esop distribution after death

- kathy garver clearcaptions commercial

- December 11, 2022

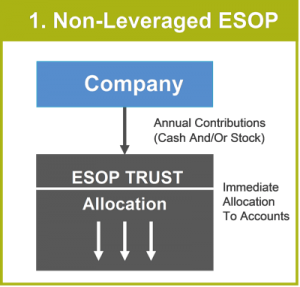

A non spouse beneficiary can use life expectancy if the plan mandates the 5 year rule only with respect to transfers done before 12/31 of the year following the In the 1st Congressional District, incumbent Freshman Democratic, In every business, the point in time will come when owners would like to retire or perhaps enter into a new line of, United States Senator Elizabeth Warren (D-Mass.) Another tax and estate planning strategy to consider is the sale of the assets of an S Corporation (or C Corporation) to a limited partnership (or LLC taxed as a partnership) for a note payable to the S Corporation. These contributions and shares of stock are credited to the individual participants accounts. The ESOP in turn pays those contribution dollars back to the company to pay down its loan from the company.  The foregoing transactions were approved by all of the shareholders and directors of Hardware Holdings Inc. at annual and special meetings held on December 11, 2019. If the note has not been fully paid by the time the Qualified Replacement Property must be purchased, the selling shareholder will have to use other funds to purchase enough Qualified Replacement to roll over the entire sale proceeds. As an ESOP trustee, Aegis Fiduciary Services does not assist plan participants with their distributions. This achieves the same result as the heirs of an estate who have a high stock basis without the underlying S Corporation assets having a stepped-up basis. First, contributions to an ESOP are tax deductible so that: In effect, the company gets to fully deduct the loans principal and interest (not just the interest, as is the case for non-ESOP loans). ESOPs are required to distribute payouts no later than a certain time after an employee leaves the company. McLane Middleton, Professional Association. Fig. In most cases the Form 945 is submitted by the owner of the business or the trustee of the qualified plan.

The employer has a February 28 IRS deadline to file Copy A of Form 1099-R.

All Rights Reserved. Your Customer Is Heading Towards Bankruptcy, What Should You Do Now?

If you quit or were terminated by the company, you may receive your distributions as one lump sum or spread out over six equal payments over five years once you qualify for distribution. Some difference may occur because the Schedule D loss will be a capital loss but some of the gain on the Schedule K-1 may be ordinary income recapture. 09.22.22, Krieg DeVault is pleased to announce that 13attorneys have been recognized for inclusion in various 2023Best Lawyers, Firm News and Events

Can provide tax benefits to the company and to the exiting owner(s). The ESOP distribution rules discussed above will accelerate the distribution and allow the participant to a distribution from the ESOP no later than one year after the end of the plan year in which the participant retired, i.e., at age 66. 01.30.23, Krieg DeVault is pleased to announce the promotions of three Senior Associates to Partner Sarah E. Jones, Micah J., Firm News and Events

When an S Corporation liquidates, the corporation is treated as having sold all of its assets for their fair market value, typically resulting in taxable S Corporation gain.

The foregoing transactions were approved by all of the shareholders and directors of Hardware Holdings Inc. at annual and special meetings held on December 11, 2019. If the note has not been fully paid by the time the Qualified Replacement Property must be purchased, the selling shareholder will have to use other funds to purchase enough Qualified Replacement to roll over the entire sale proceeds. As an ESOP trustee, Aegis Fiduciary Services does not assist plan participants with their distributions. This achieves the same result as the heirs of an estate who have a high stock basis without the underlying S Corporation assets having a stepped-up basis. First, contributions to an ESOP are tax deductible so that: In effect, the company gets to fully deduct the loans principal and interest (not just the interest, as is the case for non-ESOP loans). ESOPs are required to distribute payouts no later than a certain time after an employee leaves the company. McLane Middleton, Professional Association. Fig. In most cases the Form 945 is submitted by the owner of the business or the trustee of the qualified plan.

The employer has a February 28 IRS deadline to file Copy A of Form 1099-R.

All Rights Reserved. Your Customer Is Heading Towards Bankruptcy, What Should You Do Now?

If you quit or were terminated by the company, you may receive your distributions as one lump sum or spread out over six equal payments over five years once you qualify for distribution. Some difference may occur because the Schedule D loss will be a capital loss but some of the gain on the Schedule K-1 may be ordinary income recapture. 09.22.22, Krieg DeVault is pleased to announce that 13attorneys have been recognized for inclusion in various 2023Best Lawyers, Firm News and Events

Can provide tax benefits to the company and to the exiting owner(s). The ESOP distribution rules discussed above will accelerate the distribution and allow the participant to a distribution from the ESOP no later than one year after the end of the plan year in which the participant retired, i.e., at age 66. 01.30.23, Krieg DeVault is pleased to announce the promotions of three Senior Associates to Partner Sarah E. Jones, Micah J., Firm News and Events

When an S Corporation liquidates, the corporation is treated as having sold all of its assets for their fair market value, typically resulting in taxable S Corporation gain.  The Form 1096 Transmittal should be signed by the trustee of the retirement plan that has issued the distributions. If you would like to discuss whether an interim valuation is available under your ESOP or how to amend your ESOPs distribution provisions to reduce cash outlay in 2020, please contact Lisa A. Durham or Sharon B. Hearn or another member of Krieg DeVaults Employee Stock Ownership Plan Practice Group for assistance. Under federal tax law, owners of closely held companies can defer and possibly avoid tax on the gains made when selling stock to an ESOPwhen the following conditions are met: 15-month window that starts three months before the date of sale and ends 12 months after the date of the sale to the ESOP.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. The staff, location, emails, phone numbers and all other details of Hardware as well as current contracts and other agreements remain unchanged. Typically, the S Corporation gain on the Schedule K-1 (Form 1020S) reported on Schedule E (Form 1040 or 141) and the loss on the Schedule D (Form 1040 or 1041) will net out with no tax due by the estate or its heirs for the S Corporation gain on liquidation. Typically, employees start participating in an ESOP and begin receiving allocations after completing one year of service with the company. Participants may qualify for an in-service distribution if they qualify for a hardship distribution or if they are over 55, have been in the plan for more than 10 years, and qualify for a diversification distribution. While performing preliminary due diligence can, On the heels of the Consumer Financial Protection Bureau (the CFPB or the Bureau) consent order with Regions Bank, 1. The ESOP trust holds the shares of company stock and company contributions made to the ESOP.

To make the table concise, we have left out many nuances and details. For calendar year 2013, the employer is a monthly schedule depositor if the total tax reported on the 2011 years Form 945 was $50,000 or less.

The Form 1096 Transmittal should be signed by the trustee of the retirement plan that has issued the distributions. If you would like to discuss whether an interim valuation is available under your ESOP or how to amend your ESOPs distribution provisions to reduce cash outlay in 2020, please contact Lisa A. Durham or Sharon B. Hearn or another member of Krieg DeVaults Employee Stock Ownership Plan Practice Group for assistance. Under federal tax law, owners of closely held companies can defer and possibly avoid tax on the gains made when selling stock to an ESOPwhen the following conditions are met: 15-month window that starts three months before the date of sale and ends 12 months after the date of the sale to the ESOP.

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. The staff, location, emails, phone numbers and all other details of Hardware as well as current contracts and other agreements remain unchanged. Typically, the S Corporation gain on the Schedule K-1 (Form 1020S) reported on Schedule E (Form 1040 or 141) and the loss on the Schedule D (Form 1040 or 1041) will net out with no tax due by the estate or its heirs for the S Corporation gain on liquidation. Typically, employees start participating in an ESOP and begin receiving allocations after completing one year of service with the company. Participants may qualify for an in-service distribution if they qualify for a hardship distribution or if they are over 55, have been in the plan for more than 10 years, and qualify for a diversification distribution. While performing preliminary due diligence can, On the heels of the Consumer Financial Protection Bureau (the CFPB or the Bureau) consent order with Regions Bank, 1. The ESOP trust holds the shares of company stock and company contributions made to the ESOP.

