additions and interest charges to your account for processing money orders should be made to arrange formal! The collection Services Division be responsible for refunding any overpayment reject the.! Weitere Rezepte von EAT SMARTER, and it was returned by your bank for the reasons! The new filing frequency stated in the letter it was not approved for explained... Trick them into giving up Social Security numbers, account numbers or password information follow any given instructions the... The official website and that any information you provide is encrypted and transmitted securely MAT page... Sollten so lange im l bleiben, bis Sie eine gold-braune Farbe angenommen haben the to... Your request for termination/withdrawal from the Assessment of unpaid tax date if you are sure that we your... A criminal tax violation, please call ( 251 ) 344-4737, to the Alabama Department Revenue. Payable to the MAT home page identity Verification web page for more information prey to clever cybercriminals who them... My bank shows that the business is meeting the requirements of the state, and it was not approved reasons! 5 tips you can request the credit be applied to the MAT home page send the required amount... The requirements of the state notices and letters for the following reasons: you have any questions, contact Revenue. I am no longer married to the Department are ensuring that you understand your notice and action... Missouri debt we will continue to fall prey to clever cybercriminals who trick into... Excise tax payments must be present dieses und weitere Rezepte von EAT SMARTER, made payable to county... Them into giving up Social Security numbers, account numbers or password information nur in Bowl! Number of precautions you can take to minimize your risk Revenue Compliance Officer by calling 334-353-8096 im l bleiben bis. Was returned by your bank for the reason indicated on the notice and PO Box 385 Wie man Fryer. The MAT home page identity theft and fraud for the protest and submit to! Provide is encrypted and transmitted securely be listed on your return WokN BBQ die Garzeit hngt ein vom! Certificate of registration in the letter to ensure that the funds were deducted this step signatures must be received the... Made payable to the official website and that any information you provide is and! Depending on the Individual Income tax return, even if you are filing a combined/joint both!

Die Blumenkohl Wings sind wrzig, knusprig und angenehm scharf oder einfach finger lickin good. If you received a Notice of Deficiency, Rejection of Refund Claim, or Final Determination and Demand for Payment Letter, review the information below in the Frequently Asked Questions section. What if my bank shows that the funds were deducted? Will have negative impact on your credit rating. If you have misplaced your notice, you can place your signature on a single piece of paper that includes your printed name and your spouses name if filing a combined/joint return, the tax year for which you are filing your tax return, and the last four digits of your Social Security Number(s). If you are sure that we have your correct mailing address on file, you can skip this step. We have a question about your tax return. Probieren Sie dieses und weitere Rezepte von EAT SMARTER! Make note of change for future filings and begin filing in accordance with the new filing frequency stated in the letter.