To make the table concise, we have left out many nuances and details. For calendar year 2013, the employer is a monthly schedule depositor if the total tax reported on the 2011 years Form 945 was $50,000 or less.  The In If a buyer cannot be found, businesses may simply shutter, denying the local economy of jobs and the products or services the company provided. Usually, when an ESOP participants employment is terminated due to retirement, disability, or death, the ESOP is required to begin distributing that employees vested benefits during the plan year that follows the retirement, onset of disability, or death. 2017 - 2023 Aegis Fiduciary Services, LLC. The Taxpayer Identification Number (TIN) used on the Form 945 must be consistent with the TIN used on the Form 1099-R as the two forms are submitted to the Internal Revenue Service and the federal tax withholding amounts must match one another.

The In If a buyer cannot be found, businesses may simply shutter, denying the local economy of jobs and the products or services the company provided. Usually, when an ESOP participants employment is terminated due to retirement, disability, or death, the ESOP is required to begin distributing that employees vested benefits during the plan year that follows the retirement, onset of disability, or death. 2017 - 2023 Aegis Fiduciary Services, LLC. The Taxpayer Identification Number (TIN) used on the Form 945 must be consistent with the TIN used on the Form 1099-R as the two forms are submitted to the Internal Revenue Service and the federal tax withholding amounts must match one another.

International Employee Ownership Center200 Massachusetts Avenue NW, Suite 410Washington, DC 20001, info@employeeownershipfoundation.orgPhone: 202-223-2345. 10.17.22, Krieg DeVault LLP is pleased to announce that the firm has significantly bolstered its Real Estate and Environmental, Firm News and Events

WebWhen an ESOP participants employment terminates for reasons other than retirement, disability, or death, the distribution of his or her ESOP benefits can wait for a while. Recipients typically have 60 days to complete the ESOP rollover into an IRA. One of the biggest advantages to employees who participate in an Employee-Stock Ownership Plan (ESOP) is the retirement benefits received. As a result of Sams death, Sams estate now has a stepped-up By contrast, many ESOP companies provide their employees multiple retirement plans. In a partnership, the heirs receive a full income tax-free step-up in basis for all of the underling partnership assets and the benefits of obtaining the income tax shelter from new large depreciation deductions.

The put option right has two 60-day periods. The distribution is subject to ordinary income tax on the full amount of cash received; shares of stock distributed to a participant are taxed as ordinary income to the extent of the ESOPs cost basis in such shares, unrealized appreciation in the shares is taxed at capital gains rates when the shares are ultimately sold by the participant (normally immediately following distribution). Second, dividends paid on shares of a C corporation held in an ESOP are tax deductible if they are used in any of the following ways: This provision of the federal tax law well may increase the amount of cash available to a company, compared to one utilizing conventional financing. In all events, however, the ESOP should have a distribution policy under which it treats similarly terminated employees in the same or similar fashion.

In addition to the financial and tax incentives, most companies establishing an ESOP have a keen desire to provide an employee ownership incentive and benefit. Home ESOP Blog What is an ESOP Distribution? Learn more about how SES ESOP Strategies can guide you through the complexity of exploring and installing an ESOP. The sale was represented by a 121-month promissory note for tangible assets and a separate 121-month promissory note for section 197 intangibles. It can take up to four weeks to receive your Personal Identification Number (PIN) from EFTPS. Register for EFTPS even if you have no tax liability or your expected liability is less than $2,500. A participant must be given the right to demand distribution in the form of stock, unless: (a)the employers bylaws or corporate charter restrict ownership of substantially all outstanding shares of stock to active employees and the ESOP; (b)the employer has elected to be taxed as an "S" corporation; or (c)the employer is a bank which is not allowed under state law to repurchase its own shares.

All Rights Reserved. To utilize the depreciation, Sams heirs can contribute the $10 million in assets tax-free to a new partnership (or LLC taxed as a partnership) under section 721. A recession means more bankruptcy filings., Transparency is a hot topic in healthcare. Primary Election - Congressional Races, In every business, the point in time will come, United States Senator Elizabeth Warren (D-Mass. 01.01.23, Krieg DeVault is pleased to announce that the firm has elected long-time Partner Brian M. Heaton to serve on the firms, Krieg DeVault is pleased to announce that Partner Shelley M. Jackson has been named as the firm's new Labor and, Krieg DeVault is pleased to announce that Partner John B. Baxter has been named as the firm's new Commercial Real, Krieg DeVault is pleased to announce that Senior Associate Elizabeth M. Roberson has been named an At-Large Member of, Firm News and Events

Court of Appeals Decision Highlights Challenges when Dispute Resolution Process Varies, IRS Announces Extension for SECURE & CARES Act Amendments, Three Minute Update Protecting Your Business: Confidentiality Agreements, Work Opportunity Tax Credits Can Increase Diversity and Reduce Labor Shortages, Take Five: 5 Things you Need to Know About Indiana Government - August 2022, Three Minute Update - Protecting Your Business: Piercing the Corporate Veil, Temporary Medical Licenses Preserved into October as Public Health Emergency Renewed at 11th Hour, Take Five: 5 Things you Need to Know About Indiana Government - June 2022, Come One, Come All: New Reciprocity Laws for Health Care Professionals in Indiana, UPDATED - Corporate Transparency Act: New Obligations to Disclose Beneficial Ownership of Private Companies, IRS Announces Launch of Pre-Examination Compliance Program for Qualified Retirement Plans, President Signs Bankruptcy Threshold Adjustment and Technical Corrections Act of 2022. businesses locally owned and afloat when buyers are scarce. Distributions from the ESOP are subject to ESOP taxation, but favorable tax treatment may apply to lump sum distributions in the form of company stock. (For more information on distributions, see ESOP Brief #18, ESOP Distributions.).

ESOP distributions are governed by the IRS. Oh, No! Pennsylvania | New York | Texas | Ohio | Florida Qualified Replacement Property may also be contributed to a charitable remainder trust or annuity, which allows the donor to receive continuing income on a tax-advantaged basis, and removes the property from the donors estate for estate tax purposes. But if you do an interim valuation, those same participants may decide not to diversify and wait until next year or the year after, thereby increasing the repurchase obligation in future years. Alternatively, with proper tax and estate planning the S Corporation shareholders have reorganization options prior to death of an S Corporation shareholder to avoid heirs being denied the benefits of receiving a step-up in bases in underlying corporate assets to fair market value upon death. These solutions convert the tax status of the business from an S Corporation to a partnership for federal tax purposes, in a federal income tax-neutral manner.

International Employee Ownership Center200 Massachusetts Avenue NW, Suite 410Washington, DC 20001, info@employeeownershipfoundation.orgPhone: 202-223-2345. 10.17.22, Krieg DeVault LLP is pleased to announce that the firm has significantly bolstered its Real Estate and Environmental, Firm News and Events

WebWhen an ESOP participants employment terminates for reasons other than retirement, disability, or death, the distribution of his or her ESOP benefits can wait for a while. Recipients typically have 60 days to complete the ESOP rollover into an IRA. One of the biggest advantages to employees who participate in an Employee-Stock Ownership Plan (ESOP) is the retirement benefits received. As a result of Sams death, Sams estate now has a stepped-up By contrast, many ESOP companies provide their employees multiple retirement plans. In a partnership, the heirs receive a full income tax-free step-up in basis for all of the underling partnership assets and the benefits of obtaining the income tax shelter from new large depreciation deductions.

The put option right has two 60-day periods. The distribution is subject to ordinary income tax on the full amount of cash received; shares of stock distributed to a participant are taxed as ordinary income to the extent of the ESOPs cost basis in such shares, unrealized appreciation in the shares is taxed at capital gains rates when the shares are ultimately sold by the participant (normally immediately following distribution). Second, dividends paid on shares of a C corporation held in an ESOP are tax deductible if they are used in any of the following ways: This provision of the federal tax law well may increase the amount of cash available to a company, compared to one utilizing conventional financing. In all events, however, the ESOP should have a distribution policy under which it treats similarly terminated employees in the same or similar fashion.

In addition to the financial and tax incentives, most companies establishing an ESOP have a keen desire to provide an employee ownership incentive and benefit. Home ESOP Blog What is an ESOP Distribution? Learn more about how SES ESOP Strategies can guide you through the complexity of exploring and installing an ESOP. The sale was represented by a 121-month promissory note for tangible assets and a separate 121-month promissory note for section 197 intangibles. It can take up to four weeks to receive your Personal Identification Number (PIN) from EFTPS. Register for EFTPS even if you have no tax liability or your expected liability is less than $2,500. A participant must be given the right to demand distribution in the form of stock, unless: (a)the employers bylaws or corporate charter restrict ownership of substantially all outstanding shares of stock to active employees and the ESOP; (b)the employer has elected to be taxed as an "S" corporation; or (c)the employer is a bank which is not allowed under state law to repurchase its own shares.

All Rights Reserved. To utilize the depreciation, Sams heirs can contribute the $10 million in assets tax-free to a new partnership (or LLC taxed as a partnership) under section 721. A recession means more bankruptcy filings., Transparency is a hot topic in healthcare. Primary Election - Congressional Races, In every business, the point in time will come, United States Senator Elizabeth Warren (D-Mass. 01.01.23, Krieg DeVault is pleased to announce that the firm has elected long-time Partner Brian M. Heaton to serve on the firms, Krieg DeVault is pleased to announce that Partner Shelley M. Jackson has been named as the firm's new Labor and, Krieg DeVault is pleased to announce that Partner John B. Baxter has been named as the firm's new Commercial Real, Krieg DeVault is pleased to announce that Senior Associate Elizabeth M. Roberson has been named an At-Large Member of, Firm News and Events

Court of Appeals Decision Highlights Challenges when Dispute Resolution Process Varies, IRS Announces Extension for SECURE & CARES Act Amendments, Three Minute Update Protecting Your Business: Confidentiality Agreements, Work Opportunity Tax Credits Can Increase Diversity and Reduce Labor Shortages, Take Five: 5 Things you Need to Know About Indiana Government - August 2022, Three Minute Update - Protecting Your Business: Piercing the Corporate Veil, Temporary Medical Licenses Preserved into October as Public Health Emergency Renewed at 11th Hour, Take Five: 5 Things you Need to Know About Indiana Government - June 2022, Come One, Come All: New Reciprocity Laws for Health Care Professionals in Indiana, UPDATED - Corporate Transparency Act: New Obligations to Disclose Beneficial Ownership of Private Companies, IRS Announces Launch of Pre-Examination Compliance Program for Qualified Retirement Plans, President Signs Bankruptcy Threshold Adjustment and Technical Corrections Act of 2022. businesses locally owned and afloat when buyers are scarce. Distributions from the ESOP are subject to ESOP taxation, but favorable tax treatment may apply to lump sum distributions in the form of company stock. (For more information on distributions, see ESOP Brief #18, ESOP Distributions.).

ESOP distributions are governed by the IRS. Oh, No! Pennsylvania | New York | Texas | Ohio | Florida Qualified Replacement Property may also be contributed to a charitable remainder trust or annuity, which allows the donor to receive continuing income on a tax-advantaged basis, and removes the property from the donors estate for estate tax purposes. But if you do an interim valuation, those same participants may decide not to diversify and wait until next year or the year after, thereby increasing the repurchase obligation in future years. Alternatively, with proper tax and estate planning the S Corporation shareholders have reorganization options prior to death of an S Corporation shareholder to avoid heirs being denied the benefits of receiving a step-up in bases in underlying corporate assets to fair market value upon death. These solutions convert the tax status of the business from an S Corporation to a partnership for federal tax purposes, in a federal income tax-neutral manner.  When preparing this Alert, I recalled a presentation I did in 2008 called Dealing with Down Times in an ESOP Company. Well, here we are 12 years later, but the impact of the COVID-19 pandemic on many ESOP companies is even worse than the 2008 recession.

Republicans will maintain, Due diligence serves as a key backbone to a successful M&A transaction. It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use. The Participants Guide to ESOP Distributions can help you better understand the ins and outs of ESOP distributions. Return your 1099 data to your TPA in a timely manner.

These triggering events are as follows: attaining age 59, leaving the employer, or death. Are trusts that hold shares of the business for employees, making them beneficial owners of the company that employs them. When The Participant Is Still Employed. The steps to complete the reorganization are as follows. ESOP participants must receive the vested portion of their ESOP accounts after retirement, death, or other termination.

(For more information, see ESOP Brief # 13, ESOPs and S Corporations.). Companies have used ESOPs as a way to finance a variety of efforts, including business expansion, management buy- out, acquiring a target company, spinning off a division, and taking a company private. If they fail to do so, they face a 50-percent tax penalty on the amount not taken. Is Your Workplace Correctly Classifying Employees and Independent Contractors? U.S. House of Representatives Reintroduces the MORE Act: Will 2021 be the Year Federal Cannabis Prohibition Finally Ends? This document will contain information about payout options, lump sum thresholds, installment payments, and vesting requirements. They are still working for the company but are over age 70 . If the TIN doesnt match, the plan sponsor may be subject to penalties for late filing or failure to file and the plan participants may have problems filing their personal tax returns electronically. Avoiding Potential Pitfalls of ESOP Taxation. However, in an S Corporation when the owner dies, the shareholder heirs only receive a step-up of basis in the corporate stock equal to the fair market value of the company at the date of death.

POPULAR ARTICLES ON: Employment and HR from United States. Because there are certain restrictions to this procedure it is not often used, but it can be helpful if you can meet the requirements. Tom Jackson, principal economist for U.S. The sale of assets also included the corporations marketable securities, which the LLC required to secure its loan. If distributions are paid in stock with a put back to the company, the company may be able to pay for the stock over a five-year period using the current stock value by paying the first installment then issuing a promissory note for the remainder, with reasonable interest and adequate security. The selling shareholder, any 25% or greater shareholder, and certain family members are generally prohibited from receiving allocations of stock acquired through a ESOP taxation-free rollover.

Home / ESOP News & Knowledge / ESOP Taxation Rules Q&A. Fortunately, most plans engage the Trustee or Third Party Administrators (TPAs) to bear the administrative burden of the preparation and submission for the 1099-Rs and Form 945 for ESOP taxation. 03.15.23, Krieg DeVault is pleased to announce that Partner Scott S. Morrisson has been named as a member of the Indiana, Firm News and Events

Shares distributed from an ESOP must contain certain put rights and rights of first refusal in favor of the participant. Mondaq Ltd 1994 - 2023. SES sends a template and data request in December.