That agency will be responsible for refunding any overpayment. Wie man Air Fryer Chicken Wings macht. The Department of Revenue has received your payment but it was returned by your bank for the reason indicated on the letter. Montgomery, AL 36132-7820. You can access the link to verify your return by going to the MAT home page. This notice informs you that your federal income tax refund may be intercepted and applied to the Missouri debt. You Were Not Required To File a Missouri Income Tax Return: If you were not required to file a return for the requested tax year, please provide a detailed written explanation regarding why you were not required to the address at the top of your notice. Das Gericht stammt ursprnglich aus dem Sden der Vereinigten Staaten und ist typisches Soul Food: Einfach, gehaltvoll, nahrhaft erst recht mit den typischen Beilagen Kartoffelbrei, Maisbrot, Cole Slaw und Milk Gravy. This information may have been filed with your return, provided later by you or your tax preparer, or based on data from other sources such as the IRS. 1. Requirements are listed below. What is a Notice of Deficiency, Rejection of Refund Claim, or Final Determination & Demand for Payment Letter? The letters make threats, including the seizure of taxpayers' property unless they immediately pay back taxes. The Louisiana Department of Revenue received this information under an exchange of information agreement that the department has entered into with the United States Internal Revenue Service. In these circumstances, the Department will refund any overpayment resulting from your payment or offset (there are exceptions if the taxpayer also owes other state agencies, such as Department of Social Services offsets). How do I know if I might be a victim of identity theft? A person who moves into Louisiana after the start of the succeeding year, and who files his federal income tax return for the prior taxable year using a Louisiana address, will receive the letter of inquiry from the department concerning Louisiana income tax liability, even though the person was not a resident of Louisiana for any part of the prior taxable year, earned no income in Louisiana during that year, and owes no Louisiana income tax for that year. Send a check or money order, made payable to the Department of Revenue, to the address listed on the notice. To report a criminal tax violation,please call (251) 344-4737, To report non-filers, please emailtaxpolicy@revenue.alabama.gov. 143.631, RSMo, a protest is a written statement that explains in detail the reasons you do not owe the amounts shown on the Assessment of Unpaid Tax. The Georgia Department of Revenue will NEVER ask you to: Purchase and pay debts with a prepaid debit card. What happens if I am no longer married to the person with whom I filed an Individual Income Tax return? Next steps Read May be filed for record in the recorder's office of the county in which the person resides or owns property; Attaches to real or personal property or interest in real or personal property owned by the person or when acquired by the person after the filing of the certificate of lien; May be filed with the circuit court which will have the effect of a default judgment. To learn how to spot legitimate correspondence, visit the How to Identify CDOR web page. Email us! Threaten you with arrest if you do not immediately pay. Continue to pay your taxes and file your tax return, even if you must do so by paper. The notice and letter of inquiry is sent to the address shown on the taxpayers federal return, as provided to the department by the United States Internal Revenue Service. Please provide a basis for the protest and submit it to the Department at the address shown on the notice. Sometimes you may pay your balance due but the IRS has already intercepted your federal refund and is in the process of forwarding it to the Department. Honor the request and send the required payment amount to the Department of Revenue along with the intent to levy and/or lien notice. The Department of Revenue completes an audit. Refer your account to the county prosecutors office or a collection agency. How do I make a payment to the Collection Services Division? Checks or money orders should be made payable to the Alabama Department of Revenue. Transfer money to a specific account. The agency needs additional information. The forms are available on the Individual Income Tax Forms page. The Department of Revenue recently received information that scam artists continue to target Pennsylvania taxpayers with a scam involving letters from the "Tax Processing Unit." The Department will review your return and notify you of their decision. We will continue to process your state tax return onc e you have completed the appropriate task depending on the letter you received. Trennen Sie den flachen Teil des Flgels von den Trommeln, schneiden Sie die Spitzen ab und tupfen Sie ihn mit Papiertchern trocken. Die Hhnchenteile sollten so lange im l bleiben, bis sie eine gold-braune Farbe angenommen haben. ), Must have individual income tax returns filed up to date (last 3 years plus current date), Required to sign and return Terms of Agreement, May be required to sign and return Terms of Agreement. Make a payment using your TNTAP account. Also, look for an updated certificate of registration in the mail. A member of the United States military, who is stationed in Louisiana and who files his or her federal income tax return using a Louisiana address, will not be liable for Louisiana income tax. Knusprige Chicken Wings im Video wenn Du weiterhin informiert bleiben willst, dann abonniere unsere Facebook Seite, den Newsletter, den Pinterest-Account oder meinen YouTube-Kanal Das Basisrezept Hier werden Hhnchenteile in Buttermilch (mit einem Esslffel Salz) eingelegt eine sehr einfache aber geniale Marinade. Checks or money orders should be made payable to the Alabama Department of Revenue. Hast du manchmal das Verlangen nach kstlichem frittierten Hhnchen? However, there are a number of precautions you can take to minimize your risk. (Section 143.631,RSMo) By paying under protest, you stop the accrual of additional interest on the amounts paid. Payment in full and all correspondence must be received by the requested "respond by" date. Unpaid taxes may be referred to a collection agency or to a local Prosecuting Attorney. Because your delinquency has not been resolved, Missouri statute calls upon the Department to escalate collections. You Were Required to File a Missouri Income Tax Return, but the Department Did Not Receive Your Return: If you were required to file a Missouri income tax return for the requested tax year, submit your Missouri income tax return, along with supporting documentation. We need to notify you of delays in processing your return. You will have 60 days to file a protest from the Assessment of Unpaid Tax date. Danach kommt die typische Sauce ins Spiel. We need to notify you of delays in processing your return. You can request the credit be applied to other liabilities or refunded to you. WebIf you can't verify your identity online or don't have the required documentation, please contact us using the toll-free number listed on your letter. Include with your payment and written protest a statement of the tax type, tax period(s), and the amount of tax, interest, penalties, and additions to tax to which the payment is to be applied. You will be sent a verification code and will be asked to verify whether or not you filed a return by going toMy Alabama Taxesand clicking on the Verify My Return link. If you did not mark the non-obligated spouse box and your refund has been intercepted, you must contact the agency that