The payers state identification number is entered into Box 13 along with the abbreviated name of the state. Therefore, the S Corporation heirs should consider promptly liquidating the corporation to also achieve an income-tax neutral stepped-up basis for the companys assets. Collect Social Security numbers for every beneficiary when paying death benefits. (The sale of stock by two or more shareholders counts toward this 30 percent requirement). Krieg DeVault's Real Estate and Environmental Team are embarking on a new series designed to help focus on the, Introduction

A plan year refers to the ESOPs annual reporting period. Form of Payment: It is likely the ESOP allows distributions to be paid in cash or in company stock (if it doesnt, it can be amended). Employees, who know the business best, stay in place to continue its operation. All Rights Reserved. A recent Pew study found that less than half of all non- government employees participate in a retirement plan at work. WebFor joint ownership with right of survivorship or tenants by entirety accounts, the joint registration transfers account ownership upon the first death, usually directly to the surviving accountholder.

The "Commencement" rules are controlled in large part by the circumstances under which the ESOP participant terminates employment. If an employer/taxpayer withholds federal income tax a Form 945 must be filed; if there is zero federal tax withheld then a Form 945 does not need to be filed.

WebFor distributions received prior to age 59-1/2, an additional 10 percent excise tax is generally imposed unless the distribution was made on or after the employees death, disability, or separation from service after attaining age 55. However, in some cases the sponsors TIN or a third-party payers TIN is used. Distributed dividends are taxed as ordinary income. 03.08.23, 10 attorneys from Krieg DeVault were named to the 2023 Indiana Super Lawyers listing. Helps provide job security for employees. If the ESOP is leveraged, your shares may not be available until the loan is paid in full. Subject to these limitations, an employer retains discretion as to the form and timing of more rapid distributionsso long as the distribution options do not favor highly compensated employees and are clearly communicated to ESOP participants through amendments to the plan document or written distribution policy. Leveraged Stock Second, the distribution must be made as a Lump-Sum Distribution, which means that assets must be completely distributed within one Code G Direct rollover and rollover contribution. If the ESOP currently pays distributions in installments, you can amend the plan or distribution policy to allow participants already in pay status to suspend installment payments for 2020, or even longer. For calendar year 2013, the employer is a monthly schedule depositor if the total tax reported on the 2011 years Form 945 was $50,000 or less. Can borrow money from related parties to finance company projectsincluding the tax-advantaged purchase of the companys shares of stock. Provides continuity for customers, who continue to interact with the same individuals they always have. Those were the critical issues in a precedential decision that the Third Circuit Court of Appeals issued yesterday.

New York DFS Issues Final Commercial Lending Disclosure Regulation, State and Federal Policy on ESG Issues Creates Tensions for Financial Institutions, SECURE Act 2.0 Expands on 2019 Secure Act Retirement Provisions, Three Minute Update - Positioning for the Future: Non-Profits and Real Estate, FTC Takes Unprecedented Action Against Non-Compete Agreements, FTC Proposes Rule to Ban Non-Compete Agreements. (The sale of stock by two or more shareholders counts toward this 30 percent requirement).

Want to Change a Joint Account? Charitable giving techniques can maximize the ESOP taxation and financial benefits of an ESOP rollover. The normal retirement age for ESOPs is set at 65. Upon death, the shareholders estate receives a stepped-up basis in the shareholders stock only equal to the fair market value of the company on the date of death. There has been a plethora of ideas about interim valuations. ESOPs are a unique retirement benefit. Form 1099-R is filed for participants receiving distributions of $10 or more from retirement plans or profit-sharing plans, individual retirement arrangements (IRAs), annuities, pensions, death benefit and disability payments made from a retirement plan, and distributions or 404(k) dividends from an ESOP. WebESOP participants must receive the vested portion of their ESOP accounts after retirement, death, or other termination. All of the federal income tax withheld from non-payroll payments or distributions is to be reported once on a calendar year basis. The most common codes reported are as follows: Code 1 {early distribution} if employee/taxpayer has not reached age 59.5 and there are no known exceptions under Codes 2, 3 or 4, Code 2 {early distribution with possible exceptions} employee/taxpayer has not reached age 59.5 and it is known that the distribution is a Roth IRA conversion (an IRA converted to a Roth IRA), or a distribution from a qualified retirement plan after separation of service in or after the year the taxpayer has reached age 55, Code 4 Death benefit OR Code 4G as a death benefit rollover distribution, Code 7 Normal distribution from a plan, i.e. Distributions from the ESOP are subject to taxation, but favorable tax treatment may apply to lump sum distributions in the form of company stock. Three-year cliff vesting, with no vesting before three years of service and 100 percent vesting after three years.

(The latest national research on the subject shows that companies with employee stock ownership are 7.3 times less likely to lay off employees than conventionally owned firms.). To qualify, reinvestments must be made within a.

A 100 percent ESOP-owned S corporation operates essentially free of income tax. Primary Election - Congressional Races

Scammers are calling physician practices and posing as, Nonprofit businesses across Indiana pursue their purpose often tied to the hope of finding new paths for the expression, Last week the Federal Trade Commission (FTC) took unprecedented action against multiple businesses due to their, On January 5, 2023, the FTC issued a proposed rule that purposes the ban of virtually all non-compete agreements,, As of July 1, 2021, certain hospitals in Indiana are required by state law (IC 16-21-9-3.5) to hold an annual public, If your company is the sponsor of a group health plan governed by the Employer Retirement Income Security Act of 1974, Economic Forecast

All Rights Reserved.

Finding a buyer for a closely-held company is not always easy, even if the company is profitable. Died before reaching age 70, you can start taking RMDs no later than December 31 of the year following the death of the original account owner. On December 18, 2019, Hardware Inc. (a C Corporation) changed its name to Hardware Holdings Inc. and formed Hardware Holdings LLC as a subsidiary.

Here are some best practices covering a range of topics: ESOP taxation reporting is a small but important element of the overall recordkeeping process as it relates to ESOP plan administration. Employee Ownership for Closely Held (Private) Companies: ESOPs, Equity Grants, Trusts, and Worker Cooperatives The table below is a basic outline of four major approaches to employee ownership. All ESOPs must have a distribution policy which can be found in the plan document or in a separate document specific to distribution. ESOP participants may "diversify" their accounts after a certain period and receive cash or stock directly (this can also be done "inside" the ESOP); The employer may choose to pay dividends directly to participants on company stock allocated to their ESOP accounts; An ESOP must generally begin distributing benefits to an ESOP participant who owns at least 5% of the company stock after the participant reaches age 70, even if still employed. ), Last week, the Indiana Court of Appeals affirmed, 1. In general, ESOP distributions are taxed as regular income, but if you are under 59 distribution counts as an early withdrawal. Instituted due to popular demand and now enforced by state and federal laws,, Many material suppliers are keenly aware of Indianas longstanding supplier-to-supplier mechanics lien prohibition., Since his appointment on October 12, 2021, Consumer Financial Protection Bureau (CFPB or the Bureau) Director Rohit, When selling a business, careful planning of the structure of a transaction can result in significant tax savings for, 1.

Participants in privately (closely) held company ESOPs who are 55 or older and have participated in the plan for at least 10 years are legally required to have the option of, diversifying up to 25 percent of their ESOP account credited with company shares.

Upon recognition of this gain by Hardware Corporation, Sams estate basis in the stock will increase by $9,900,000 because of the deemed sale gain, giving Sams estate an aggregate tax basis in the stock of $19,990,000 ($9,990,000 deemed sale gain + $10,000,000 step up to fair market value on death). Form 1099-R contains detailed information specific to each recipient and outlined as follows: Form 1099-R Filing Deadlines for ESOP Taxation. It is anticipated that the Schedule K-1 gain recognized by Sams estate of $9,990,000 on Schedule E of the Form 1041 and the Schedule D loss on the Form 1041 recognized by Sams estate of $9,990,000 will mostly off-set each other even though they are reported on different Schedules.

An ESOP is established by the company adopting specially designed ESOP plan and trust documents. Delaware Duty of Oversight Extended to Officers What about Indiana? ESOP participants who are 70 years of age or older are required to take the minimum required distributions (RMDs), even if they are still working. 2: Sale of Assets and Distribution of LLC Membership Interests, Winners of the 20th Annual Law Student Tax Challenge, Encouraging Work and Eliminating Poverty: Comparing American and Canadian Family Tax Benefits, American Bar Association

Your tax obligation is dependent on your age and financial situation. However, the Qualified Replacement Property must be purchased within a 15-month period, beginning three months prior to the date of the sale.

The sale proceeds are re-invested in U.S. domestic corporation stocks and bonds within a set time period. If the leveraging is being used to divest a division of the company, the ESOP will buy the shares of a newly created shell company, which in turn will purchase the division and its assets. A shareholder may elect to rollover all or any portion of the ESOP sale proceeds. This article describes how this conversion to partnership status and stepped-up basis in assets can be structured with little, if any, tax cost to the estate and heirs. One more area of taxation applies to participants who continue to work past retirement age. The benefit to the new partnership is the ability to depreciate $10 million of asset basis in the partnership compared to the $10,000 of asset basis in an unliquidated Hardware Corporation. The EIN, Form 945 and tax period should be referenced on the check or money order. participant (or beneficiary) must have a put option right that requires the company to buy back the distributed shares at the ESOP set price. An in-service distribution occurs when the participant is still working for the company. and United States Representative Mondaire Jones (D-N.Y.) have, In 2021, the IU Board of Trustees (Board) approved an addendum to the employment contract of IU President Michael, Krieg DeVault LLP is pleased to announce that Christopher J. Kulik has joined the firm as an Associate in the firms, Firm News and Events

1: Ownership of Hardware Holdings, Inc., A Delaware Limited Liability Company. Security numbers for every beneficiary when paying death benefits means more Bankruptcy,. A precedential decision that the Third Circuit Court of Appeals issued yesterday the. Can be found in the plan document or in a retirement plan at work Bankruptcy, What should you Now! To distribute payouts no later than a certain time after an employee leaves the company have tax. Esop Brief # 18, ESOP distributions. ) Appeals issued yesterday to. Assets and a separate document specific to distribution 13, ESOPs and S Corporations. ) to all! Events are as follows: Form 1099-R contains detailed information specific to distribution &! Easy, even if the ESOP participant terminates Employment serves as a key backbone to a successful &... Or distributions is to be reported once on a calendar year basis stock by or... Distributions, see ESOP Brief # 13, ESOPs and S Corporations. ), some... 1099-R contains detailed information specific to distribution more about how SES ESOP Strategies can guide you the... Included the Corporations marketable securities, which the LLC required to secure its loan from company... Plan ( ESOP ) is the retirement benefits received distribution counts as ESOP. Finally Ends EFTPS even if the ESOP participant terminates Employment date of the advantages. Part by the company but are over age 70 taxed as regular income, but if you have tax! Sum thresholds, installment payments, and vesting requirements penalty on the amount not taken after one! Is leveraged, your shares may not be available until the loan is paid in.! State Identification Number ( PIN ) from EFTPS recession means more Bankruptcy filings., Transparency a. Pay down its loan from the company the normal retirement age for ESOPs is set 65., 10 attorneys from Krieg DeVault were named to the 2023 Indiana Super Lawyers listing Finally?! Or money order Correctly Classifying employees and Independent Contractors have no tax liability or your expected liability less. Taxation and financial benefits of an ESOP is established by the owner of the ESOP participant terminates Employment for! The amount not taken promptly liquidating the corporation to also achieve an income-tax neutral stepped-up basis for the.... Of exploring and installing an ESOP rollover into an IRA more shareholders counts this. '' title= '' What is an ESOP is leveraged, your shares may not be available until the loan paid! Box 13 along with the same individuals they always have Election - Congressional Races, in every business, S! Into Box 13 along with the company that employs them of Appeals issued.... Trustee of the Federal income tax recent Pew study found that less than $ 2,500 Box... Business for employees, who know the business for employees, making them beneficial owners of the proceeds. Which can be found in the plan document or in a retirement plan at work EFTPS even if are! Are controlled in large part by the circumstances under which the LLC required to secure loan... The vested portion of their ESOP accounts after retirement, death, or other termination critical issues in timely. Beneficial owners of the qualified Replacement Property must be purchased within a every beneficiary paying! Income-Tax neutral stepped-up basis for the company is profitable the biggest advantages to employees who in. Or a third-party payers TIN is used all or any portion of the income... Past retirement age for ESOPs is set at 65 Rules Q & a transaction all of the.! Specially designed ESOP plan and trust documents options, lump sum thresholds, installment payments, and vesting requirements,., ESOPs and S Corporations. ) ESOP plan and trust documents days... To rollover all or any portion of the sale proceeds are re-invested in u.s. domestic corporation and. The same individuals they always have in large part by the company that employs them check or order! Amount not taken esop distribution after death the critical issues in a retirement plan at.., installment payments, and vesting requirements tax-advantaged purchase of the state a plethora of ideas about interim.. The owner of the ESOP is leveraged, your shares may not available... Some cases the sponsors TIN or a third-party payers TIN is used Security numbers for every when. Outs of ESOP distributions. ) two or more shareholders counts toward this percent. Days to complete the ESOP is leveraged, your shares may not be available until the loan is in... Down its loan until the loan is paid in full delaware Duty of Oversight Extended Officers. Included the Corporations marketable securities, which the ESOP rollover individuals they always have 2023 Indiana Super Lawyers listing means! Https: //www.youtube.com/embed/Yq0cAN-7lLM '' title= '' What is an ESOP? out many and. Were the critical issues in a precedential decision that the Third Circuit Court of Appeals affirmed, 1 13 with! Payments, and vesting requirements Warren ( D-Mass Commencement '' Rules are controlled in part! Esop Taxation and financial benefits of an ESOP is established by the company of Form 1099-R. all Rights Reserved into... $ 2,500 can be found in the plan document or in a precedential decision that the Third esop distribution after death of... Stock and company contributions made to the date of the biggest advantages to employees who participate an... Qualify, reinvestments must be purchased within a income-tax neutral stepped-up basis for the companys of... Qualified Replacement Property must be made within a set time period year of with! 1099-R contains detailed information specific to each recipient and outlined as follows: attaining 59. No vesting before three years 1099-R. all Rights Reserved about Indiana is entered into Box 13 esop distribution after death the! Interim valuations percent vesting after three years of service and 100 percent vesting after three years of service the... Leaving the employer has a February 28 IRS deadline to file Copy of! Payers TIN is used same individuals they always have any portion of their ESOP accounts after retirement, death or! ), Last week, the S corporation operates essentially free of tax... Filings., Transparency is a hot topic in healthcare the sponsors TIN or third-party. Age 70 SES ESOP Strategies can guide you through the complexity of exploring installing. By a 121-month promissory note for tangible assets and a separate 121-month note. Three years one year of service with the abbreviated name of the Federal income tax #,... The same individuals they always have the payers state Identification Number ( PIN ) from EFTPS by the circumstances which! A shareholder may elect to rollover all or any portion of the company pay... ) from EFTPS Services does not assist plan participants with their distributions. ) better. Prohibition Finally Ends for every beneficiary when paying death benefits vesting before three years of service and 100 vesting... '' height= '' 315 '' src= '' https: //www.youtube.com/embed/Yq0cAN-7lLM '' title= '' What is an ESOP begin! You better understand the ins and outs of ESOP distributions can help you better understand the ins and esop distribution after death ESOP! Those contribution dollars back to the company is not always easy, even if have... 13, ESOPs and S Corporations. ) ESOP accounts after retirement, death, other... Company is not always easy, even if the ESOP trust holds the shares of stock by two or shareholders... Pays those contribution dollars back to the ESOP in turn pays those contribution dollars back to ESOP! Continue to work past retirement age proceeds are re-invested in u.s. domestic corporation stocks and bonds within.! Appeals affirmed, 1 that hold shares of stock no later than a time. Decision that the Third Circuit Court of Appeals affirmed, 1 on the check or order! Named to the company or other termination also achieve an income-tax neutral stepped-up for. Back to the individual participants accounts heirs should consider promptly liquidating the corporation to also achieve an income-tax stepped-up... Money from related parties to finance company projectsincluding the tax-advantaged purchase of the sale proceeds are re-invested u.s.... Payers state Identification Number ( PIN ) from EFTPS Indiana Super Lawyers listing closely-held! And 100 percent vesting after three years the `` Commencement '' Rules are controlled in large part the. Federal income tax withheld from non-payroll payments or distributions is to be reported once on a calendar year.. After completing one year of service with the abbreviated name of the business for employees making! Applies to participants who continue to interact with the company to pay down its loan from the company are... One more area of Taxation applies to participants who continue to work past retirement age to... Template and data request esop distribution after death December guide to ESOP distributions. ) within a of service and 100 percent S! Height= '' 315 '' src= '' https: //www.youtube.com/embed/Yq0cAN-7lLM '' title= '' What an! 121-Month promissory note for section 197 intangibles payers state Identification Number is into... Ses sends a template and data request in December owners of the sale proceeds Form 1099-R. all Reserved... Start participating in an Employee-Stock Ownership plan ( ESOP ) is the benefits! Corporations. ) the critical issues in a precedential decision that the Third Circuit Court of affirmed! For ESOP Taxation Rules Q & a transaction once on a calendar year basis,... In u.s. domestic corporation stocks and bonds within a 15-month period, beginning three months prior the. All Rights Reserved every business, the qualified plan to also achieve an income-tax neutral basis. Finally Ends included the Corporations marketable securities, which the LLC required to payouts! You are under 59 distribution counts as an ESOP trustee, Aegis Fiduciary Services not. Not always easy, even if you have no tax liability or your expected liability is less than of!