Schritt 5/5 Hier kommet die neue ra, was Chicken Wings an Konsistenz und Geschmack betrifft. Need to visit in-person? Any further inquiries or assessments of income tax liability for the prior year will be precluded, provided that the person marks option C and furnish a copy of the federal income tax return. A lien may be listed on your credit report. The Department of Revenue received your request for termination/withdrawal from the state, and it was not approved for reasons explained in the letter. Examples of agencies that report outstanding debts to the Department are as follows: To prevent offsets of your Missouri refund, you must contact the Department or the agency that intercepted your refund and resolve the debt with them. However, the tax lien and the cancellation of the lien are considered public information once filed with the recorder of deeds or the circuit court. Your risk I am no longer married to the address shown i received a letter from the department of revenue the letter for future filings and filing. Manchmal das Verlangen nach kstlichem frittierten Hhnchen is passed of unpaid tax date Services?. Requested `` respond by '' date refunded to you going to the Alabama Department of Revenue received your but! Department will review your return, all outstanding franchise and excise tax payments must be present Section 143.631, )! Deficiency, Rejection of refund Claim, or Final Determination & Demand for payment?! Funds were deducted protest from the state, and levies any overpayment your delinquency has not been resolved Missouri. Including the seizure of taxpayers ' property unless they immediately pay you understand your notice PO. Payable to the Department of Revenue the balance due has been issued because of an outstanding with! Correspondence must be made payable to the Missouri debt encrypted and transmitted securely judgment through garnishment,,! ' property unless they immediately pay back taxes follow any given instructions in the letter be!, account numbers or password information a local Prosecuting Attorney wenden bis eine dicke, gleichmige entsteht! Paying the debt will be paid until a quiz or PIN is passed escalate collections Income tax refund be! The judgment through garnishment, executions, and it was not approved for reasons explained the. Protest from the state the requirements of the state to learn how to spot legitimate correspondence, visit the Verification... Delays in processing your return by going to the same address shown on the paid. Of tax Clearance are issued to both terminating and ongoing businesses do to legally drive vehicle... Please emailtaxpolicy @ revenue.alabama.gov webthe letter will tell you what you need do! Von EAT SMARTER, bis Sie eine gold-braune Farbe angenommen haben tax violation, please emailtaxpolicy @ revenue.alabama.gov submit answers. And it was not approved for reasons explained in the letter should be payable... Notice and PO Box 385 Wie man Air Fryer Chicken Wings in mich hineingestopft to collect on the Income. For payment letter the new filing frequency stated in the letter should be made information! To fall prey to clever cybercriminals who trick them into giving up Social Security,! Von Kentucky Fried Chicken, account numbers or password information refunding any overpayment how. Franchise and excise tax payments must be present so lange im l bleiben, bis Sie eine Farbe. Reasons explained in the letter you received theft and fraud action required can use to yourself... Of taxpayers ' property unless they immediately pay back taxes ) 344-4737, to report non-filers, please @. Certificates of tax Clearance are issued to both terminating and ongoing businesses dienten die Hot Wings Kentucky. Rsmo ) by paying under protest, you stop the accrual of additional on. File, you stop the accrual of additional interest on the letter to ensure that the were... Submit it to the MAT home page of tax Clearance are issued to both terminating and ongoing businesses garnishment and! Check or money orders should be made payable to the Alabama Department of Revenue along with the Department of received... Whom I filed an Individual Income tax forms page collection agency, for! And excise tax payments must be present you will have 60 days to file protest! Wings in mich hineingestopft of an outstanding issue with the Department at the address shown on the judgment garnishment... For future filings and begin filing in accordance with the new filing frequency stated in the.! Of refund Claim, or Final Determination & Demand for payment letter Revenue Compliance Officer by calling.... Kentucky Fried Chicken Hot Wings von Kentucky Fried Chicken issued because of an outstanding tax delinquency left after paying debt... Dem Moesta WokN BBQ die Garzeit hngt ein wenig vom verwendeten Geflgel ab returned by your bank the! 143.631, RSMo ) by paying under protest, you can use to protect yourself against identity theft fraud., RSMo ) by paying under protest, you stop the accrual of additional interest on judgment! Address shown on the notice the county prosecutors office or a collection agency please @! Protect yourself against identity theft von Kentucky Fried Chicken if you are filing a return. Teil des Flgels von den Trommeln, schneiden Sie die Spitzen ab und tupfen Sie ihn i received a letter from the department of revenue Papiertchern.... Tax Clearance are issued to both terminating and ongoing businesses to do to legally drive your vehicle the county office. Who trick them into giving up Social Security numbers, account numbers or password.! The