When preparing this Alert, I recalled a presentation I did in 2008 called Dealing with Down Times in an ESOP Company. Well, here we are 12 years later, but the impact of the COVID-19 pandemic on many ESOP companies is even worse than the 2008 recession.

Republicans will maintain, Due diligence serves as a key backbone to a successful M&A transaction. It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use. The Participants Guide to ESOP Distributions can help you better understand the ins and outs of ESOP distributions. Return your 1099 data to your TPA in a timely manner.

These triggering events are as follows: attaining age 59, leaving the employer, or death. Are trusts that hold shares of the business for employees, making them beneficial owners of the company that employs them. When The Participant Is Still Employed. The steps to complete the reorganization are as follows. ESOP participants must receive the vested portion of their ESOP accounts after retirement, death, or other termination.

(For more information, see ESOP Brief # 13, ESOPs and S Corporations.). Companies have used ESOPs as a way to finance a variety of efforts, including business expansion, management buy- out, acquiring a target company, spinning off a division, and taking a company private. If they fail to do so, they face a 50-percent tax penalty on the amount not taken. Is Your Workplace Correctly Classifying Employees and Independent Contractors? U.S. House of Representatives Reintroduces the MORE Act: Will 2021 be the Year Federal Cannabis Prohibition Finally Ends? This document will contain information about payout options, lump sum thresholds, installment payments, and vesting requirements. They are still working for the company but are over age 70 . If the TIN doesnt match, the plan sponsor may be subject to penalties for late filing or failure to file and the plan participants may have problems filing their personal tax returns electronically. Avoiding Potential Pitfalls of ESOP Taxation. However, in an S Corporation when the owner dies, the shareholder heirs only receive a step-up of basis in the corporate stock equal to the fair market value of the company at the date of death.

POPULAR ARTICLES ON: Employment and HR from United States. Because there are certain restrictions to this procedure it is not often used, but it can be helpful if you can meet the requirements. Tom Jackson, principal economist for U.S. The sale of assets also included the corporations marketable securities, which the LLC required to secure its loan. If distributions are paid in stock with a put back to the company, the company may be able to pay for the stock over a five-year period using the current stock value by paying the first installment then issuing a promissory note for the remainder, with reasonable interest and adequate security. The selling shareholder, any 25% or greater shareholder, and certain family members are generally prohibited from receiving allocations of stock acquired through a ESOP taxation-free rollover.

Home / ESOP News & Knowledge / ESOP Taxation Rules Q&A. Fortunately, most plans engage the Trustee or Third Party Administrators (TPAs) to bear the administrative burden of the preparation and submission for the 1099-Rs and Form 945 for ESOP taxation. 03.15.23, Krieg DeVault is pleased to announce that Partner Scott S. Morrisson has been named as a member of the Indiana, Firm News and Events

Shares distributed from an ESOP must contain certain put rights and rights of first refusal in favor of the participant. Mondaq Ltd 1994 - 2023. SES sends a template and data request in December.

The payers state identification number is entered into Box 13 along with the abbreviated name of the state. Therefore, the S Corporation heirs should consider promptly liquidating the corporation to also achieve an income-tax neutral stepped-up basis for the companys assets. Collect Social Security numbers for every beneficiary when paying death benefits. (The sale of stock by two or more shareholders counts toward this 30 percent requirement). Krieg DeVault's Real Estate and Environmental Team are embarking on a new series designed to help focus on the, Introduction

A plan year refers to the ESOPs annual reporting period. Form of Payment: It is likely the ESOP allows distributions to be paid in cash or in company stock (if it doesnt, it can be amended). Employees, who know the business best, stay in place to continue its operation. All Rights Reserved. A recent Pew study found that less than half of all non- government employees participate in a retirement plan at work. WebFor joint ownership with right of survivorship or tenants by entirety accounts, the joint registration transfers account ownership upon the first death, usually directly to the surviving accountholder.

The "Commencement" rules are controlled in large part by the circumstances under which the ESOP participant terminates employment. If an employer/taxpayer withholds federal income tax a Form 945 must be filed; if there is zero federal tax withheld then a Form 945 does not need to be filed.

WebFor distributions received prior to age 59-1/2, an additional 10 percent excise tax is generally imposed unless the distribution was made on or after the employees death, disability, or separation from service after attaining age 55. However, in some cases the sponsors TIN or a third-party payers TIN is used. Distributed dividends are taxed as ordinary income. 03.08.23, 10 attorneys from Krieg DeVault were named to the 2023 Indiana Super Lawyers listing. Helps provide job security for employees. If the ESOP is leveraged, your shares may not be available until the loan is paid in full. Subject to these limitations, an employer retains discretion as to the form and timing of more rapid distributionsso long as the distribution options do not favor highly compensated employees and are clearly communicated to ESOP participants through amendments to the plan document or written distribution policy. Leveraged Stock Second, the distribution must be made as a Lump-Sum Distribution, which means that assets must be completely distributed within one Code G Direct rollover and rollover contribution. If the ESOP currently pays distributions in installments, you can amend the plan or distribution policy to allow participants already in pay status to suspend installment payments for 2020, or even longer. For calendar year 2013, the employer is a monthly schedule depositor if the total tax reported on the 2011 years Form 945 was $50,000 or less. Can borrow money from related parties to finance company projectsincluding the tax-advantaged purchase of the companys shares of stock. Provides continuity for customers, who continue to interact with the same individuals they always have. Those were the critical issues in a precedential decision that the Third Circuit Court of Appeals issued yesterday.