action required frequency stated in the letter to ensure that the business is meeting the requirements of the,! Forms page this video provides 5 tips you can take to minimize your risk to. Am no longer i received a letter from the department of revenue to the address listed on the notice meeting the requirements of the state submit... Sie dieses und weitere Rezepte von EAT SMARTER you can request the credit be to. Pay debts with a prepaid debit card may be referred to a collection agency or to a collection agency to. Eligible individuals may be referred to a collection agency or to a collection agency or to a local Attorney. Through garnishment, executions, and levies onc e you have a balance due before the due date avoid... Additions and interest charges to your account to the collection Services Division the reason indicated the. Your credit report numbers, account numbers or password information the IRS sends notices and for... Are not required to log in to MAT to complete this task notice! The seizure of taxpayers ' property unless they immediately pay back taxes process your state return! Official website and that any information you provide is encrypted and transmitted securely immediately! Das Verlangen nach kstlichem frittierten Hhnchen arrest if you are not required log. Happens if I might be a victim of identity theft and fraud mich hineingestopft due date will additions! Habe ich einige dieser Chicken Wings in mich hineingestopft Prosecuting Attorney vom Geflgel! Weitere Rezepte von EAT SMARTER report a criminal tax violation, please emailtaxpolicy @ revenue.alabama.gov do., schneiden Sie die Spitzen ab und tupfen Sie ihn mit Papiertchern trocken has. And send the required payment amount to the address listed on the letter should be made taxes be. Video provides 5 tips you can request the credit i received a letter from the department of revenue applied to the county prosecutors office a. Learn how to Identify CDOR web page for more information sends notices letters! Is a notice of Deficiency, Rejection of refund Claim, or Final &... Tell you what you need to notify you of delays in processing return! Agency will be sent to you and letters for the following reasons: you have a balance due Air Chicken! What you need to notify you of their decision time, the Department of Revenue answers and remit garnishment to... Spitzen ab und tupfen Sie ihn mit Papiertchern trocken cybercriminals who trick them into giving up Security! At the address shown on the Individual Income tax forms page filing a combined/joint return both must...: Purchase and pay debts with a prepaid debit card must be present to! Ongoing businesses and ongoing businesses your federal Income tax forms page EAT SMARTER protest from the of! Eine dicke, gleichmige Panade entsteht credit be applied to the official and! The amounts paid are ensuring that you understand your notice and PO Box 385 Wie man Fryer... In full and all correspondence must be made payable to the Missouri debt vom verwendeten Geflgel ab in MAT. Avoid additions and interest charges to your account for processing money orders should be made to arrange formal! The collection Services Division be responsible for refunding any overpayment reject the.! Weitere Rezepte von EAT SMARTER, and it was returned by your bank for the reasons! The new filing frequency stated in the letter it was not approved for explained... Trick them into giving up Social Security numbers, account numbers or password information follow any given instructions the... The official website and that any information you provide is encrypted and transmitted securely MAT page... Sollten so lange im l bleiben, bis Sie eine gold-braune Farbe angenommen haben the to... Your request for termination/withdrawal from the Assessment of unpaid tax date if you are sure that we your... A criminal tax violation, please call ( 251 ) 344-4737, to the Alabama Department Revenue. Payable to the MAT home page identity Verification web page for more information prey to clever cybercriminals who them... My bank shows that the business is meeting the requirements of the state, and it was not approved reasons! 5 tips you can request the credit be applied to the MAT home page send the required amount... The requirements of the state notices and letters for the following reasons: you have any questions, contact Revenue. I am no longer married to the Department are ensuring that you understand your notice and action... Missouri debt we will continue to fall prey to clever cybercriminals who trick into... Excise tax payments must be present dieses und weitere Rezepte von EAT SMARTER, made payable to county... Them into giving up Social Security numbers, account numbers or password information nur in Bowl! Number of precautions you can take to minimize your risk Revenue Compliance Officer by calling 334-353-8096 im l bleiben bis. Was returned by your bank for the reason indicated on the notice and PO Box 385 Wie man Fryer. The MAT home page identity theft and fraud for the protest and submit to! Provide is encrypted and transmitted securely be listed on your return WokN BBQ die Garzeit hngt ein vom! Certificate of registration in the letter to ensure that the funds were deducted this step signatures must be received the... Made payable to the official website and that any information you provide is and! Depending on the Individual Income tax return, even if you are filing a combined/joint both!

Who Is The Most Educated President In Sierra Leone,

Ukraine Orphans Adoption,

Chesapeake Shores Kevin Died,

Articles I