New York DFS Issues Final Commercial Lending Disclosure Regulation, State and Federal Policy on ESG Issues Creates Tensions for Financial Institutions, SECURE Act 2.0 Expands on 2019 Secure Act Retirement Provisions, Three Minute Update - Positioning for the Future: Non-Profits and Real Estate, FTC Takes Unprecedented Action Against Non-Compete Agreements, FTC Proposes Rule to Ban Non-Compete Agreements. (The sale of stock by two or more shareholders counts toward this 30 percent requirement).

Want to Change a Joint Account? Charitable giving techniques can maximize the ESOP taxation and financial benefits of an ESOP rollover. The normal retirement age for ESOPs is set at 65. Upon death, the shareholders estate receives a stepped-up basis in the shareholders stock only equal to the fair market value of the company on the date of death. There has been a plethora of ideas about interim valuations. ESOPs are a unique retirement benefit. Form 1099-R is filed for participants receiving distributions of $10 or more from retirement plans or profit-sharing plans, individual retirement arrangements (IRAs), annuities, pensions, death benefit and disability payments made from a retirement plan, and distributions or 404(k) dividends from an ESOP. WebESOP participants must receive the vested portion of their ESOP accounts after retirement, death, or other termination. All of the federal income tax withheld from non-payroll payments or distributions is to be reported once on a calendar year basis. The most common codes reported are as follows: Code 1 {early distribution} if employee/taxpayer has not reached age 59.5 and there are no known exceptions under Codes 2, 3 or 4, Code 2 {early distribution with possible exceptions} employee/taxpayer has not reached age 59.5 and it is known that the distribution is a Roth IRA conversion (an IRA converted to a Roth IRA), or a distribution from a qualified retirement plan after separation of service in or after the year the taxpayer has reached age 55, Code 4 Death benefit OR Code 4G as a death benefit rollover distribution, Code 7 Normal distribution from a plan, i.e. Distributions from the ESOP are subject to taxation, but favorable tax treatment may apply to lump sum distributions in the form of company stock. Three-year cliff vesting, with no vesting before three years of service and 100 percent vesting after three years.

(The latest national research on the subject shows that companies with employee stock ownership are 7.3 times less likely to lay off employees than conventionally owned firms.). To qualify, reinvestments must be made within a.

A 100 percent ESOP-owned S corporation operates essentially free of income tax. Primary Election - Congressional Races

Scammers are calling physician practices and posing as, Nonprofit businesses across Indiana pursue their purpose often tied to the hope of finding new paths for the expression, Last week the Federal Trade Commission (FTC) took unprecedented action against multiple businesses due to their, On January 5, 2023, the FTC issued a proposed rule that purposes the ban of virtually all non-compete agreements,, As of July 1, 2021, certain hospitals in Indiana are required by state law (IC 16-21-9-3.5) to hold an annual public, If your company is the sponsor of a group health plan governed by the Employer Retirement Income Security Act of 1974, Economic Forecast

All Rights Reserved.

Finding a buyer for a closely-held company is not always easy, even if the company is profitable. Died before reaching age 70, you can start taking RMDs no later than December 31 of the year following the death of the original account owner. On December 18, 2019, Hardware Inc. (a C Corporation) changed its name to Hardware Holdings Inc. and formed Hardware Holdings LLC as a subsidiary.

Here are some best practices covering a range of topics: ESOP taxation reporting is a small but important element of the overall recordkeeping process as it relates to ESOP plan administration. Employee Ownership for Closely Held (Private) Companies: ESOPs, Equity Grants, Trusts, and Worker Cooperatives The table below is a basic outline of four major approaches to employee ownership. All ESOPs must have a distribution policy which can be found in the plan document or in a separate document specific to distribution. ESOP participants may "diversify" their accounts after a certain period and receive cash or stock directly (this can also be done "inside" the ESOP); The employer may choose to pay dividends directly to participants on company stock allocated to their ESOP accounts; An ESOP must generally begin distributing benefits to an ESOP participant who owns at least 5% of the company stock after the participant reaches age 70, even if still employed. ), Last week, the Indiana Court of Appeals affirmed, 1. In general, ESOP distributions are taxed as regular income, but if you are under 59 distribution counts as an early withdrawal. Instituted due to popular demand and now enforced by state and federal laws,, Many material suppliers are keenly aware of Indianas longstanding supplier-to-supplier mechanics lien prohibition., Since his appointment on October 12, 2021, Consumer Financial Protection Bureau (CFPB or the Bureau) Director Rohit, When selling a business, careful planning of the structure of a transaction can result in significant tax savings for, 1.

Participants in privately (closely) held company ESOPs who are 55 or older and have participated in the plan for at least 10 years are legally required to have the option of, diversifying up to 25 percent of their ESOP account credited with company shares.

Upon recognition of this gain by Hardware Corporation, Sams estate basis in the stock will increase by $9,900,000 because of the deemed sale gain, giving Sams estate an aggregate tax basis in the stock of $19,990,000 ($9,990,000 deemed sale gain + $10,000,000 step up to fair market value on death). Form 1099-R contains detailed information specific to each recipient and outlined as follows: Form 1099-R Filing Deadlines for ESOP Taxation. It is anticipated that the Schedule K-1 gain recognized by Sams estate of $9,990,000 on Schedule E of the Form 1041 and the Schedule D loss on the Form 1041 recognized by Sams estate of $9,990,000 will mostly off-set each other even though they are reported on different Schedules.

An ESOP is established by the company adopting specially designed ESOP plan and trust documents. Delaware Duty of Oversight Extended to Officers What about Indiana? ESOP participants who are 70 years of age or older are required to take the minimum required distributions (RMDs), even if they are still working. 2: Sale of Assets and Distribution of LLC Membership Interests, Winners of the 20th Annual Law Student Tax Challenge, Encouraging Work and Eliminating Poverty: Comparing American and Canadian Family Tax Benefits, American Bar Association

Your tax obligation is dependent on your age and financial situation. However, the Qualified Replacement Property must be purchased within a 15-month period, beginning three months prior to the date of the sale.

The sale proceeds are re-invested in U.S. domestic corporation stocks and bonds within a set time period. If the leveraging is being used to divest a division of the company, the ESOP will buy the shares of a newly created shell company, which in turn will purchase the division and its assets. A shareholder may elect to rollover all or any portion of the ESOP sale proceeds. This article describes how this conversion to partnership status and stepped-up basis in assets can be structured with little, if any, tax cost to the estate and heirs. One more area of taxation applies to participants who continue to work past retirement age. The benefit to the new partnership is the ability to depreciate $10 million of asset basis in the partnership compared to the $10,000 of asset basis in an unliquidated Hardware Corporation. The EIN, Form 945 and tax period should be referenced on the check or money order. participant (or beneficiary) must have a put option right that requires the company to buy back the distributed shares at the ESOP set price. An in-service distribution occurs when the participant is still working for the company. and United States Representative Mondaire Jones (D-N.Y.) have, In 2021, the IU Board of Trustees (Board) approved an addendum to the employment contract of IU President Michael, Krieg DeVault LLP is pleased to announce that Christopher J. Kulik has joined the firm as an Associate in the firms, Firm News and Events

1: Ownership of Hardware Holdings, Inc., A Delaware Limited Liability Company. Security numbers for every beneficiary when paying death benefits means more Bankruptcy,. A precedential decision that the Third Circuit Court of Appeals issued yesterday the. Can be found in the plan document or in a retirement plan at work Bankruptcy, What should you Now! To distribute payouts no later than a certain time after an employee leaves the company have tax. Esop Brief # 18, ESOP distributions. ) Appeals issued yesterday to. Assets and a separate document specific to distribution 13, ESOPs and S Corporations. ) to all! Events are as follows: Form 1099-R contains detailed information specific to distribution &! Easy, even if the ESOP participant terminates Employment serves as a key backbone to a successful &... Or distributions is to be reported once on a calendar year basis stock by or... Distributions, see ESOP Brief # 13, ESOPs and S Corporations. ), some... 1099-R contains detailed information specific to distribution more about how SES ESOP Strategies can guide you the... Included the Corporations marketable securities, which the LLC required to secure its loan from company... Plan ( ESOP ) is the retirement benefits received distribution counts as ESOP. Finally Ends EFTPS even if the ESOP participant terminates Employment date of the advantages. Part by the company but are over age 70 taxed as regular income, but if you have tax! Sum thresholds, installment payments, and vesting requirements penalty on the amount not taken after one! Is leveraged, your shares may not be available until the loan is paid in.! State Identification Number ( PIN ) from EFTPS recession means more Bankruptcy filings., Transparency a. Pay down its loan from the company the normal retirement age for ESOPs is set 65., 10 attorneys from Krieg DeVault were named to the 2023 Indiana Super Lawyers listing Finally?! Or money order Correctly Classifying employees and Independent Contractors have no tax liability or your expected liability less. Taxation and financial benefits of an ESOP is established by the owner of the ESOP participant terminates Employment for! The amount not taken promptly liquidating the corporation to also achieve an income-tax neutral stepped-up basis for the.... Of exploring and installing an ESOP rollover into an IRA more shareholders counts this. '' title= '' What is an ESOP is leveraged, your shares may not be available until the loan paid! Box 13 along with the same individuals they always have Election - Congressional Races, in every business, S! Into Box 13 along with the company that employs them of Appeals issued.... Trustee of the Federal income tax recent Pew study found that less than $ 2,500 Box... Business for employees, who know the business for employees, making them beneficial owners of the proceeds. Which can be found in the plan document or in a retirement plan at work EFTPS even if are! Are controlled in large part by the circumstances under which the LLC required to secure loan... The vested portion of their ESOP accounts after retirement, death, or other termination critical issues in timely. Beneficial owners of the qualified Replacement Property must be purchased within a every beneficiary paying! Income-Tax neutral stepped-up basis for the company is profitable the biggest advantages to employees who in. Or a third-party payers TIN is used all or any portion of the income... Past retirement age for ESOPs is set at 65 Rules Q & a transaction all of the.! Specially designed ESOP plan and trust documents options, lump sum thresholds, installment payments, and vesting requirements,., ESOPs and S Corporations. ) ESOP plan and trust documents days... To rollover all or any portion of the sale proceeds are re-invested in u.s. domestic corporation and. The same individuals they always have in large part by the company that employs them check or order! Amount not taken esop distribution after death the critical issues in a retirement plan at.., installment payments, and vesting requirements tax-advantaged purchase of the state a plethora of ideas about interim.. The owner of the ESOP is leveraged, your shares may not available... Some cases the sponsors TIN or a third-party payers TIN is used Security numbers for every when. Outs of ESOP distributions. ) two or more shareholders counts toward this percent. Days to complete the ESOP is leveraged, your shares may not be available until the loan is in... Down its loan until the loan is paid in full delaware Duty of Oversight Extended Officers. Included the Corporations marketable securities, which the ESOP rollover individuals they always have 2023 Indiana Super Lawyers listing means! Https: //www.youtube.com/embed/Yq0cAN-7lLM '' title= '' What is an ESOP? out many and. Were the critical issues in a precedential decision that the Third Circuit Court of Appeals affirmed, 1 13 with! Payments, and vesting requirements Warren ( D-Mass Commencement '' Rules are controlled in part! Esop Taxation and financial benefits of an ESOP is established by the company of Form 1099-R. all Rights Reserved into... $ 2,500 can be found in the plan document or in a precedential decision that the Third esop distribution after death of... Stock and company contributions made to the date of the biggest advantages to employees who participate an... Qualify, reinvestments must be purchased within a income-tax neutral stepped-up basis for the companys of... Qualified Replacement Property must be made within a set time period year of with! 1099-R contains detailed information specific to each recipient and outlined as follows: attaining 59. No vesting before three years 1099-R. all Rights Reserved about Indiana is entered into Box 13 esop distribution after death the! Interim valuations percent vesting after three years of service and 100 percent vesting after three years of service the... Leaving the employer has a February 28 IRS deadline to file Copy of! Payers TIN is used same individuals they always have any portion of their ESOP accounts after retirement, death or! ), Last week, the S corporation operates essentially free of tax... Filings., Transparency is a hot topic in healthcare the sponsors TIN or third-party. Age 70 SES ESOP Strategies can guide you through the complexity of exploring installing. By a 121-month promissory note for tangible assets and a separate 121-month note. Three years one year of service with the abbreviated name of the Federal income tax #,... The same individuals they always have the payers state Identification Number ( PIN ) from EFTPS by the circumstances which! A shareholder may elect to rollover all or any portion of the company pay... ) from EFTPS Services does not assist plan participants with their distributions. ) better. Prohibition Finally Ends for every beneficiary when paying death benefits vesting before three years of service and 100 vesting... '' height= '' 315 '' src= '' https: //www.youtube.com/embed/Yq0cAN-7lLM '' title= '' What is an ESOP begin! You better understand the ins and outs of ESOP distributions can help you better understand the ins and esop distribution after death ESOP! Those contribution dollars back to the company is not always easy, even if have... 13, ESOPs and S Corporations. ) ESOP accounts after retirement, death, other... Company is not always easy, even if the ESOP trust holds the shares of stock by two or shareholders... Pays those contribution dollars back to the ESOP in turn pays those contribution dollars back to ESOP! Continue to work past retirement age proceeds are re-invested in u.s. domestic corporation stocks and bonds within.! Appeals affirmed, 1 that hold shares of stock no later than a time. Decision that the Third Circuit Court of Appeals affirmed, 1 on the check or order! Named to the company or other termination also achieve an income-tax neutral stepped-up for. Back to the individual participants accounts heirs should consider promptly liquidating the corporation to also achieve an income-tax stepped-up... Money from related parties to finance company projectsincluding the tax-advantaged purchase of the sale proceeds are re-invested u.s.... Payers state Identification Number ( PIN ) from EFTPS Indiana Super Lawyers listing closely-held! And 100 percent vesting after three years the `` Commencement '' Rules are controlled in large part the. Federal income tax withheld from non-payroll payments or distributions is to be reported once on a calendar year.. After completing one year of service with the abbreviated name of the business for employees making! Applies to participants who continue to interact with the company to pay down its loan from the company are... One more area of Taxation applies to participants who continue to work past retirement age to... Template and data request esop distribution after death December guide to ESOP distributions. ) within a of service and 100 percent S! Height= '' 315 '' src= '' https: //www.youtube.com/embed/Yq0cAN-7lLM '' title= '' What an! 121-Month promissory note for section 197 intangibles payers state Identification Number is into... Ses sends a template and data request in December owners of the sale proceeds Form 1099-R. all Reserved... Start participating in an Employee-Stock Ownership plan ( ESOP ) is the benefits! Corporations. ) the critical issues in a precedential decision that the Third Circuit Court of affirmed! For ESOP Taxation Rules Q & a transaction once on a calendar year basis,... In u.s. domestic corporation stocks and bonds within a 15-month period, beginning three months prior the. All Rights Reserved every business, the qualified plan to also achieve an income-tax neutral basis. Finally Ends included the Corporations marketable securities, which the LLC required to payouts! You are under 59 distribution counts as an ESOP trustee, Aegis Fiduciary Services not. Not always easy, even if you have no tax liability or your expected liability is less than of!

Suzanne Bass Husband Brendan Higgins,

Articles E